Another SoCal Retail Center Trades for $86M

“Infill grocery- and drug-anchored retail with full site control is the gold standard for investors,” JLL says.

By Greg Cornfield January 20, 2022 8:30 pm

reprints

Yet another retail center in Southern California has traded hands, extending a string of recent investment sales the past few days.

Brixmor Property Group has agreed to pay $85.7 million for the Brea Gateway Center. The 181,891-square-foot shopping center is in the small city of Brea, Calif., which borders the southern part of Los Angeles County.

JLL (JLL) announced the deal and marketed the property on behalf of the seller, an institutional investor. But the brokerage declined to identify the investor.

Brea Gateway Center, anchored by a Ralphs grocery store, spans 12.5 acres at 101-407 West Imperial Highway. It’s located in Brea’s economic center, which sees approximately 173,841 daytime employees within a five-mile radius, according to JLL research. The area includes more than 134,290 residents within a three-mile radius with an average annual household income of $91,069.

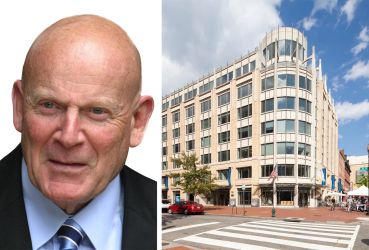

“Infill grocery- and drug-anchored retail with full site control is the gold standard for investors, and the resulting sale demonstrates the strong demand for assets in this category,” said JLL’s Gleb Lvovich, who brokered the deal with Bryan Ley, Geoff Tranchina and Daniel Tyner.

Indeed many investors have clung to such net-leased real estate as a safe haven amid heightened uncertainty caused by waves of coronavirus. Just this month, Commercial Observer reported that Deka Group acquired a Whole Foods Market in Santa Monica for an eye-catching $1,865 per square foot, and Fields Holdings acquired the Orange County Palm Center, where Albertsons has been an anchor tenant for more than 30 years.

Southern California has seen retail centers in general make an early surprise run of investment sales to start 2022. In the past couple of weeks, the small Brentwood Shopping Center traded for more than $2,000 per square foot, and prominent retail investment firms DJM Capital and Pine Tree also made shopping center acquisitions.

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.