Renter Rewards Startup Stake Closes $4M Seed Round: Exclusive

By Philip Russo September 28, 2021 9:00 am

reprints

Fintech platform Stake has closed $4 million in seed financing, the startup announced Tuesday.

The Manhattan-based startup, which claims to be the first to offer cash back rewards to renters to build landlord loyalty, had its round led by Shadow Ventures, with core contributors including Hometeam Ventures, Olive Tree Holdings, Blue Field Capital, Hampton VC, Gaingels, as well as Ellen Levy (managing director at Silicon Valley Connect).

Stake plans to use the funds to grow its no-fees platform for making renting monetarily rewarding for renters, while allowing owners to create more financially secure communities, according to a news release from the company.

“We’re on a mission to create and build renters’ savings,” said Rowland Hobbs, CEO and co-founder of Stake. “By bringing the power of financial technology to real estate, Stake is delivering a win-win. The first win is a better return for renters with cash back.

“The second win is loyalty that creates outperforming rental communities with efficient incentives, higher retention, and less defaults. This seed capital investment will continue to build our loyalty driven data closer to making an even larger and lasting impact for renters and owners and operators by making renting financially rewarding.”

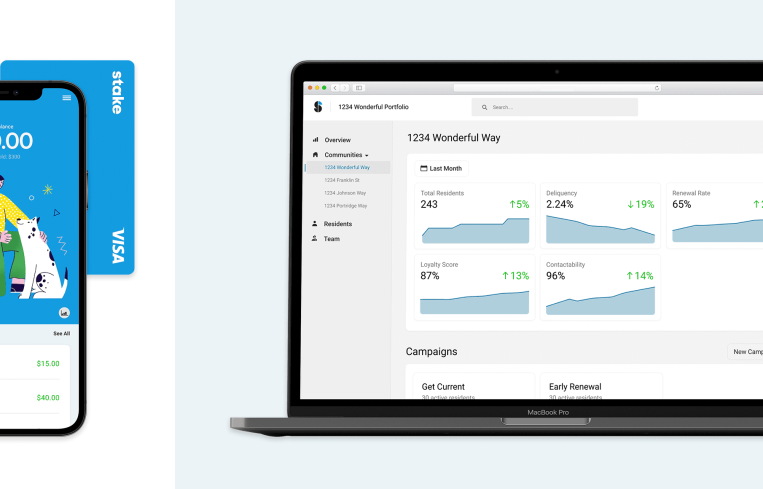

Co-founders Hobbs and Jimmy Jacobson, director of engineering, have built a rewards app for renters and a data-driven, cloud-based dashboard for property and asset managers that enables owners and operators like Greystar, Great Jones, Brick Capital and Legacy Wealth Holdings to decrease their expenditures on concessions and incentives by more than 50 percent, lease up twice as fast, reduce delinquencies up to 50 percent, and boost top-line revenue with a 7 to 15 percent increase in retention and renewals, according to a company statement.

Stake is offered in more than $1 billion of real estate assets, representing $150 million in gross lease value, and is available to more than 10,000 residents across 50 states.

Renters earn cash back when they pay their rent, keep the money saved, or take any action the landlord wants to reward, including lease signings, renewals, maintenance or community activities. The cash back amount is paid for and set by the landlord, the average amount of which is 5 percent of the rent. The landlord pays a per reward transaction fee. There are never any fees or debt accumulation to the renter, only savings, according to a statement from Stake.

“Stake joined our inaugural Multifamily Technology Accelerator in November 2020, and was immediately adopted by strategic asset managers who wanted to outperform the market,” said Nick Durham, senior associate at Shadow Ventures, who recently joined Stake’s board of directors. “The opportunity Stake has tapped into is to reinvent revenue management with a resident-first focus.”

Stake also announced that B.J. Naedele, president and chief commercial officer of Shop Your Way and an investor at NextUp Ventures, has joined Stake’s board.

Philip Russo can be reached at prusso@commercialobserver.com.