CRE Finance Pros Trailblazed, Found Homes Away From Home in 2020

Barred from offices, many on this year's Power Finance list found unique ways to get away while still staying productive — including RVs

By Mack Burke May 3, 2021 9:00 am

reprints

COVID-19 sent most commercial real estate finance professionals home for the warmer months and beyond, but many retreated to faraway areas of the country, or logged ample amounts of time simply traversing it to get away from urban centers or the traditional home office.

Some of real estate’s bigger finance, investment and development names helped fuel the narrative behind a migration south, as Starwood Capital Group’s Barry Sternlicht or Witkoff Group’s Steven Witkoff have said publicly that they ventured down to their subtropical or tropical abodes in Florida.

Others, like Square Mile Capital Management’s Jeff Fastov, found refuge elsewhere. The nearly 40-year veteran of the industry spent a lot of time at his house in Big Sky country in Montana, where he set up numerous screens and “production studios to Zoom appropriately,” he quipped.

MetLife’s Gary Otten, though, found himself more transient. He was on the road a few times in the late summer, though not necessarily to clear his head.

“I moved three daughters into colleges in the Southeast last August,” he said. Otten spent two nights in limited or select service hotels and said he was “pleased with the way my family and I fared.”

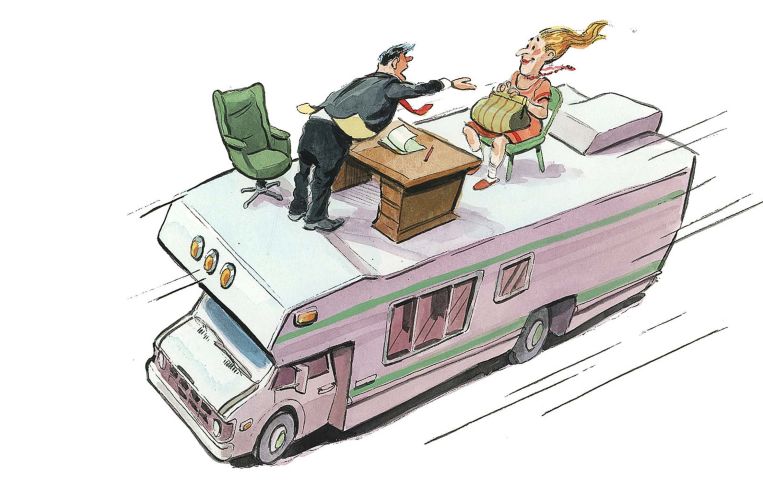

Some finance professionals, too, joined the wave of what’s become a hot sale amid the pandemic among newcomers and experienced hands alike: road-tripping with RVs.

Acore Capital’s Warren de Haan did just that, renting RVs and making two cross-country trips with his family last year, while not missing a beat in his company’s business activities, he said. He does have a generous amount of experience with the colossal leisure vehicles.

“I’m a big fan of them for a lot of reasons,” de Haan said. “It’s just a phenomenal way to bring family together in an unpolarized way. My parents had one, too. I find it to be incredible.”

The ACORE managing partner’s cross-country trips went west to east, followed by an east-to-west trajectory. To put a clock on it, it took his crew 12 days to travel back from the East Coast.

His first route went from Southern California — ACORE’s stomping grounds — up through Utah and Colorado, then through the Badlands in South Dakota, and east through the Midwest, passing Chicago, and then traveling through Ohio and into the Northeast. He took a more southerly route in his nearly two-week haul back to California, passing through Tennessee, Oklahoma, northern Texas and then Nevada.

He said it was important for him to get a vehicle that was sized properly enough to allow his family of four to have access to whatever they’d like — whether a parking lot, an RV park or a National Park, for example — and be equipped well enough, technologically, so they can be “plugged in and able to work.”

Cushman & Wakefield’s Rob Rubano went out on a limb and also ventured forth on his own RV trek for the first time, but his travels didn’t take him the same lengths as de Haan’s. Rubano ventured to the Carolinas for a spell.

Still, he ended up part of a much larger trend. RV travel spiked during the pandemic, as sales of the vehicles hit new heights. The sales have been brisk enough to garner attention from prospective commercial real estate investors and lenders, given the attractive return profiles RV parks can garner, although the sector is a hard one to pin down from an underwriting and cash flow perspective.

Still, in April, an affiliate of Brookfield Asset Management was able to lock in $2.2 billion in commercial mortgage-backed securities debt that was secured, in small part, by its fee simple interests in 771 RV resort sites located throughout 13 states.

RV parks or resorts are difficult for many financiers to wrap their heads around, as they are essentially moving targets without a ton of optionality from a property level perspective; it’s about the downside risk. They are mostly just land, equipped with parking pads, with bells and whistles for RV owners or renters to plug in and live relatively comfortably. Many also sport traditional apartment or residential-style amenities, such as a central clubhouse building, pools and recreation areas. Some coastal parks are also able to leverage beachside and waterfront locations.

Rubano, himself, is currently out in the market on behalf of AutoCamp for a $200 million balance sheet deal on a portfolio of outdoor lodging assets. “We have had a ton of reception to it, a real depth of lender interest for it,” he said. “With the pandemic, it’s on trend.”

With the surge in vaccinations, air travel gradually resuming, and proposed summer reopenings in many major cities drawing nearer, the book is still out on whether RV’ing is just a passing fad for eager, cooped-up urbanites.

“RV sales have never been as good as they are right now,” said de Haan, who actually recently bought his own rig after renting multiple times for his travels last year. “More are RV’ing, but when the world goes back to normal, what will happen?”