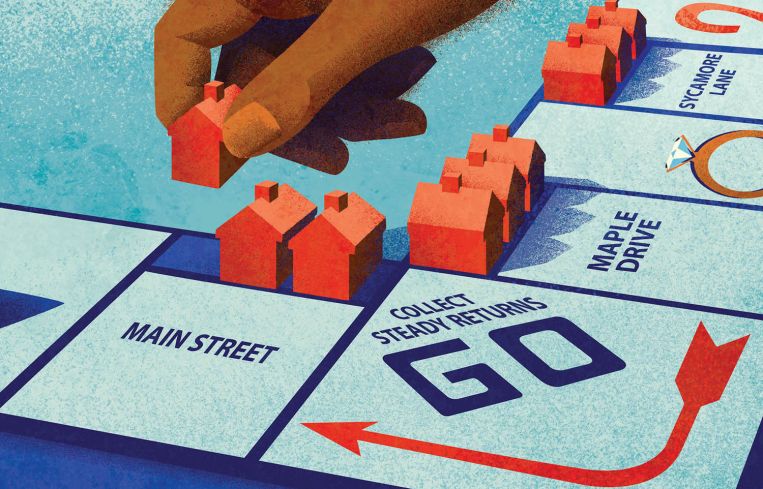

Moving Pieces: How the Single-Family Rental Boom Spawned a Need for Expertise

New investors mean high demand for experienced brokers and market intelligence

By Patrick Sisson January 8, 2021 4:49 pm

reprints

When Michael Finch was advising a family-owned investment group late last year about where to invest, single-family rental was an easy sell.

“Go back 30 years, and it has outperformed every asset class,” said Finch, executive vice president and principal at SVN | SFRhub Advisors, the nation’s only exclusively single-family brokerage. He convinced the group to invest $80 million in a nationwide portfolio of rental properties. “There are none of the extreme highs of multifamily, but also none of the lows. At worst, it’s stable, and rents grow incrementally in downtimes. But during the good times, like now, it booms.”

With the single-family rental (SFR) market absorbing an unprecedented influx of billions of dollars of new capital over the last six months — a reaction to the uncertainty of so many asset classes during the pandemic — Finch, whose firm boasts $1 billion in active assets in 35 states, and other brokers like him are seeing more and more investors and institutional players pay for guidance on how to play with an asset class seen as a relative safe harbor.

At the same time, more conventional brokerages, such as JLL and Marcus & Millichap, have reacted to client demand and opportunity, and recently started navigating the SFR market, too.

“We’ve constantly been bringing commercial investors into the space,” said Finch. “COVID just accelerated it.”

A confluence of trends was already supercharging single-family well before the pandemic drew in big investors: a housing shortage with no end in sight, a demographic wave of older millennials looking to settle down with more space, and dramatically improved technology and operations enabling easier management of often-scattered portfolios by management firms, such as Marketplace Homes. The Urban Institute has predicted that there will be five new renters in the U.S. for every three homeowners through 2030.

Marco Santarelli, founder and CEO of Orange County-based Norada Real Estate Investments, which assembles turnkey SFR investment properties for investors in 20-plus markets across the country, has seen consistent growth since the firm started 17 years ago. Norada completed 700 transactions in 2020, and expects to break the 1,000-deal barrier in 2021.

Just as commercial investors are starting to get educated and invest in medical and life sciences as alternative office options, institutional players see SFR as an attractive alternative, said Michael Hunter, global head of alternatives and strategic transactions at Nuveen Real Estate, which just invested $400 million in Sparrow, a new platform to evaluate and buy SFR.

“A lot of groups are suddenly being asked to invest more money than they ever have before,” he said. “It’s fuel to the fire. None of the big names who have entered the space in the last six months are looking to go small.”

Couple the perception of low risk and high demand with the lack of truly dominant players — the 20 biggest single-family rental operators only control roughly 300,000 of the 16 million such units nationwide — and investors may see easy opportunity. But this part of the rental market requires radically different asset evaluation, Finch said.

He said it also needs brokers and brokerage services, who understand the unique nature of the market, and can both assemble and analyze portfolios of rental homes amid rising prices and scarce supply. SFR often works on a different scope and scale. Firms like SFRhub and Northmarq get called to assemble deals for institutional buyers looking to buy 1,000 homes at a time.

“It’s hard for commercial guys to get their head around it,” Finch said. “You can’t arbitrarily put cap rates on homes like you do in multifamily. Every portfolio here is a snowflake. If you take three different portfolios of 50 SFR homes in Atlanta, there’s no chance they’ll be alike.”

One of the largest challenges facing brokers and buyers is the supply shortage. Roofstock, a startup marketplace for SFR properties that focuses mostly on individual investors, said homes are often sold within two weeks of going on the market. Traditional means of acquiring inventory, such as foreclosures, targeting retirees who are looking to downsize, and finding mom-and-pop property owners seeking to sell, hasn’t quite matched the appetite of new investors in the sector.

The supply gap has helped supercharge the build-to-rent business, which provides brokers with a new role connecting homebuilders, such as Tricor Homes or NexMetro Communities, to investors looking to buy up a bundle of homes in a single transaction. Starts for build-to-rent properties, which have trended upward for two decades, hit 14,000 during the third quarter of 2020, a 27 percent jump over the previous year, according to the National Association of Home Builders.

Don Walker, president of strategic planning and financial forecasting at John Burns Real Estate Consulting, counted 285 active build-for-rent communities nationwide in early January, which boast an occupancy level of 97 percent. Norada’s Santarelli said that as inventory tightens in markets nationwide, he’s being “forced” to look at more build-to-rent options to satisfy investor clients.

“A lot of them are being operated like an apartment, and investors are buying a cash-flow stream,” Walker said. “Some builders want to build and hold for a long haul, but others either want to build, get homes leased, let them mature and eventually put them on the market, or simply connect with an investor to sell as soon as they get an occupancy certificate.”

Finding inventory is one thing, but assembling the right portfolios is key; it’s a “business of aggregating homes,” said Finch, and can be especially tricky working across markets and bundling homes for institutional investors looking for hundreds of properties.

Key aspects of buying and selling are market intelligence and experience in assembling portfolios that meet investor needs and create efficiency for owners. Finch always tells sellers to let investors cherry-pick portfolios; within a selection of SFR assets spread around a single metro area, 70 percent of homes may appeal to one buyer, so sellers should take the premium and hold the remaining 30 percent for the right ownership group.

“Portfolios of as small as 10 or 15 homes can be sold at a big premium,” Nuveen’s Hunter said. “That’s where value is created. Finding the right portfolio can be the biggest barrier to entry.”

Roofstock, which made its name servicing smaller investors, has parlayed its extensive database into a tool to attract institutional clients. The company’s Rental Genome Project has mapped out every single one of the nation’s roughly 90 million single-family homes over the last four-and-a-half years, tracking ownership, local market conditions and, when applicable, rental rates.

This data feeds strategic and “surgical” acquisitions, said Suresh Srinivasan, Roofstock’s chief marketing officer. Roofstock can find SFR portfolio owners, and based on their equity and rental rates, offer to trade them properties to help improve their yield profiles. The company even targets fix-and-flippers with direct-mail solicitations, which has helped them pick up “shadow inventory,” Srinivasan said.

“There is a lot of pressure on brokers, who are starting to turn to us, because they don’t have the tech to tackle this space,” he added. “Large money managers are turning to them asking to get direct exposure to single-family. We already have large funds using us as a platform to expand their portfolios. If you have $50 million you want to deploy with a specific appetite for risk and investment targets, we can help you execute.”

Forecasts of steady market growth suggest brokers will have even bigger market opportunities going forward. Walker said those looking to get into the space will have a big learning curve to make it work.

“Large commercial brokers have gotten into the space, and it’s hard, expensive, and requires a lot more tech,” said Srinivasan. “It’s fraught with risk.”