As Airbnb Goes Public, Challenges Remain — And Not Just From the Pandemic

By Tom Acitelli December 10, 2020 12:22 pm

reprints

Home-sharing portal Airbnb was prepared to go public on the Nasdaq Thursday afternoon, pricing its shares at $68 a piece for a total valuation of $47 billion (though both that share price and valuation are expected to spike in the first day of trading). The initial public offering, which Goldman Sachs and Morgan Stanley are handling for Airbnb, comes several months after the company originally wanted to go public. It also arrives amid two sets of challenges for the firm.

One challenge comes from the novel coronavirus pandemic, which ate into Airbnb’s core business, as leisure and business travel tanked amid stay-at-home advisories and health warnings. Bookings dropped by double-digit percentages in major markets all over the globe and revenue declined 50 percent.

This downturn both pushed back the IPO until the end of 2020 at the earliest and made it all the more urgent, as the company needed to raise money to make up for the COVID-spurred shortfall.

In the meantime, Airbnb ditched its non-core businesses to focus on facilitating bookings and laid off one-fourth of its staff, or about 1,900 employees. It also made plans to spend hundreds of millions of dollars reimbursing hosts for canceled visits. And it raised some $1 billion in debt and equity in an April deal with Sixth Street Partners and Silver Lake. The moves paid off on the bottom line as Airbnb reported a $219 million profit in the third quarter.

The IPO, one of the most anticipated of 2020, now arrives as Airbnb continues to grapple with a second challenge that’s dogged it since well before the pandemic: backlash from neighbors of its hundreds of thousands of host sites, and local and state regulations aimed at curbing what many see as nothing more than illegal hotels. A recent Wall Street Journal report pegged this backlash — which has gone hand in hand with the company’s growth since its 2008 founding — as a greater threat than the pandemic, which is receding amid vaccination plans.

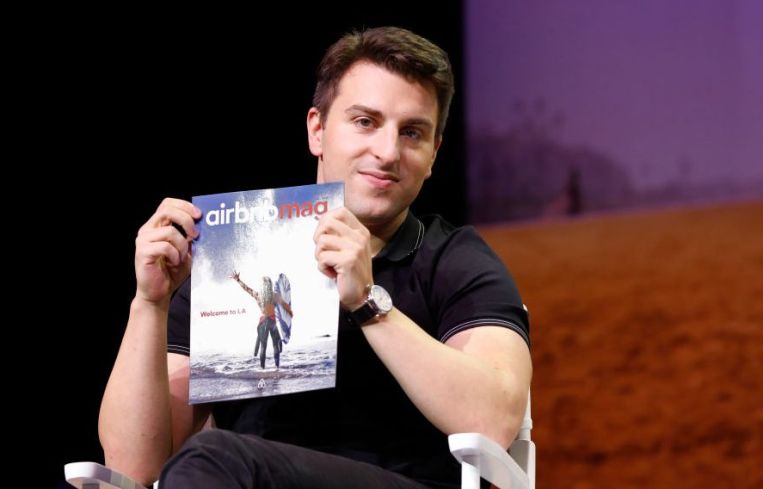

In fact, Airbnb sees the effects of the pandemic as a boost to its core business, at least in the short term, with the regulatory hurdles and the neighborly opposition as the longer-frame focus of its lobbying and public relations efforts. This boost could end up justifying the high valuation that comes with Thursday’s IPO. During an interview on CNBC ahead of the offering, Airbnb CEO Brian Chesky noted that a much greater share of Airbnb’s bookings now come from stays of more than 28 days.

“What’s happening is traveling and living are starting to blur together in this world of flexibility,” Chesky said, according to a transcript of the interview. “People aren’t just going to the same 20 cities. They are not just traveling for business and staying for two nights. They are actually starting to live all over the world and they’re doing it on Airbnb. And that opens the door to so many possibilities in these services and offerings that we can now do, because people really want to feel grounded in where they’re living.”