LYND and NYCE Partner on $478M in Crowdfunded Multifamily Deals

By Chava Gourarie October 29, 2020 1:25 pm

reprints

Texas-based LYND has teamed up with startup NYCE Companies on $477.6 million in multifamily deals, in a bid to open real estate investment to a new class of investors.

The joint venture has closed on two deals thus far, totaling over $100 million, with several others in the pipeline, and plans to offer investment on all of them on crowdfunding platforms.

The two closed deals include a 327-unit apartment complex in Margate, Fla., acquired for $56.8 million, and a 280-unit housing development in San Antonio, at 7106 Culebra Commons. The San Antonio site was acquired for $3.8 million and financed by a $41.2 million construction loan from Mason Joseph Company. It will include three seven-story buildings and construction began in September.

LYND, a longtime multifamily developer and manager based in San Antonio, and NYCE, an upstart real estate development company run by Philip Michael, have both previously raised money through crowdfunding platforms.

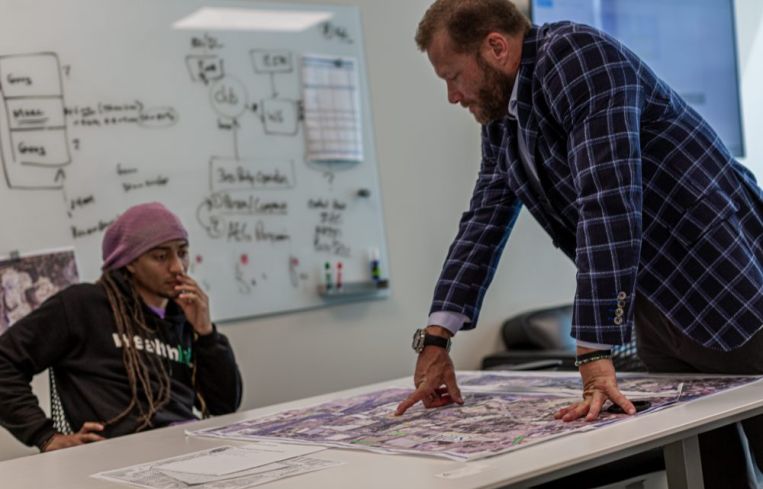

Michael, a self-described “crazy Danish kid with dreadlocks,” has been using social media to reach out to communities of color to make real estate investing more accessible. His goal is to create 100,000 millionaires of color by 2030, by making investing approachable to people who have traditionally been left out of that avenue of wealth creation.

Michael’s first crowdfunded project, a housing development near Temple University in Philadelphia, raised $360,000 on the crowdfunding platform Republic. Investors needed just $79 to invest—“the price point of curiosity,” Michael called it—and 1,335 investors participated, the majority of whom were first-time investors, per Michael.

Michael reached out to LYND CEO David Lynd after seeing one of the firm’s offerings on CrowdStreet, which is only available to accredited investors. “They only target high-net worth investors,” Michael said. “So I said, ‘Let’s bring this to people of color.’”

While the San Antonio and Margate offerings will be open to everyone, the venture will tap into Michael’s existing network of new retail investors and his social media following. “[David] brings the institutional level projects, and we bring the movement,” Michael said.