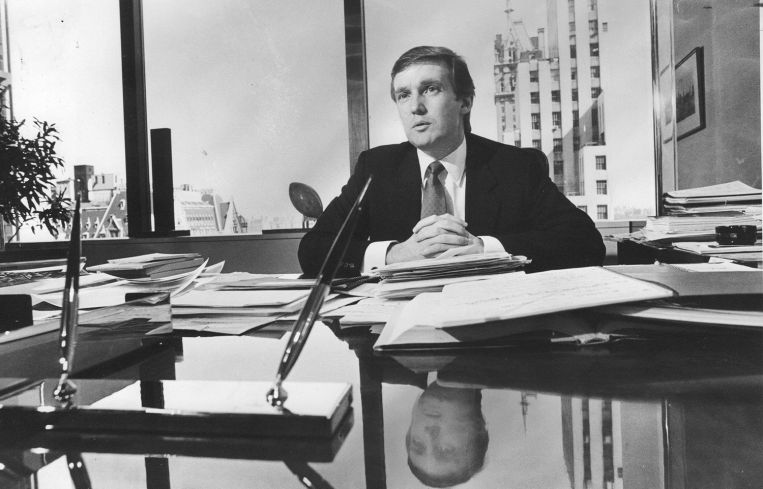

Trump Tower Remains Its Namesake’s No. 1 Real Estate Cash Cow

But Donald Trump has a big mortgage coming due on the marquee Manhattan property

By Tom Acitelli September 27, 2020 9:09 pm

reprints

A New York Times report released Sunday detailing information from the past two decades of President Donald Trump‘s tax returns paints a portrait of a real estate tycoon chronically in need of cash and reliant on tax avoidance measures as well as one who is personally on the hook for hundreds of millions in loans due in the next few years.

It also highlights in a particularly stark way something that’s long been known: That Trump’s 37-year-old Trump Tower—his first true commercial real estate trophy outside of his father Fred Trump Sr.‘s shadow—remains his biggest success in the industry. As the Times reported, the 58-story mixed-use tower at 725 Fifth Avenue has delivered more than $20 million in profits annually—or $336.3 million—since 2000, which “has done much to help keep him afloat,” the newspaper said of Trump.

The developer turned reality TV star turned president has also cleaned up on partnerships he has with Vornado Realty Trust in two office towers: 1290 Sixth Avenue in Manhattan and 555 California Street in San Francisco. Tenants such as Goldman Sachs, Microsoft, investment manager Neuberger Berman, and law firm Kirkland & Ellis paid tens of millions of dollars to Trump’s Vornado partnerships in 2018 alone, the Times reported. (It should be noted that Vornado Chairman Steve Roth, who has had a pretty good pandemic business-wise, remains one of Trump’s most steadfast allies in commercial real estate. Here are some others.)

Trump has apparently made use of these three assets to plug his financial holes. In 2013, he withdrew $95.7 million from his Vornado partnerships, the Times reported. And, the year before that, Trump leveraged his ownership of Trump Tower—taking what now appears to be an enormous risk.

“In 2012,” the Times report said, “he took out a $100 million mortgage on the commercial space in Trump Tower. He took nearly the entire amount as a payout, his tax records show. His company has paid more than $15 million in interest on the loan, but nothing on the principal. The full $100 million comes due in 2022.”

A lawyer for the Trump Organization disputed the accuracy of the Times’ reporting.