Washington D.C.’s 25 Most Powerful Real Estate Players in 2020

Who’s got the right stuff when it comes to real estate in the nation’s capital.

By The Editors June 16, 2020 9:00 am

reprints

Painting the words “Black Lives Matter” on 16th Street in front of Lafayette Square could be described as the ultimate power move. Mayor Muriel Bowser has power. And she wields it.

We’ve said before that the word “power” means something different in Washington D.C. than it does in the rest of the country; the power in our nation’s capital is normally the outward facing kind: the power over foreign policy or tax policy or regulatory policy. Commercial Observer also looks more inwardly; who has the power to make a neighborhood? Who has the power to attract a tenant? Who has the power to bring 25,000 jobs to Crystal City?

Trying to make sense of who are the most powerful people in Washington, D.C. real estate is tough amid an ongoing pandemic, social upheavals and an economic tailspin. We tried to look for a slightly different list than we had last year. (There are, however, some repeats.) Yes, the dealmakers are still critical, and many of them have kept their heads high despite the country’s many travails. (We believe their role will be even more important next year as real estate attempts to crawl out of the hole in which it currently finds itself.) There are plenty of players with a national portfolio who certainly deserve a place on the list, and you might find them in our Power 100 list next month. And while we feel it’s a sober moment, we have to tip our hat to Mark Lerner for bringing a winning ball club to D.C.

The following are the men and women who have made their mark on the district—even if we’ll admit that Bowser gets points for making her mark more singularly than the rest.

Holly Sullivan

Head of Worldwide Economic Development, Amazon

Amazon will get its Crystal City headquarters, but probably not a helipad.

In the fall of 2019, a year after Amazon first announced the winners of its HQ2 search, the e-commerce giant received approval for the first phase of its four million-square-foot Northern Virginia campus from Arlington County officials.

The first phase will consist of two 22-story buildings located in the 16-acre Metropolitan Park in Pentagon City, with 2.1 million square feet of office space and 67,000 square feet of retail.

While Amazon’s Holly Sullivan, the head of worldwide economic development, was the key figure in the HQ2 search, the tech giant has taken somewhat of a backseat during the development process, at least publicly, leaving it primarily in the hands of its development partner, JGB Smith.

Amazon purchased the land for the buildings from JGB, and the company, together with design firm ZGF Architects, shepherded the project through the Arlington County review process. The developers broke ground on the first phase, known as Met Park in January 2020, according to an Amazon spokesperson, and construction continued through the pandemic, as it was considered essential in Virginia.

Amazon has also leased approximately 850,000 square feet of space from JGB for use until Met Park is ready, in 2023, per Amazon.

Amazon has roughly 700 employees in Arlington and 400 open positions, per the spokesperson. It plans to eventually hire 25,000 employees, one of the conditions of receiving a $750 million incentive package for locating in Virginia.

The effect on the surrounding real estate market has been notable, but not as dramatic as some initially expected. On the residential side, an analysis from CoreLogic found that housing prices in neighborhoods closer to the campus rose faster than housing overall. On the commercial side, there’s been an uptick of activity, including from JGB, which plans to redevelop six office buildings in the area.

(So far, officials have nixed the helipad, given the site’s proximity to the Pentagon, but Amazon hasn’t given up and is determining its feasibility.)—Chava Gourarie

Douglas Fleit

CEO, American Real Estate Partners

The more than 40-year-old Rosslyn Metro Center — the 22-story mall and office building built atop the Rosslyn train station — was in desperate need of a refresh when American Real Estate Partners (AREP) bought it in 2015.

After years of planning, AREP unveiled its $35 million renovation project to the three-story mall last year which included relocating the escalators to open up the space, taking down walls to let in more light and adding a 20,000-square-foot food hall.

AREP started work on the project — which also includes upgrades to the office portion — in 2019 and renamed it Rosslyn City Center.

“We’re doing a very complicated facelift while the building is staying in full-operation, which is a tall order,” AREP’s CEO Douglas Fleit said.

But it’s the kind of project AREP was built for. Fleit co-founded the company in 2003 with Brian Katz following the dot-com bust with the goal to take struggling buildings and help them realize their full-potential.

“We were founded on the principles of value addition,” he said.

Since then AREP has done more than $4 billion of acquisitions and recently moved into the discretionary fund business, crossing the $2 billion mark in discretionary fund investments which Fleit called a “major milestone.”

Aside from the Rosslyn City Center, AREP also started work on its largest new construction development in its history last year, the 15-story 7 Tower Bridge office property in Conshohocken, Pa., designed by Skidmore, Owings & Merrill. The property is already 55 percent pre-leased with investment firm Hamilton Lane serving as the anchor tenant.

And even with the coronavirus pandemic threatening to dramatically change the office market, Fleit — who co-founded Cushman & Wakefield’s Washington, D.C. operation in 1981 — is confident AREP’s projects will still do well because the company designs its spaces without trying to pack tenants in.

“Every time the market makes this kind of adjustment we tend to grow,” he said. “I would be disappointed if we didn’t have the same significant growth we had in the last couple of cycles.”—Nicholas Rizzi

Josh Peyton

Managing Director, Avison Young

Avison Young’s Managing Director Josh Peyton continues to be a major player in the industry.

“The Washington region continued its strategic growth plan by adding key players and acquisitions,” he said. “We brought on Jonathan Hipp to lead a robust NNN sales practice out of the Washington office in February. Jon is a national leader in the NNN space, and his energy, industry presence and deep client relationships are going to be invaluable to our business in D.C.”

Also in February, Avison Young acquired D.C.–based BMS Realty Services, a property management company, adding approximately 1.7 million square feet of institutional commercial properties and 23 members to the local management platform.

Peyton’s biggest deal recently was representing International Baccalaureate in its headquarters move from 7501 Wisconsin Avenue in Bethesda, Md., to City Ridge, a mixed-use development at 3900 Wisconsin Avenue in NW D.C. The deal was valued at over $130 million.

Peyton, who’s been with Avison Young since 2010, has successfully negotiated office transactions for a diverse client base, including Fortune 500 companies, law firms and nonprofits.

Since the pandemic hit, his team has been addressing the obvious acceleration of branding and marketing in a digital environment and getting deals done from wherever they are.

“I’m extremely proud to work at Avison Young where our first thoughts and continuous efforts are on the health and safety of our employees, the safety of tenants in buildings we lease and/or manage and because we are providing leading guidance on return to office procedures to our landlord and tenant clients,” he said. “At the same time, our brokers, managers and staff have been working tirelessly to respond to business and transactions while working from home,” he said.

Over the last 90 days, Peyton and his team have closed in excess of 1 million square feet in leases and executed several sales and have a good pipeline of transactions going into the summer months, he said.—Keith Loria

Toby Bozzuto

President and CEO, The Bozzuto Group

Toby Bozzuto knows that he has the opportunity and responsibility for his team to leverage their collective voice for the greater good.

“We can—and should—use our voice to stand up for those who can’t,” the president and CEO of the Bozzuto Group told Commercial Observer.

On May 31, in response to the recent surge of racial injustice, Bozzuto sent a letter to his employees.

“I am hopeful that I can learn best practices for our company to embrace a culture of diversity and inclusion, while concurrently denouncing racism and inequality in any form,” he wrote. “We must always set the bar higher for ourselves, and learn what we could be doing better. This is a top priority for me and for Bozzuto.”

This stance is by no means a new one for the company.

“In 2019, we rolled out an enhanced corporate social responsibility program called Rise by Bozzuto,” Bozzuto told CO. “Recently, as part of a COVID-19 relief effort, Bozzuto employees and residents rallied to raise $50,000 over just a few weeks for two national charities helping others impacted by the coronavirus.”

The company raised and matched funds for #FeedtheFrontLine with Sweetgreen and World Central Kitchen, and participated in A Wider Circle’s Virtual 5k Race to End Poverty.

The real estate they’re involved in is also important, too; the Bozzuto Group, which makes about $450 million in revenue and has some 150 new construction projects under its belt, recently partnered with The Chevy Chase Land Company to bring 100,000 square feet of grocery-anchored retail serving 280 apartments and 65 condominiums, direct access to the new Purple Line and a community gathering space. It’s expected to be complete in the fall of 2021.

Another big project was the College Park groundbreaking, a $140 million redevelopment of a site south of the University of Maryland’s front door in College Park.

“Our teams were proud to begin this project despite the uncertainty of a global pandemic,” he said. “This news was great not only for Bozzuto and our partners, but for the local economy and surrounding community.”—K.L.

Sadhvi Subramanian

Senior Vice President and Mid-Atlantic Market Manager, Capital One

With 19 years at Capital One under her belt, Sadhvi Subramanian has experienced a few market downturns over the years.

“This one is different from anything we’ve previously experienced,” Subramanian said. “This time the government shut [consumer] activity down, there’s a lot that’s still unknown and it’s really a global crisis we’re dealing with.”

The bank had a number of deals signed up pre-COVID that have since closed, but its focus has narrowed to serving its existing customer base, for now.

“As far as new opportunities go, I think most lenders are taking a step back and working with their existing clients,” Subramanian said. “I think people are staying away from transactions that include potential risk, and if you look at deals closing today the pricing is higher and leverage is lower. It’s a far more conservative structure compared with February.”

Capital One started off the year with strong momentum following a stellar 2019. Subramanian added an impressive $1.7 billion in new production to her lending portfolio in 2019, bringing its total to roughly $5 billion.

One notable 2019 origination was the $132 million construction loan for MRP Realty’s Bryant Street, a significant mixed-use opportunity zone project in D.C. Capital One serviced as administrative agent, holding $72 million while syndicating the remainder to Citizens Bank.

Another was a $65 million loan for The Vale, a 301-unit apartment building with 18,300 square feet of retail along Georgia Avenue. The 2.25-acre project is being developed by a partnership of Urban Atlantic, Hines, Triden and PGIM Real Estate.

In addition to her significant influence within the lending sphere, Subramanian brought Capital One and Commercial Real Estate Women (CREW) together, spearheading the bank’s sponsorship of CREW’s research on women in CRE. In May, Subramanian was also added as a member of the Federal City Council, a non-profit organization dedicated to the advancement of civic life in D.C.—Cathy Cunningham

Martha Naughten and Kaitlyn Rausse

Senior Leasing Directors, Carr Properties

The Carr Properties team of senior leasing directors Martha Naughten and Kaitlyn Rausse have had quite the year, recently recognized with the 2019 Commercial Real Estate Brokers Association’s regional landlord/developer agent of the year award. The execs led among their D.C. peers with 1.1 million square feet of completed lease transactions in 2019.

The pair were a natural fit for the Power D.C. list, as their impressive accomplishments have continued into 2020.

“During these extraordinarily challenging times, we are very proud to be part of Carr Properties,” Naughten said. “With our cohesive approach to customer service and strong customer relationships, Carr has maintained an operating portfolio that is over 95 percent leased.”

Rausse added that in 2019 the duo executed 60 lease transactions that totaled more than 1.1 million square feet and had an aggregate lease value of $811 million.

“Contributing to the success was our cohesive approach to customer service alongside well-positioned assets and innovative developments,” Rausse said. “We are thrilled to continue our long-term relationship with Baker Donelson at 901 K Street. We were pleased to bring this deal to a close during a pandemic at economic terms that were beneficial to both parties.”

In the months ahead, Carr Properties’ development pipeline will deliver next generation buildings focused on wellness.

“Carr Properties will continue to deliver forward-thinking and sustainable designs, as best shown in our active local developments,” Naughten said, pointing to The Wilson in Bethesda, Md. and Signal House in the Union Market neighborhood of D.C. “Both developments epitomize the future of office with state-of-the-art HVAC and touchless technology incorporated throughout the building.”—K.L.

Lou Christopher

Vice Chairman, CBRE

Lou Christopher, CBRE’s Vice Chairman, has spearheaded some of Washington, D.C.’s most significant real estate assignments on behalf of Fortune 500 companies, large law firms and other leading enterprises.

In 2019, the 32-year industry vet completed 35 transactions totaling $668 million. He closed two major deals recently, as part of the team of CBRE professionals that represented legal powerhouse Mayer Brown in its 173,483-square-foot lease renewal at 1999 K Street, and PwC in its lease at 655 New York Avenue, NW, where it signed for 198,600 square feet across the top four floors.

For several clients with leases expiring in the next three years that are happy with their current building, Christopher is advising them to renegotiate now and right-size their footprint and rent terms, taking advantage of today’s extremely tenant favorable market conditions.

“Our strategy has always been to put our clients’ needs first,” Christopher said. “In the current environment that means for most tenants, we are strongly suggesting they wait to see how the market softens and what new workplace trends emerge. For a few select clients, we are advising them to act now if an unbelievable opportunity presents itself with many compelling reasons to move forward and sign.”

Christopher believes CBRE is positioned to further set itself apart from competitors even during the current tough economic time.

“As the world’s largest real estate company, we have by far the most revenue, resources and the lowest debt-to-income ratio in the industry,” he said. “I am confident CBRE will not only weather the storm, but will become stronger and increase market share as a result.”—K.L.

Tim Leon

Executive Vice President, Citizens Bank

It’s the second year Citizens Bank’s Tim Leon has made our Power D.C. list, and for good reason. The lender racked up close to $1.5 billion in D.C. originations last year, and when COVID-19 hit it continued serving its customers.

“We’ve been very focused, making sure we’re in close, robust communication with our clients and understanding that each client and their circumstances are different,” Leon said. “We’re staying on top of our existing portfolio, particularly as it relates to COVID’s potential impact on clients’ portfolios.”

For now, Citizens is limiting its lending activity to its existing customer base and targeting opportunities within the credit tenant lease space — for example acquisitions with single, investment-grade tenants, executed at a leverage point the bank is comfortable with.

“We’re not interested in taking market risk because it’s very difficult to underwrite now,” Leon said. “It’s difficult to underwrite what will happen in the future with the level of uncertainty that is present.”

The bank is also eyeing future opportunities in the life sciences and medical space, Leon said.

Rewinding to the pre-COVID world, Citizens Bank’s 2019 originations included a $138 million loan to DSC Partners for the acquisition of 28 office and industrial buildings in Montgomery, Md., and a $92 million loan to Comstock Partners for its acquisition of Commerce Metro Center, a portfolio of three office buildings in Reston, Va.

As for lending locales, there are worse places to be than the nation’s capital as the industry finds its feet post-pandemic.

“Washington, D.C. has always performed better than many of the major markets in economic downturns because of the presence of the federal government, which acts as an anchor and stabilizes the market,” Leon said. “D.C. is not recession proof but it is recession resilient.”—C.C.

Kurt Stout, Charles Dilks, Keith Lavey, Jarret Morrell and Matthew Johnston

Government Solutions Team, Colliers

Colliers Government Solutions, a national platform providing services to owners and investors of government-leased properties across the United States, aims to offer a full suite of services focused on the sector.

Over the past year, Colliers’ team of Kurt Stout, Charles Dilks, Keith Lavey, Jarret Morrell and Matthew Johnston have been influential in supplying their management expertise for government-leased assets, thanks to the formal launch of its integrated services platform in February 2020.

“That culminated an effort that, in some respects, dates back to our arrival at Colliers in 2011,” Stout said. “The Government Solutions platform fully integrates market-leading leasing, property management, project management and investment sales teams.”

With offices shutting down a couple of weeks after the enactment of the platform, the team was forced to throw out the entire Year One playbook—which involved extensive domestic travel—and instead figure out a new plan.

“Our integration has substantially improved our service delivery because we benefit from a continuous, real-time exchange of front-line information and experience across the entire platform,” Stout said. “For example, our leasing team was one of the first to hear about new COVID-19 lease clauses that would eventually affect our management portfolio of more than 300 government assets. This information helped our management team and our clients anticipate the operational impact of GSA’s new policies.”

Currently, federal government leased properties represent a small niche, only 0.2 percent of the total U.S. commercial and investment property market.

“We see a lot of capital circling the sector, considering how to successfully invest,” Stout said. “Our strategy through the remainder of the year is to harness our entire platform to assist these investors—both existing funds and new entrants—in determining how they can participate in the government sector.”—K.L.

Darian LeBlanc

Executive Vice Chair, Cushman & Wakefield

Darian LeBlanc leads Cushman & Wakefield’s Government Services Advisory Group, providing advisory services to the firm’s institutional-owner clients, as well as the market-leading investment sales and agency leasing teams in D.C.

“The first half of this year has been challenging to say the least. With the decrease in private sector leasing activity, there has been an increased focus on government tenants across the country,” he said. “The demand for market insights and predictive information on the government has skyrocketed and meeting that need while remaining quarantined has not been easy. I lead an exceptional team of professionals concentrating solely on what is happening inside of government real estate and they have all adapted to this ‘new COVID-19 normal’ and are working tirelessly to meet the needs of our clients.”

LeBlanc leads a team that is one of the top government advisory groups locally and across the country. Some of their most recent wins as a team include representing the sale of 1425 New York Avenue as well as 5001 Eisenhower Avenue.

“We finished the re-leasing of One Constitution Square recently, a 345,000-square-foot building that was fully vacated by GSA in late 2017,” LeBlanc said. “We achieved 100 percent occupancy in August with the last of four leases and followed that up with a sale of the building for Stonebridge/Walton Street.”

Over the last decade, LeBlanc has completed more than 471 transactions totaling over 19 million square feet and more than $5.6 billion in total consideration. Those figures have earned him accolades from organizations such as NAIOP, CREBA and the African American Real Estate Professionals of DC.

Looking ahead, he knows things will be challenging as fears about the coronavirus continue.

“Staying abreast of the evolving trends [and] patterns of all tenants, particularly the government in our case, is critical to our clients’ success,” he said. “Doing the deal right in front of you has never been more important than it is today—losing any deal could mean waiting a while for the next opportunity.”—K.L.

Jim Davis

President and CEO, Davis Construction

There are plenty of small towns in America that have less than 3,000 people. For that reason Davis Construction, which employs roughly that many employees and subcontractors on their many projects, had reason to be concerned: Take a population of that many people and you will get a certain number of COVID-19 cases.

However, Davis was an early adopter of safety practices on all their sites: They color-coded their contractors’ hard hats and staggered shifts. They reduced the number of cross-contamination from workers by car pooling workers from the same color-coded groups. They required that masks stay firmly put on workers’ faces.

“We have seen the number of positives go down significantly,” Jim Davis, the firm’s president and CEO, told Commercial Observer. And in recent weeks they finally reached the milestone that they were shooting for: zero positive cases.

That should make everyone breathe a sigh of relief, as Davis Construction is at work on about $1 billion worth of real estate in the D.C. area.

The big projects that Davis has worked on in the last year include Capital One’s Headquarters in Tysons Corner; Douglas Development and Brookfield’s 756,000-square-foot project at 655 New York Avenue; and a project at Reston Station which in addition to office space and apartments will also include “the largest underground parking garage east of the Mississippi.”

Davis, 61, is the fourth generation to lead the company; his great-grandfather started out as a janitor at the National Building Museum in 1915 when he met some architects and agreed to build them a boat house and began the business.—Max Gross

Muriel Bowser

Mayor of the District of Columbia

Muriel Bowser has definitely left her mark on the capital.

Earlier this month, the words “Black Lives Matter” appeared in bright yellow letters on a street leading up to the White House, marking one of the more vivid displays of confrontation between the D.C. Mayor and the President.

“There is a lot of distrust of police and the government. There are people who are craving to be heard and to be seen and to have their humanity recognized,” Mayor Bowser said in regards to commissioning the street mural at a June 5 news conference. “We had the opportunity to send that message loud and clear on a very important street in our city.”

The protests, calling for an end to police brutality following the killing of George Floyd while in police custody, are capping off a tumultuous time for the district after it emerged as one of the country’s hotbeds for coronavirus infections.

Mayor Bowser’s ReOpen D.C. advisory group, co-chaired by Wharf developer Monty Hoffman and Dantes Partners’ Buwa Binitie, has come up with advice and help for affordable housing, retail, commercial and neighborhood-level real estate needs. Late last month, the mayor presided over the district’s first phase of reopening, where hotels, outdoor dining, and retail curbside pick-up and delivery were opened back up.

Earlier this year, Mayor Bowser spearheaded legislation to offer tax breaks to incentivize construction of affordable housing in some of D.C.’s wealthiest neighborhoods, including Capitol Hill, Rock Creek East, Rock Creek West and Upper Northeast. In this year’s budget, she asked for $4 million annually in tax abatements for projects in high-need areas.

The mayor, who was reelected in November 2018, is the first D.C. mayor to earn a second term in 16 years.—Sarika Gangar

Norman Jemal

Managing Principal, Douglas Development

Douglas Development is one of the D.C. area’s largest real estate developers, and Norman Jemal helps run the show.

His father, Douglas Jemal, founded the firm in the early 1990s with the proceeds he earned from selling his share in Nobody Beats the Wiz, an electronics store chain that he and his brothers started in New York City. (The elder Jemal also happens to be a native Brooklynite whose daughter married the nephew of New York City developer Joseph Cayre.) So Douglas has stayed on as president of his eponymous company, and his sons Norman and Matthew serve respectively as managing principal and senior vice president.

Norman Jemal has helped the firm oversee the completion of several ambitious projects over the past few years, including the conversion of the old Hecht Warehouse, which his father bought sight unseen in 2011 even as Douglas Development was particularly cash-strapped, according to The Washington Post.

These days the company is working on a few mid-sized residential and commercial projects in D.C., including the conversion of a former federal office building at 1900 Half Street SW on the waterfront in Buzzard Point into 432 apartments with ground floor retail.

“We did get slowed down by corona as some of the people working on the project contracted the virus, but we were able to negotiate around that and set up procedures,” said Jemal.

The firm is also constructing a 234-key AC Hotel by Marriott at 601 K Street NW, by Mount Vernon Square, and a 321-unit market-rate rental project called Addison Row in Capitol Heights, Md. And it even has a few projects outside of the D.C. area, including a new two-building, 217-unit rental development in Richmond, Va., and the renovation of a million-square-foot office tower in Syracuse, N.Y. —Rebecca Baird-Remba

Antonio “Tony” Marquez

Executive Vice President and Chief Commercial and

Industrial Lending Officer, EagleBank

Tony Marquez, 61, has been in charge of commercial lending activities at EagleBank since 2011. Over those years, the bank has grown into one of the largest and most recognizable commercial real estate financing names within its DMV stomping grounds — District of Columbia, Maryland and Virginia.

Just as you’ll find EagleBank consumer banking outposts scattered throughout the region, branching out and encircling its Tysons, Va. and K Street regional headquarters, you might as easily see a piece of real estate that’s been financed by the community staple. Its loan book has grown to over $7.5 billion as of the end of last year — a 51 percent jump from 2015 — and 85 percent of it is secured by real estate. Marquez estimated that 98 percent of their existing loans are in the DMV area.

The more than $2.1 billion of loans on income-producing commercial property from 2015 has since ballooned to $3.7 billion, as of the end of last year. And with that, EagleBank carried just under $1.04 billion of commercial and residential construction debt on its balance sheet at the end of 2019, which is nearly identical to its 2018 output.

This year seemed to be yet another banner year in the making for the bank before COVID-19 rocked its stock (NASDAQ: EGBN) — as it did to so many other publicly-traded companies — shook up its workforce and forced it to prioritize the Small Business Administration (SBA) PPP lending program, Marquez said.

The bank processed more than 1,300 SBA loans, totaling around $500 million, in the span of five or six weeks. They had done just 69 SBA loans in all of 2019.

“How the loan book will evolve over the coming quarters is a story that’s going to be written over time,” Marquez said. “For the rest of this quarter and into the third quarter, [we’ll have] a much more defensive posture because we have enough to keep us entertained.”—Mack Burke

Chad Habeeb

Principal and Director of Leasing, FD Stonewater

When federal agencies are looking for new space in D.C. or elsewhere, they usually come to FD Stonewater, which exclusively focuses on leasing deals with the federal government.

In the past year alone, Chad Habeeb, the firm’s leasing director, has closed a 300,000-square-foot lease for the headquarters of the U.S. Attorney’s Office at 601 D Street NW, and a 200,000-square-foot deal for D.C.’s Office of the Attorney General in the same building. Tishman Speyer was in contract to buy the building, and by the time the New York developer closed on the sale for $163 million last year, Habeeb and his team had leased up most of the 10-story, 1970s office property.

Although Tishman had planned to renovate the building into Class A office space, it ended up performing a much more limited renovation because the entire building was leased.

“They were able to save a lot of money because they didn’t have to renovate it [as much], they simply had to provide the TI [tenant improvement costs] that the government needed,” said Habeeb.

He also completed a 500,000-square-foot headquarters lease for the U.S. Drug Enforcement Administration at 600 and 700 Army Navy Drive in Pentagon City, Va.

“We do pride ourselves on being able to execute those large, complicated deals but we also do smaller deals, too,” Habeeb explained. “We’ve done 5,000-square foot deals and 1-million-square-foot deals. The GSA [General Services Administration], their average deal across the country is about 15,000 square feet.”

Habeeb, now 36, managed to land in federal real estate right after college. After graduating from the University of North Carolina-Chapel Hill, he was hired as a space management specialist in the real estate department at the U.S. Department of Justice. He’s been working with federal agencies ever since, alternating between doing landlord and tenant work during stints at JLL, CBRE and then FD Stonewater.—R.B.R.

Mark Calabria

Director, Federal Housing Finance Agency

Mark Calabria, 50, the former chief economist for Vice President Mike Pence, was tasked as director of the Federal Housing Finance Agency (FHFA) with preparing Fannie Mae and Freddie Mac for an exit from conservatorship. Less than a year after his seat was confirmed came the public health crisis that would rattle the economy and thrust the FHFA, as a regulatory body, and Fannie and Freddie into the trenches to help keep the housing market afloat.

“The overarching goal of FHFA has been to protect borrowers and renters, while ensuring that the mortgage market functions as efficiently as possible during these economically difficult times,” Calabria told CO in an emailed statement. “All actions made at FHFA during the pandemic have been driven by data. As the country recovers, we will continue to follow the data and update our policies as needed.”

Since mid-March, when the executive branch considered the potential dangers of COVID-19 and subsequently picked up the fight, the FHFA — almost in lock step with the Federal Reserve and Treasury Department — has been proactive.

It quickly made forbearance available for multifamily owners with agency debt and barred tenants from being evicted for missed rent payments during the period of the property owner’s forbearance. And for mortgages in forbearance, it established a four-month limit to servicers’ obligations to advance principal and interest payments.

Calabria said in a mid-May speech to the Mortgage Bankers Association that the four-month advance limitation “provides much-needed stability and clarity to the mortgage market. It enables mortgage servicers to know the duration of their advance obligations on loans for which borrowers have not made their monthly payment.”

Among other efforts and changes in underwriting standards being deployed by Fannie and Freddie, it also allowed for some flexibilities around appraisals and loan closings for agency borrowers in response to government administrative issues that cropped up in many localities across the country, having extended these provisions until at least the end of June, according to Calabria.—M.B.

Jerome Powell

Chairman of the Federal Reserve

As it started becoming clear in March that coronavirus wouldn’t somehow magically disappear, the Federal Reserve was among the most proactive players in trying to head off the crisis from an economic standpoint.

In early March, the Fed slashed rates to zero but the stock market still suffered day-after-withering-day of falls. On March 11, without blinking an eye, Fed chairman Jerome Powell announced the Fed was providing half a trillion dollars in short-term loans for distressed borrowers. The very next day, the Fed put another half trillion dollars for repo loans.

Powell appears to have learned from one of his predecessors, Ben Bernanke, what worked so well during the fiscal crisis of 2008: Get as much money out the door as quickly as possible.

And the Fed has continued putting as much money out to ease nerves and shore up the economy when the U.S. finally reopens. At the beginning of this month, Powell undertook injecting $600 billion into small businesses with the hope of preserving millions of jobs through the Main Street Lending Program.

He has been at once a teller of hard truths and an assuring presence that he would keep injecting liquidity into the market and not do anything to startle it: Case in point, last week Powell said that the unemployment rate would remain a horrible 9.3 percent through the end of the year (although that would still be a considerable improvement)… and that the Fed would keep interest rates near zero until 2022.

While the Fed will no doubt have its hands full for the foreseeable future, just about everyone is glad that the 67-year-old Princeton and Georgetown-educated Powell is in the chairman’s seat.—M.G.

Katie Wiacek

Managing Director, Hines

Building a city-within-a-city is no mean feat. And then add in negotiations with the government and the U.S. Army, plus a ground lease to boot, and you have the makings of a true real estate goliath.

Katie Wiacek, managing director at Hines, has been grappling with one such giant as the firm’s D.C. lead for The Parks at Walter Reed redevelopment project. The multi-phase project, expected to be completed in 2028, will transform the historic Walter Reed Army Medical Center into a 3.1 million-square-foot mixed-use campus, housing everything from office and retail to apartments and condos, as well as a hotel, a school and green space.

“Every development is complex, but the scale of this, with a 66-acre site, and the parties involved, the historic layer, and putting in all new infrastructure—it’s very multifaceted,” Wiacek said.

The executive, who joined Hines straight out of college 12 years ago, has been working on the project since its inception in 2013. Since then, Hines, along with partners Urban Atlantic and Triden Development Group, has seen the opening of the DC International School and inked a deal with Whole Foods to anchor the project’s 323-unit luxury apartment complex, The Hartley.

“The work has been everything from initially working through the master plan, phasing, budgeting, financing, and leasing; it really runs the gamut,” she said.

In December, the firm celebrated the opening of 80 units of affordable housing at the complex’s Abrams Hall. A few months later, it closed on construction financing for The Hartley with Santander Bank N.A. and EagleBank.

The firm expects to deliver the first market rate condo and multifamily projects later this year, as it pushes ahead amid the pandemic.

“I am optimistic about for-sale and for-rent multifamily product given the historic stability of the DC market and the diversity of industry here, bolstered by the federal government – not to mention it’s a great area to live in,” she said.—S.G.

Matt Kelly

CEO, JBG SMITH

JBG SMITH has a great deal to be proud of over the past 12 months, as it’s made enormous progress with National Landing and Amazon’s new headquarters campus. It’s no surprise then to see CEO Matt Kelly make a return appearance on the Power D.C. list.

“In partnership with Amazon and Arlington County, we made incredible progress in formulating designs and gaining approvals on the first phase of their campus and associated public spaces,” Kelly said. “With the start of construction in early 2020, we took the biggest step yet in turning our collective vision for National Landing into a reality.”

During the first quarter, JBG SMITH completed the core and shell of National Landing’s retail hub, Central District Retail, ahead of schedule and under budget. The 109,000-square-foot entertainment and shopping destination will be anchored by Alamo Drafthouse Cinema, a specialty grocer, restaurants, bars and other experiential offerings.

In late 2019, JBG SMITH secured another lease with Amazon, bringing the company’s current footprint to 857,000 square feet across five buildings in National Landing. Under the terms of the most recent agreement, Amazon will occupy 272,000 square feet at 2100 Crystal Drive.

In March, the company secured all the necessary approvals from Arlington County to develop two residential towers at 1900 Crystal Drive comprising approximately 811 residential units and 40,000 square feet of street-level retail across two new mixed-use buildings.

“On the residential front and in keeping with our reputation as a developer of high-quality assets with an emphasis on placemaking, we delivered West Half, a multifamily building that overlooks Nationals Park,” Kelly said. “We also recently celebrated the completion of 900 W Street and 901 W Street (256 units) in the vibrant Shaw neighborhood.”

Additionally, in April, JBG SMITH submitted designs for the first building of Virginia Tech’s Innovation Campus, which will be the initial phase of a new mixed-use district in Potomac Yard.—K.L.

Monty Hoffman

Founder and Chairman, Hoffman & Associates

When names of the leaders in D.C.’s real estate industry are bandied about, one name that always comes up is Monty Hoffman, founder and chairman of Hoffman & Associates.

This year, Hoffman and his team have continued to break boundaries in their development of large-scale communities.

“I am incredibly proud of Hoffman & Associates’ growth,” Hoffman said. “In the past year, we have expanded our leadership team allowing for more opportunity to grow our existing talent while adding new members to our team as we enter new markets.”

Major construction progressed amid the vexing circumstances presented by COVID-19—including Phase 2 of The Wharf, which remains on track to deliver in 2022. The company executed two D.C. record-breaking transactions totaling $1.65 billion in financing for The Wharf, a testament to the neighborhood’s success.

“Our team matched best-in-class designs with market demands, having preleased 60 percent of Phase 2’s office space along with forming an operating partnership for our 130,000-square-foot luxury hotel, Pendry Washington, D.C. - The Wharf, the hospitality brand’s first property in the nation’s capital,” Hoffman said.

The company has also formed partnerships on several major community development projects in Falls Church, Va. and Raleigh, N.C.

“In a little over a year we opened a new office in Raleigh, N.C., in the heart of our 800,000-square-foot Seaboard Station project, expanded to Virginia with our Falls Church mixed-use development project and continued to expand our D.C. footprint with Waterfront Station II,” Hoffman said.

Over the past few months, he’s also served as a member of the ReOpen DC Advisory committee.

“We are using our industry expertise and knowledge in retail, commercial, and neighborhood-level real estate to provide recommendations to safely and effectively reopen the city,” he said. “As the city makes its way through the first phase of reopening, we are making the most of The Wharf neighborhood’s ample outdoor space, proximity to the water and adaptable infrastructure to provide socially distant summer recreation.”—K.L.

Amy Bowser and Greg Lubar

Executive Managing Director of Agency Leasing; Vice Chairman of Tenant Representation, JLL

The JLL team in Washington, D.C. saw big growth over the last year, and two of its leaders — Amy Bowser, the executive managing director of agency leasing, and Greg Lubar, the vice chairman of tenant representation — are a big reason why.

For Bowser’s team, the success was built on the aggregate of all the deals done across the city resulting in just shy of 1.4 million square feet of leasing.

“2019 was a rewarding year in many ways,” Bowser said, noting that the team added Brooks Brown as a new partner and team leader. “We also worked on some large high-impact transactions and transformative projects in the District including The Wharf, Terrell Place, 1201 New York and 815 Connecticut, among others.”

Lubar noted there was much to be proud of in the last six months, but notable deals included the renewal of the contract for Volkswagen which resulted in nearly 1 million square feet of transactions across the country, a 590,000-square-foot deal for WeWork within D.C. Metro, and a sizable deal for consulting firm ICF.

“At 200,000 square feet, ICF [signing in Reston Station] was the single-largest deal I did,” Lubar said. “They have been a 20-year client of mine and this was the second headquarters deal we’ve done for them in the last 15 years.”

With all that’s happening in the world, JLL has placed a special emphasis right now on staying connected.

“We are working in new ways and redoubling our efforts to remain well-informed and prepared for what lies ahead,” Bowser said. “We are listening and learning as much as possible as we’re going through this current environment to maintain our competitive edge in the market.”

For Lubar, he’s applying lessons learned from past crises like the dot-com bust and the Great Recession.

“We’ll be deploying strategies we used then to right size, reevaluate needs, reduce costs and discover some new things we’ve never done before,” he said.—K.L.

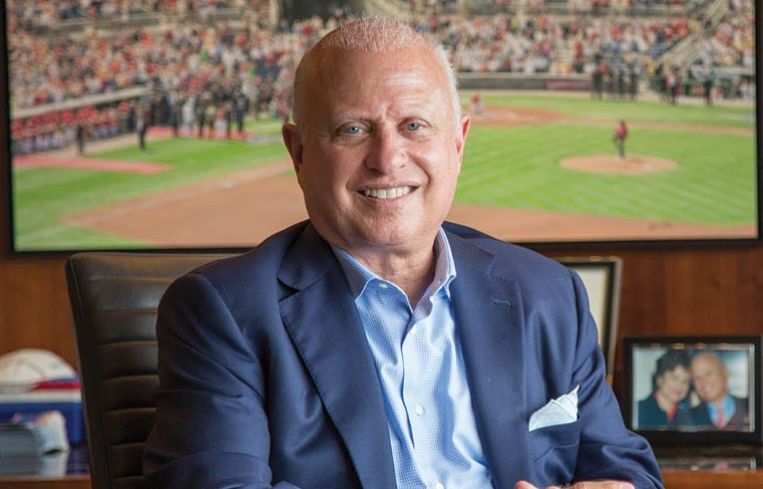

Mark Lerner

Principal at Lerner Enterprise; Principal Owner of the Washington Nationals

It’d be easy enough for Mark Lerner to earn his place on any D.C. power players list after bringing the city its first baseball championship in decades last year.

The Washington Nationals, which Lerner took control of from his father in 2018, defeated the Houston Astros to clinch the first Major League Baseball championship in the franchise’s history since it moved to D.C. in 2005.

Of course, it’s not just Lerner’s success on the baseball diamond that earned him his spot.

Lerner is a principal of Lerner Enterprises, founded by his father in 1952, where he has worked for more than 40 years. The firm, one of the largest private real estate companies in D.C., has holdings including a large chunk of Tysons Corner and Washington Square, and it has developed more than 20 million square feet, with no plans of slowing down anytime soon.

Last year, the company broke ground on a 244-unit luxury apartment building, 1000 South Capitol, near the Washington Nationals stadium in Capitol Riverfront. Construction is expected to finish in the spring of 2022.

Lerner is also working on the first phase of the 110-acre Black Hill Germantown mixed-use project in Germantown, Md., set to finish this fall. That phase includes a 255-unit apartment building, 5,000 square feet of retail space and a community clubhouse.

And the company has plenty more giant projects in the works.

It’s currently in the planning and design stages for Lerner Esplanade, a 550-unit residential property in Dulles, Va.; a 21-story commercial development at 1725 Tysons Boulevard in Tysons, Va.; and a 10-story office property at 1100 Half Street in the Capitol Riverfront, which includes a rooftop convention center.

And even as the coronavirus pandemic forced MLB to delay its season, Lerner didn’t just let the Nationals Park stadium sit unused. Lerner partnered with José Andrés’ World Central Kitchen to turn the spot into a cooking and packaging center to send off thousands of daily free meals.—N.R.

James Cassidy and Jud Ryan

Executive Managing Directors, Newmark Knight Frank

Ever since this dynamic duo arrived at Newmark Knight Frank together in 2016, James Cassidy and Jud Ryan have taken NKF’s investment sales business in the Mid-Atlantic region to new heights.

“We’re most proud of the fact that for the third year in a row, we’ve closed 100 percent of our sales listings for our clients while doubling our transactional volume and exceeding pricing expectations by 2.5 percent, on average,” Cassidy said.

As co-executive managing directors in the firm’s Washington, D.C., office, they’ve led a team whose accomplishments include 22 deals closed in 2019 and a doubling of transaction volume over the past year, making them the fastest growing practice in the D.C. market. Notable transactions in the District include the Watergate Building, 99 M Street, and the McPherson Building.

In terms of dollar volume, the $209.1 million sale of the McPherson Building, a 12-story, 255,968-square-foot office in downtown DC, topped the list.

“We approach every deal as if it were our ‘biggest’ as we have to validate the faith and trust our clients place in our team to execute,” Ryan said. “We firmly believe that you are only successful in that moment of success and that you have to do it again and again.”

In the months ahead, as the country tries to navigate a new normal in the wake of COVID-19, Ryan and Cassidy plan to stay the course.

“We see this period of disruption as an opportunity to further differentiate ourselves by continuing to perform for our clients and to fill the role of a trusted advisor and not just a transactional broker,” Cassidy said. “Lastly, we will continue to leverage our full-service platform in our sales process and our national capital markets platform to uncover the most aggressive capital for each sale mandate.”—K.L

Scott Hoffman

Vice Chairman, Savills

Scott Hoffman has crafted a storied career assisting law firms, corporations and nonprofits on finding solutions to some of the most complex real estate challenges in the Washington, D.C. market.

The vice chairman of Savills has completed more than 15 million square feet of real estate transactions totaling in excess of $1 billion over his career, helping top law firms like Shearman & Sterling, Sheppard, Mullin, Richter & Hampton, Womble Bond Dickinson and Wilkinson Walsh in the process.

Over the last year, Hoffman has been as busy as ever, navigating the pandemic and continuing to find solutions for his clients. He was even named a Commercial Real Estate Brokers Association’s top leasing agent for 2019.

“What I am most proud of during the past 12 months is a difficult question but a few things rise to the top of the list—personally, my kids and their ability to adapt to virtual learning (with minimal complaints),” he said. “Professionally, witnessing a tremendous amount of hard work of multiple parties come to fruition while finding a solution to a complex real estate situation for a client.”

For instance, representing education consulting firm EAB, Hoffman simultaneously arranged a lease bifurcation, lease termination, lease assignment and a new lease, providing the firm with nearly $100 million in real estate cost savings. The multifaceted process resulted in the disposition of a 137,000-square-foot lease via a lease amendment and assignment to WeWork at 655 New York Avenue, NW; the giveback of 65,000 square feet via a termination with Brookfield/Jemal; and a 150,000-square-foot new lease at 2445 M Street, NW.

He also led the team advising Williams & Connolly in their 300,000-square-foot relocation to Phase 2 of the new Wharf waterfront development in Southwest D.C.

His post-COVID-19 strategy is to be mindful about what is going on around us, seeking advice from the experts on proper protocols and policy, understanding the fluidity of the situation and remaining nimble.—K.L.

Campbell Smith

Leader of Mid-Atlantic Business Unit, Trammell Crow

Campbell Smith became head of Trammell Crow Company’s Mid-Atlantic region in early 2019, after 17 years with the company.

In the short time since, TCC has completed the buildout of the Federal Communication Commission’s 470,000-square-foot headquarters at Sentinel Square, delivered the redeveloped Motion Picture Association of America (MPAA) Building—a trophy office property at 888 16th Street, one block from the White House—and started construction on a 360-unit apartment building at 2607 Reed Street NE, among other projects.

At the MPAA building, TCC compleased lease transactions with law firms McGuire Woods and Hausfield, and sold an office condo to the Ronald Reagan Presidential Foundation Institute.

Prior to 2019, Smith was the managing director and COO of the Mid-Atlantic business unit, where he led many of the projects now reaching completion, including the MPAA building, and the 2.5-acre Armature Works, a mixed-use project in NoMa. The latter project includes 640 apartments, a 200-unit hotel, as well as retail, and is being developed by TCC’s residential arm, High Street Residential.

While the outbreak of the coronavirus pandemic has slowed the pace of business, Smith said he did not expect to see long-term damage. “We believe that these will be relatively short term impacts, and the favorable demographic and job growth trends that have supported new development in the DC area market for decades will re-emerge and lead to continued growth,” Smith wrote in an email.

In addition, TCC is active across multiple asset types, including logistics and bulk distribution, which has not been hit as hard during the pandemic.—C.G.