From Wunderkind to Wondering What Happened: The Fall From Power of Adam Neumann

By Commercial Observer June 25, 2020 8:00 am

reprints

When looking at the starkest loss of power since the release of our last Power lists, the answer could easily be all of us: cowering in our homes, afraid to go outside, much less into the office. Doesn’t exactly scream “power player.”

Then again, it could also be New York City itself, which lost considerable luster during the peak of COVID-19 infection that it has yet to regain.

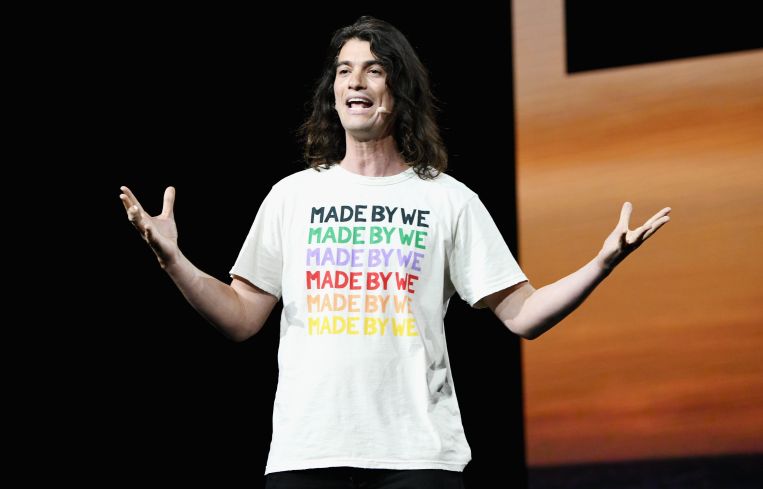

But from a more conventional standpoint, looking at the individual player in CRE who enjoyed obvious clout last year that has since been drained, the clear winner is Adam Neumann, who went in one year from CRE’s re-inventor to its most notable litigant, from a game-changing boy wonder reportedly worth $14 billion to a “former” everything including billionaire, as Forbes recently put his net worth at around $750 million (In April, Bloomberg put it even lower, at $450 million.). Of course, this doesn’t exactly put him in the poorhouse, but the full scope of Neumann’s fall is shocking.

Neumann, We Company’s Co-Founder and CEO, shared the number 16 slot on last year’s Power 100 with his co-founder and Chief Creative Officer, Miguel McKelvey.

The listing was a quick and partial account of the growth and accomplishments of WeWork and its associated companies. Among them: that large (1,000+ employees) companies accounted for 32 percent of WeWork’s membership, a membership that boasted over 400,000 participants across 425 locations in 100 cities in 27 countries.

They had also just secured a $2 billion investment from SoftBank Group.

We all know how that went.

After making WeWork the largest private tenant in Manhattan and building the rebranded We Company toward a controversial $47 billion valuation, its attempted IPO raised uncomfortable questions about the company’s business model and Neumann’s leadership. Once he lost investor SoftBank’s support, the man who sought to bring his company to Mars saw the whole thing crumble to dust. Barely a month after filing the company’s IPO paperwork, Neumann resigned in what Vanity Fair referred to as, “one of the most spectacular flameouts in recent corporate history, an Icarus story for its time.”

This past April, Neumann sued SoftBank for breach of contract after the bank withdrew an offer to buy $3 billion in WeWork shares.

Neumann still has money – $450 million can buy a lot of…well, pretty much anything. But Neumann’s tale gives a touch of a lie to the commonly-held belief that money is power. Better to have it than not, of course, but money alone is often not enough.

As we view this year’s Power lists, especially in this most turbulent and life-changing of years, it behooves us to look beyond the valuations and surface achievements.

With CRE’s foundation roiling underneath us in the wake of COVID-19, Neumann’s story is a stark but essential reminder to look with a more discerning eye – see who’s adjusting to the current and likely future landscape, and, perhaps most importantly, see who built their success on a foundation that’s tethered to the Earth, not solely to grandiose visions in the wide, starry eyes of its creator.

For true power is that which is deeply rooted in leadership, innovation and, well, resiliency.

Save the date for the 2020 Power Series