CO’s 30 Under 30: The Top Leasing and Sales Professionals of 2019

By The Editors October 1, 2019 9:00 am

reprints

Grit is rarely felt so keenly as it is in your twenties. You have so much to prove in those early years. It’s the time when you don’t necessarily have such a large stash of resources to utilize, or to fall back on. It’s when you’ve really only got your pluck and determination to rely on if you intend to get anywhere.

Those on this year’s list of the top young leasing and sales professionals certainly have those qualities.

They have done the thankless shoe leather work of going from office to office in search of leads. They’re in constant search of a fresh perspective to get the deal done. They’ve managed to find opportunity within the market’s twists-and-turns. And they’ve done it with the confidence and attention to detail that ensures it’s been done right.

Every year we’re asked what qualities we’re looking for in candidates and we answer in various ways: what they’ve done, where they’ve worked, what they’ve got planned, and Commercial Observer always hopes that each year’s list will end up looking different. (It’s one of the reasons we avoid putting on some superstars for multiple years.)

But, in truth, sometimes we just don’t know what we want until we see it. Our general advice is this: Wow us.

These are the real estate professionals who did.—M. Gross

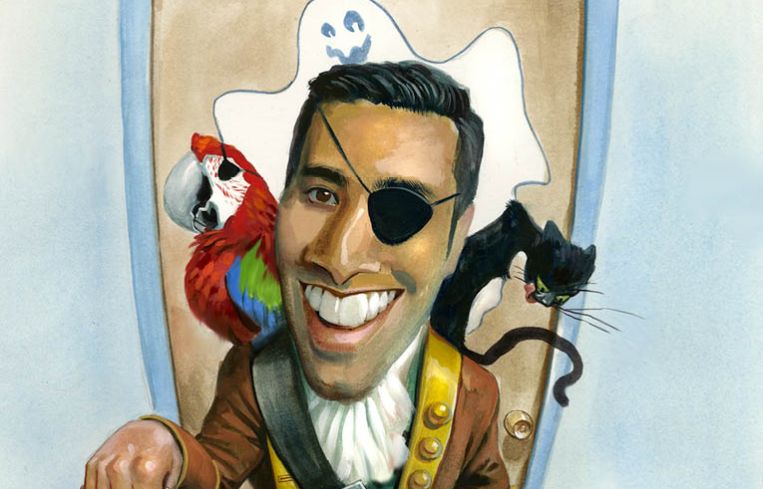

Andrew Lohrfink, 28

Director, Office Leasing & New Business Development, Tishman Speyer

Andrew Lohrfink was working on the bond desk at GFI Group and not loving it.

“After doing it for six months it was so not tangible,” Lohrfink said. “People were making money, but I didn’t know how.”

One night he went to an alumni dinner for his alma mater (Georgetown) and wound up sitting next to Matt Cassin, who is now of JMC Holdings. As they began talking, Cassin suggested Lohrfink give real estate a try. He sent his resume to Tishman Speyer, got hired as an analyst, and he’s been there ever since.

Dinners have been very good to Lohrfink. His biggest deal in the last year came after he was having dinner with several brokers at the Soho restaurant Charlie Bird and mentioned one of his properties nearby, 175 Varick Street.

A few weeks later, when Cushman & Wakefield’s Evan Algier was walking a client past the building, he remembered Lohrfink telling him about it. Rokt, the marketing technology startup, wound up taking 35,000 square feet.

Of course, 175 Varick Street is only one of the properties that the Armonk, N.Y., native does leasing for; he also works on Rockefeller Center and 300 Park Avenue. And beyond the bread-and-butter leases, Lohrfink has had his hand in buying and selling; when he was doing a stint in Tishman Speyer’s Washington, D.C., office he was part of the team that sold Tysons International Plaza to Rockpoint Group for $132 million.

Currently, Lohrfink is hunting up and down Nashville for Tishman Speyer’s entrée into the Tennessee market (either to buy or develop property) — in fact, that was where he was when he spoke to CO by phone.

“It’s my fourth trip down here — I’ve met with the biggest owners, I’ve met with the chamber of commerce, we want to make everybody aware” of what Tishman Speyer is trying to do.—M. Gross

Christopher Walther, 29

Director, Ripco Real Estate

Retail might be in a state of flux, but Ripco’s Christopher Walther couldn’t think of a better market to work in.

“Retail is sexy,” he said. “You get to deal with all these different people, get to go to all these different places … I get to explore areas of New York City that I otherwise probably wouldn’t ever go to.”

The 29-year-old broker has found success and is part of the Ripco team that’s the exclusive brokers for Starbucks in the Bronx and Queens; Dollar Tree in the Bronx; and Smash Burger in the outer boroughs.

Walther has closed on 17 deals so far this year, with his largest being the 4,000-square-foot lease that orthodontics chain Diamond Braces signed at 166-16 Jamaica Avenue in Queens, where he represented both sides.

But it was with a bit of luck that the political science major ended up at Ripco. After graduating from the University of Massachusetts Amherst in 2012, the Nashville native was trying to figure out what he wanted to do and thought commercial real estate could work.

He decided there was no better place than New York, so he packed up and moved in with his aunt and uncle in Long Beach, N.Y., while he took real estate classes and worked part-time as a waiter at Hillstone.

“It was supposed to be six weeks, but it turned into six months,” he said.

Walther’s aunt served on her condo board, which had a member whose brother worked for Simone Development Company. Simone had hired Ripco to lease space at its Throggs Neck Shopping Center in the Bronx. Through this six degrees of separation, Walther was able to get an interview with Ripco’s Miles Mahony and has been working with him since.

He recently decamped from Astoria, Queens, to Midtown East and spends his free time hiking, bird watching, playing sports and walking around the city.—N.R.

Ryan Ur, 26

Associate, Related Companies

Ryan Ur is a California kid, from a place that no one leaves. But Ur always had the itch to do just that — leave the sunny paradise of his hometown, Laguna Hills.

So, when he got an offer to play football at Cornell University, he knew that was his ticket out. Now, after almost five years in New York, he’s not looking back. “I love the fast pace, the relentlessness,” Ur said. “California’s just a little too slow.”

Real estate was a lifelong passion for Ur — he showed an early aptitude for Lincoln Logs and Monopoly — so he interned at Related during college and felt at home with the culture. When he joined Related in 2015 full time, on the Hudson Yards team, it was several months before the first office building at the megadevelopment, 10 Hudson Yards, opened.

Ur worked on the launch of that building, both before it opened and through the stabilization process: making the financial projections, building out the management team, meeting with the equity investors, and coordinating between the management, engineering, legal and accounting staff. He did the same for all the subsequent Hudson Yards office buildings and continues to be responsible for the financial performance of those assets.

“Every general manager for every building or director of security or engineering or operations, they kind of look to me for the high-level stuff, and they’ve got 10, 20, 30 years of experience on me,” Ur said. “It’s more my ability to work with people and get the most out of people, and that’s what I enjoy the most, bringing that all together to get the best out of your building.”

One of his favorite parts of the process was the Hudson Yards opening. Less than 24 hours before the grand opening in March, the place was “literally mayhem,” with maintenance staff, engineers and service workers scrambling to complete the final touches. But by the morning of, everything was perfectly in place.—C.G.

Alexandra Tennenbaum, 28

Associate Director, Newmark Knight Frank

This year has been a big one for Alexandra Tennenbaum.

The 28-year-old secured a 36,396-square-foot lease for British-based JD Sports’ New York City flagship at 1466 Broadway, was promoted to associate director of Newmark Knight Frank’s retail team, named one of Crain’s New York 2019 Rising Stars in Real Estate and had her first child, Eliana, in August.

And, to think, the Teaneck, N.J., native didn’t even start at Yeshiva University with the plan to get into real estate — she originally wanted to be a doctor.

“Everybody else in my pre-med classes were a lot more passionate about it than I was,” she said. “But I was always interested in real estate.”

She would constantly read the New York Times real estate section, reaching out to family friends when she saw interesting deals, when one of them suggested she look into retail leasing.

“I was always interested in fashion and real estate, totally separately, but I never really thought the two would meet,” she said.

“I find it more interesting than office leasing,” she added. “The tenant has more requirements and more personality.”

Tennenbaum found her passion with retail leasing and got an internship with NKF in 2014, which she eventually turned into a full-time job.

The Forest Hills, Queens, resident has been working with international brands like Watches of Switzerland, with which she signed a lease to open its first U.S. store at 60 Greene Street last year.

“We have to create a proper strategy for their rollout; looking at the bigger picture, which key cities makes sense and are interesting to pursue,” she said.—N.R.

Renee Tabache, 27

Associate Salesperson, Winick Realty Group

“I pride myself on being a shopper,” Renee Tabache said. “I like to go into a store and have a face-to-face interaction.”

That’s music to many a retailer’s ears.

And, unlike other brokers who can talk a good game about the brands that succeed and why, Tabache gets bonus points for the fact that she’s not just an average shopper. In addition to her day job as a broker for Winick Realty, she has a side hustle as a personal shopper with her own company called Mensdepartment. (If that wasn’t enough to make retailers fall in love, she dropped this gem: “I don’t have an Amazon account!”)

“My niche is both ends of the spectrum,” Tabache said. “I understand the business side from both ends where tenants should be.”

Tabache gives off the vibe of someone who’s got many irons in the fire; the Brooklyn native who attended Baruch College started off wanting to be an accountant but found it unfulfilling. “I wasn’t afraid to try something new,” Tabache said, so she tried for her real estate exam and applied to Winick’s training program.

Since coming to Winick in 2016, Tabache has been taken under the wings of Jeff Winick and Lee Block to work on some of the firm’s serious retail deals.

Tabache’s first biggie was in 2017 representing SL Green at 485 Lexington Avenue, on the corner of East 46th Street. SL Green had a massive, 18,000-square-foot retail space and Tabache divided the space in five pieces and leased it out to Soul Cycle, Dr. Smood, Gregory’s Coffee, Hudson Allergy and Bright Horizons.

This summer, Tabache, Block and Winick represented Walter & Samuels at 90 Hudson Street in Tribeca where she put the Portfolio School in 8,150 square feet.

“Every situation is different,” Tabache said, “not every deal is like the last one. Things can pop up out of nowhere.” But that’s good in Tabache’s eyes. “There’s a lot of creativity involved.”—M. Gross

Max Swerdloff, 26

Director, Kushner Companies

Zero is the magic number for Kushner Companies’ Max Swerdloff.

That’s the amount of vacant space in Kushner’s roughly 40,000-square-foot East Village retail portfolio, which Swerdloff oversees. And it’s the result of some creative deal-making, given he started off with about a dozen empty spots. It helps that Swerdloff himself is a resident of the East Village. It also helps that he’s been lauded since his days at Eastern Consolidated, where he was awarded rookie of the year for his keen eye for trends and social media outreach.

“It’s the last thing from a routine job,” Swerdloff said. “You really have to be able to relate to each client and be extremely creative, because nothing is getting done with standard terms.”

At Eastern Consolidated, Kushner Companies was a boldface name in Swerdloff’s roster of landlord clients, and he made the jump last year to represent the firm in-house. He launched the firm’s leasing division, where he serves as director of retail and commercial leasing and oversees 2.2 million square feet of retail space in New York and New Jersey. He also works on the transactional side of the retail and commercial portfolio.

“Being on the principal side, you really don’t have any blinders to different parts of the industry,” he said. “So, you get involved in a lot of the different aspects of it, with the acquisition team, or the lending team, or anything that has commercial leasing in it.”

One of the more sizeable complexes under Swerdloff’s watch is the 1.2-million-square-foot Dumbo Heights campus in Brooklyn, near the base of the Manhattan Bridge. The five-building property is now 95 percent leased to a diverse mix of creative office and retail tenants including Etsy, fitness center F45 and the restaurant Mulberry & Vine.

“Each deal is so different,” he said. “You really can’t get bored.”—S.G.

(Disclosure: CO’s publisher Joseph Meyer is married to Kushner principal Nicole Meyer.)

Maurice Suede, 28

Director, Cushman & Wakefield

Maurice Suede is as true a New Yorker as it gets. He grew up in Midwood, attended Baruch College for undergrad, and got a master’s at New York University. Now he makes his bread trading pieces of New York as a sales broker at Cushman & Wakefield.

Suede, who’s been at C&W for close to five years, got his first taste of real estate as an intern at Massey Knakal (later acquired by C&W) during his undergrad years. It wasn’t his only internship, but it was the one that stuck. “I wasn’t married to one way or another,” Suede said. “But when the offer came along, I took it and never looked back.”

Since starting at C&W in 2015, Suede has participated in 40 deals worth around $650 million. One of his biggest deals of the year was the sale of a six-story building (divided into five commercial condominiums) in Chinatown at 128 Mulberry Street for $10 million. The transaction took less than three months, and sold at 50 percent higher than the market, according to Suede, for roughly $2,100 per square foot.

One of the biggest deals of his career thus far was the sale of 304 Canal Street, best known for housing the Pearl Paint store, in 2014. Beloved by the neighborhood’s community of artists, it was a highly publicized deal.

“Everyone would go to the store for art supplies for the last 40 years,” Suede said. “It was an icon on Canal Street.” The building sold for $16.4 million to Vornado Realty Trust, at a price of roughly $1,400 per square foot.

Suede was recently promoted to director of sales, played basketball in high school, and his dream alternate life would be playing point guard for the New York Knicks.—C.G.

Jacob Stern, 26

Assistant Director, Savills

During high school and college, Jacob Stern worked sales at a high-end bicycle shop on Long Island. After several of his customers told him to look into the real estate industry, and offered to show him the ropes, he decided to give it a go.

“I enjoyed working with people and selling and always had a drive to compete for business,” he said. “I always liked the grind. While commercial real estate is a longer grind — a longer sales process — I do enjoy the go-getter mentality and always having to chase for things rather than a salary-type career.”

Stern got a job at the brokerage EVO Real Estate Group right after graduating SUNY Farmingdale in 2015, focusing on office leasing for technology and fashion clients. In 2016, he jumped to Savills, where he’s completed 31 deals totaling 300,000 square feet.

In April, Stern worked on Aberdeen Standard Investments early renewal for its 27,372-square-foot offices at 712 Fifth Avenue and worked on Mikimoto’s 23,955-square-foot renewal at 680 Fifth Avenue.

The Huntington, N.Y., native described himself as having a “no-quit mentality” who tries to be the first one in the office and the last one out.

When not working, the Greenwich Village resident is an avid cyclist — both road and mountain biking — and for the past two years has organized an annual charity bike race, Will’s Wheel, around New York, which raises money to buy bikes for underprivileged kids in Long Island.

Stern started the nonprofit after his best friend, William Brady, died last year when he was struck by a car in Long Island. This year’s race had about 100 people ride and raised about $50,000.—N.R.

Andrew Staniforth, 28

Vice President, L&L Holding Company

L&L’s redevelopment of Terminal Warehouse — the 1.2-million-square-foot West Chelsea behemoth just off The High Line — is a herculean task, involving going back and forth between its co-owner Normandy, its CookFox design team, and about 30 different individual consulting firms.

Thankfully, L&L has Andrew Staniforth managing the process, and plans to get it done by 2022.

“Eight-thousand people [are going to] occupy this building,” Staniforth said. “They’re going to need light and room and egress.” And bringing this 19th century jewel up to 2022 standards will be tough.

But, then again, Staniforth hasn’t exactly shied away from big, ambitious jobs. Coming out of the University of Pennsylvania where he studied real estate, finance and computer science (see what we said about ambitious?) Staniforth started out at Forest City Ratner where he worked on the sports and entertainment team, taking on projects like the redevelopment of the Nassau Coliseum.

In the fall of 2017, Staniforth left to work for Sidewalk Labs, the urban innovation company led by Dan Doctoroff, where he worked for the company’s Toronto headquarters and innovation lab.

“It was like going to another year and a half of school,” Staniforth remembered fondly. “It changed how I thought about problems.”

In February, the New Jersey native, who now lives in Hell’s Kitchen (within walking distance from his office and Terminal Warehouse) landed at L&L and began the long but rewarding process of getting one of the biggest redevelopments in the city up to snuff. He’s currently preparing Terminal Warehouses for its hearing before Landmarks.

And if you needed any more proof that Staniforth is a serious non-waster-of-time, we’ll mention that he has a side gig as an inventor. He’s the co-creator of Therm, a DIY thermostat that received a grant for development earlier this year from the New York State Energy Research & Development Corporation.—M. Gross

Joseph Sipala, 29

Associate Director, Newmark Knight Frank

If you have any doubts on whether the Brooklyn office market is going to make it big, go talk to Joseph Sipala.

The associate director at Newmark Knight Frank, who helped launch the firm’s Brooklyn outpost about four years ago, is happy to tick off a list of names active in the borough. His team, led by Whitten Morris, represents a number of big-name landlords such as JEMB Realty, RFR, Kushner Companies, Jamestown Properties, and Meadow Partners, as well as tenants like Cityblock Health.

“People always say there’s not a lot of office leasing going on in Brooklyn, but I think it’s still in early innings,” Sipala said. “We’re bullish on Brooklyn long-term, as more companies realize where their workforce is coming from, and the opportunity that’s available in terms of value, recruitment and retention.”

Sipala is poised to begin representing the tallest new construction office in the borough; his team recently landed an exclusive leasing assignment for JEMB’s 1 Willoughby Square in Downtown Brooklyn. The 500,000-square-foot, 34-story project is poised to top out, and Sipala plans to launch marketing efforts in the fall.

A neighboring building at 57 Willoughby Street, which is being repositioned by Meadow Partners, is also on the list of downtown buildings under Sipala’s watch.

Last year, he was instrumental in helping landlords RFR, Kushner and LIVWRK land the Brooklyn Lab Charter School at 77 Sands Street in its Dumbo Heights Campus. The school submitted a proposal in early December and was under pressure to get a lease signed by New Year’s Day. Sipala raced through the holidays to get the deal closed, with the charter school signing for 85,000 square feet.

Other notable assignments include representing landlords Jamestown, Belvedere Capital and Angelo Gordon at Industry City in Sunset Park, and repping tenant Cityblock Health in signing a 22,000-square-foot lease in Dumbo over the summer.

The three-time winner of NKF’s national rising star award got his start on the lending side of the industry, working for Wells Fargo’s private mortgage banking unit.

“It’s kind of been an inflection point in my career,” Sipala said, referring to the launch of the Brooklyn office. “I saw an opportunity to really create a niche for myself, which is hard to do, obviously, in real estate. And it’s the best decision I ever made.”—S.G.

Hayley Shoener, 29

Senior Vice President, JLL

Two weeks after graduating college, Hayley Shoener started a full-time job at JLL, and never left.

In college, Shoener had no idea what she wanted to do, so she did a variety of internships: at an ad agency, in the medical field, and after her sophomore year, at JLL’s New York office.

“It just clicked,” Shoener said. “I loved being in New York and this job gave me a really unique understanding and appreciation of the city.”

Shoener divides her time between tenant and landlord presentation and is on the team that represents Discovery Communications. After Discovery acquired Scripps Network in 2017, they were looking for consolidated offices for the merged company. “They wanted one headquarters, to get everyone under one roof,” Shoener said. “They wanted to control the building and their space, and they needed to do a lot of work for studio space to film shows.”

It took several years, but after scouring the Midtown, Downtown and Midtown South markets, they finally found the one: a prewar loft building at 230 Park Avenue South. That it wasn’t vacant didn’t deter the team, and the 362,000-square-foot lease was signed earlier this year.

“They were able to lease the whole building and work with the design team to renovate everything and design a really cool lobby that’s a Discovery experience,” Shoener said.

Shoener grew up in Princeton, N.J., and lives in Dumbo, Brooklyn. She’s the proud and exhausted mother to a 1-and-a-half-year-old terrier. “I knew it would change my lifestyle,” she said. “It was pretty drastic.”

One of her favorite restaurants is one she’s afraid to publicize in case it loses its charm. “The chef is Gabrielle Hamilton,” Shoener said. “She makes really simple dishes, but they’re all perfect in every way.”—C.G.

Zachary Redding, 28

Director, B6 Real Estate Advisors

It was an easy choice for Zachary Redding to shut down his company, Productive, which aggregated services for residential buildings, in favor of joining Paul Massey’s B6 Real Estate Advisors last year.

Redding started working under Massey in 2014 when he landed his first real estate gig at Massey Knakal, then followed him to Cushman & Wakefield and even served as his chief-of-staff for Massey’s failed mayoral bid in 2017.

“It was really different, but incredible,” he said about his brief foray into politics. “One day we met the commissioner of Major League Baseball, went to a cultural event in Flushing in the afternoon, and in the evening, we handed out food to the homeless.”

But Redding’s loyalty to his mentor isn’t what landed him on this list. The West Village resident had his hand in Amberjack Realty Capital’s $10 million purchase of part of 4 Bryant Park in August; has been marketing a three-building portfolio on Forsyth Street for $31.3 million; and is marketing a 49-year ground lease at 16-18 West 39th Street for $89 million. Redding also manages Massey’s book of business — anything from investment sales to debt and equity placement.

Redding grew up in Wilkes-Barre, Pa., and graduated from West Virginia University in 2013 with a degree in political science. He took a job selling surgical devices in Baltimore, Md., out of college but after three months realized it wasn’t for him.

“I was on the phone with my dad and I just said, ‘I love interacting with people,’ ” Redding said. “He said, ‘Why don’t you really dive into real estate and see if it’s something you like?’ ”

Real estate wasn’t really in Redding’s family; his dad managed a car dealership while his grandmother owned some small buildings in Wilkes-Barre. But he said it was the perfect choice.—N.R.

Mike Rafter, 29

Associate, Investment Sales, TerraCRG

A development site trading for $115 million is nothing to sneeze at. But when the deal takes place in Brooklyn — and, more specifically, in the largely industrial neighborhood of Gowanus — it becomes a much bigger thing.

“It was a neighborhood-changing kind of play,” said Mike Rafter, who was on the TerraCRG team that brokered the purchase of two parcels of land at 1-37 12th Street (the site of a former Pathmark) for $62 million and 118 Second Avenue (the home of a 400,000-square-foot Lowe’s) for Two Trees Management. (The seller of the Lowe’s was Forest City Ratner; Team Slope LLC sold the Pathmark.)

Since starting at TerraCRG, Rafter and his team have closed on some $400 million worth of real estate.

Like many in real estate, Rafter is to the manner born — “My dad is actually a contractor and residential developer in Massachusetts of high-end luxury single family homes,” Rafter said. “I always had an interest walking around the job sites.”

After the University of Tampa, Rafter went to CRE Brokerage in Boston where he did retail leasing before setting his sights south.

“I wanted to get to New York and transition to investment sales — specifically in Brooklyn with a focus on residential.” He hitched his wagon to TerraCRG and joined its founder Ofer Cohen, Daniel Libor and Peter Matheos doing investment sales.

And even as a chill came over the investment sales market after the new rent laws were introduced, Rafter doesn’t sound worried.

“Brooklyn specifically is really well situated,” he said. “Inventory is sooner or later going to fill up, but Brooklyn has still only reached the tip of the iceberg” in terms of its potential.—M. Gross

Shivam Patel, 29

Associate Director, Knotel

In a surprise twist, it was Convene that first caught the eye of Knotel’s Shivam Patel.

Patel was working for private equity shop Boathouse Capital and came across Convene, a provider of on-demand meeting space within the firm’s investment portfolio. “It was kind of the first time that I saw real estate being used more as a product than just a line item,” Patel said.

That piqued his interest and he jumped ship from Boathouse to Knotel about three years ago, giving him a front-row seat to the flex office space provider’s explosive growth. He serves as associate director of real estate transactions, working under execs Jeremy Bernard and Eugene Lee, and navigates everything from site selection to underwriting deals and negotiating transactions.

Late last year, he locked down a 51,000-square-foot lease at Rosen Group’s 27 West 23rd Street in a highly competitive submarket near Madison Square Park. A multinational staffing company was eager to take the entire space.

“We were a familiar company that [Rosen] had worked with in the past, and our existing relationship with them really helped secure that space,” he said. “Those types of transactions where Knotel has a leg up because of our previous experience with owners is definitely something that we look to continue to leverage.”

He counts a deal at 530-536 Broadway in Soho, which got underway when he first started at Knotel, as a game-changer for the firm. Property owners Thor Equities and Wharton Properties conducted an extensive process, originally landing on a Knotel competitor, before opting to sign Knotel for 49,000 square feet last year.

“It was probably a turning point for Knotel,” he said. “It legitimized Knotel as someone who can compete for the most coveted spaces.”

Space has been on Patel’s mind a lot lately. He’s sourced and negotiated more than 50 deals, totaling almost one million square feet, mostly in New York.

That focus will be shifting, though. On the heels of a $400 million funding round in August that vaulted Knotel into unicorn status, the company is pursuing a national expansion and Patel will be working on deals in cities such as Chicago and Atlanta.

The Michigan native will be juggling travel with wedding planning, as he recently got engaged and is planning spring nuptials with his fiancee, Michelle.—S.G.

Alicia Parente, 29

Director, Savitt Partners

One summer night, on a rooftop in Midtown, Alicia Parente was drinking an Aperol spritz and celebrating the opening of the new Caruso Menswear showroom. That’s when an executive from the Italian designer came up to her. “We wouldn’t be here if not for you,” he said.

“That was a great moment,” Parente recalled. She had spent months, together with her team at Savitt Partners, searching for the right spot for Caruso’s New York showroom.

That was one of the more recent of Parente’s many deals since joining Savitt in 2015. She works as a tenant representative with the Schoen Group, for both office and retail tenants, and also works on the agency side.

Parente joined Savitt to work in marketing after spending several years in the field at Capelli New York, but decided to get her real estate license a year in.

Some of her deals include a 16,000-square-foot lease for the Center of Motivation and Change, and a 9,000-square-foot lease for the designer Bernard Chaus. While Caruso wasn’t her largest deal, it stood out because of the legendary name and because, as an international client, the back-and-forth took extra work. And, in true Italian fashion, the Caruso team insisted on meeting the landlord in person to seal the deal over cappuccinos.

Parente grew up in Rhode Island and moved to New York immediately after graduating from the University of Rhode Island in 2012. “It feels like forever,” she said.—C.G.

Kip Orban, 26

Vice President, JLL

Not everybody can claim to be a professional athlete on the weekends while leasing space in the Empire State Building during the week. But Kip Orban can.

The 26-year-old played midfield for the Rochester Rattlers in Major League Lacrosse and spent his summers flying all over the country to compete. (He gave it up this year to focus on work and to reclaim his summers.)

But his midfield pursuits didn’t slow his activity at JLL. Orban was part of the team that represented Syneos in its 86,498-square-foot lease at 200 Vesey Street in November 2018, helped Winter Properties lease its entire 61,375-square-foot 57 East 11th Street to WeWork that same month, and represented Empire State Realty Trust in the 105,100-square-foot expansion and renewal for HNTB at the Empire State Building in September.

“It was a dream come true to be able to work on [the Empire State] assignment,” said Orban, whose father was an architect and who grew up with statues of the Empire State Building in his Westport, Conn., home.

Orban — who was recently promoted and was one of less than 5 percent of JLL brokers selected as a protege in its mentor program — always had an interest in buildings and cities, so when an alumnus at his alma mater Princeton University suggested real estate brokerage, it made perfect sense.

“No two days are the same,” he said. “You’re always out on your feet. Being glued to my desk would drive me nuts.”

Orban graduated in 2015 with a degree in politics and took a month off playing professional lacrosse. He nabbed a job at JLL right after and has been there ever since.

“It was a gut reaction, but the people I met here were really just solid people,” the Soho resident said. “It’s just a great energy over here that I picked up on and was immediately drawn to.”—N.R.

Conor Krup, 24

Director, Lee & Associates New York

It was a normal day for the folks at New Traditions Media — a startup that was basking in the glow of having recently made Crain’s list of the 50 fastest growing companies in the city — when they received a visitor with no appointment at their 36 East 23rd Street office.

Conor Krup had seen the Crain’s article. He thought he and his team at Lee & Associates might be a source of valuable information if the media firm wanted to expand into a bigger space. In fact, he had a couple off-market properties he knew about that they might want to look at.

Eventually, Krup was put in front of one of the founders of the company.

“He was a bit taken aback at first,” Krup said. “But he respected the hustle.”

And unlike those with the sizzle but no steak, Krup was actually able to speak fluently and knowledgeably about other spaces on the market that could interest the young firm. Krup and the co-founder arranged another meeting, and before long Krup had signed the firm to a 3,700-square-foot lease at 584 Broadway.

Ever since the Crain’s article came out, Krup had been going door-to-door to every name on the list. “That’s the way I try to separate myself,” Krup said. “I will show up to the office.”

The New Jersey native, who had recently graduated from Ramapo College, learned to continue hustling in the two years since, nabbing 6,400 square feet for Raven Capital Management at 75 Spring Street; 7,000 square feet for Smuggler, the film and TV production company, at 38 West 21st Street; and getting 17,625 square feet for Cargo at 100 Broadway.

In June, Krup bested his personal record when he got the accounting firm MBAF a 21,683-square-foot lease, taking the entire third floor at 600 Third Avenue. “They were located across three floors at 440 Park Avenue South,” Krup said. It was an inefficient layout.

Krup brought them an off-market lease from another accounting firm. “It didn’t work out — but having them face-to-face, showing them the space, asking questions about what they needed, opened up a whole slew of other options. It solidified trust in us. So, we negotiated a great deal with L&L [Holding Company] at 600 Third.”—M. Gross

Noah Kossoff, 25

Senior Associate, Marcus & Millichap

With the changes in the New York City multifamily market, brokers like Noah Kossoff are finding themselves in a new, unexpected role.

“We’ve been saying our job kind of went from brokers to therapists,” Kossoff said, while discussing the impact of New York’s rent reform regulations. “Obviously, this is somewhat devastating legislation, especially for guys that own some of these larger portfolios. And it’s hard to not empathize.”

Kossoff has been lending an ear to clients while working as a senior associate for the New York multifamily team at Marcus & Millichap, where he specializes in deals sized from $5 million to $150 million on multifamily and mixed-use properties in Lower Manhattan. The team, where he counts Joe Koicim and Peter Von Der Ahe as mentors, has signed 17 contracts since the rent reforms took effect in June.

“We’re still doing a lot and seeing a lot of deals get done,” he said. “We are very opportunistic and optimistic about the market itself. And we think that uncertainty breeds opportunity.”

Growing up in Manhattan’s Upper East Side, he was exposed to the real estate industry via his father’s law firm, Kossoff PLLC, and though two of his brothers eventually joined the firm, he wasn’t sold on a career in law. “I wanted a little bit more liveliness and a little bit more action,” he said.

His first year in the business, he worked on the sale of a seven-property portfolio in the West Village and Nolita that traded for a total of $110 million, at cap rates ranging from 1.5 percent to 3.5 percent. The long-standing owners, a pair of brothers who were looking to liquidate their portfolio and retire, “definitely timed the market right,” he said.

Earlier this year, he helped handle the $37.4 million sale of the seven-unit 186 Franklin Street in Tribeca, which ranks among the largest trades ever for tax class 2B buildings. The designation, which caps property taxes, is especially attractive to value-add investors.

Kossoff, who was awarded Marcus & Millichap’s Rookie of the Year in 2016, has trades lined up on Bleecker Street, Spring Street in Soho, and Elizabeth Street in Nolita. Kossoff also happens to be a Nolita resident, and in his free time plays in a semi-professional soccer league for the New York Athletic Club.

“We’re taking a long-term view of the New York market,” he said. “We think there’s definitely opportunity for both buyers and sellers.”—S.G.

Bryan Kirk, 29

Director, Investment Sales, B6 Real Estate Advisors

Bryan Kirk moved to New York from Michigan in 2014 without a clear plan of how he’d make it in the big city. He had majored in communications with a plan to go into television or film, but an internship at David Letterman’s Late Show changed his mind. “I enjoyed doing it,” Kirk said. “But I couldn’t see it as a profession.”

He worked for a software company in Detroit before moving to New York, where he landed a position as an associate at Cushman & Wakefield after months of interviewing.

Fast forward a few years, Kirk is now director of investment sales for the North Brooklyn market, which encompasses Williamsburg and Greenpoint, for B6 Real Estate Advisors, where he works alongside his partner, Robert Moore.

Within the first few months of taking over the North Brooklyn market, Kirk closed his first deal at 126 Bedford Avenue, a four-story mixed-use building that sold for $4.4 million. “Typically, when you’re going into a new market, it can be tough,” he said, so it was a welcome surprise to close a deal so quickly.

Kirk was previously on the team for North Central Brooklyn, which includes Bedford-Stuyvesant, Bushwick and Crown Heights. During that time, he sold a 165,000-square-foot building in Bed-Stuy, at 1215 Fulton Street, for $32.5 million.

Overall, he’s participated in over 80 deals worth $400 million.

Kirk says he views his job as being a source of information for property owners and makes sure to stay on top of comps and price per buildables, down to the block, as well as paying attention to any rezonings or other market trends that can affect pricing.

“If I can be their go-to info source, there’s a shot they’d consider me” when it’s time to sell, he said.—C.G.

Yasmin Kheradpey, 28

Vice President, Institutional Investment Sales, Meridian Capital Group

Yasmin Kheradpey served as the project manager for some pretty large, and rare, deals in recent months.

In December 2018, she worked on the $220 million sale of Glenn Gardens residential development on the Upper West Side as well as Eliot Spitzer’s $160 million sale of 220 East 72nd Street in July. Neither properties have changed hands since the 1970s.

“It was a quiet, off-market process,” Kheradpey said of the sale of 220 East 72nd Street. “We initially targeted the condominium guys, but the rental guys prevailed.”

Kheradpey wears a lot of hats on Meridian’s investment sales team, which she joined in 2015. She handles acquisitions, dispositions, valuation, underwriting, research, transaction due diligence, and property marketing for all asset classes, but has recently focused on multifamily properties.

“You get to explore all these different neighborhoods in New York City and see how real estate has changed these communities,” she said.

The Long Island City, Queens, resident grew up in Honolulu and was around real estate at a young age. Her father works as an engineer handling projects like designing highways to working on luxury single-family housing on the beach, which Kheradpey spent time visiting when she was a kid.

When she went to Lehigh University in Pennsylvania, she knew she wanted to focus on either finance or real estate, but real estate eventually won over. After graduation, she nabbed a spot as the only woman in Cushman & Wakefield’s inaugural Professional Real Estate Program where she tried different facets of the business until settling on the institutional investment sales team in 2014.

After C&W acquired Massey Knakal in 2014, Kheradpey and her eight-person team decided to jump ship to Meridian in 2015.

“There was just a lot going on at Cushman,” she said. “We thought Meridian would be a great place for us to go.”

It worked out and Kheradpey was promoted to vice president in April 2017.—N.R.

Sayo Kamara, 28

Associate, Colliers International

Everything might be bigger in Texas, but Sayo Kamara decided that the deals he liked were sized properly in New York.

In December of 2015 Kamara was in New York on vacation when he landed a summer internship with Lee & Associates and he decided to take it.

“I sold off all my stuff and started from scratch,” Kamara said. “I waited on tables at night.”

After the Lee & Associates internship, Kamara, a University of North Texas graduate originally from Houston, landed a gig at Cresa before finding his way to Colliers.

“My first agency assignment was 48 Wall Street,” Kamara said. At the end of 2018 he represented the landlord, MacDonald & Cie, for the 7,150-square-foot space, landing the software company UrbanFT.

Since then, he’s scored a number of great deals like representing Brookfield Properties at 105 West 125th Street in the 23,000-square-foot deal they signed with the Children’s Aid Society to expand their footprint.

But the biggest deal that Kamara landed since coming to Colliers was his representation of Macmillan Publishers when they were looking to sublease 32,000 square feet at 1 New York Plaza.

Kamara persuaded the fintech company Fidelity Information Services to look at the office and consolidate their space into one location.

“The head of real estate [for Fidelity] came up from Jacksonville to take a look at the space, and then they realized that the needed the entire balance” of the floor — i.e., another 6,000 square feet that belonged to the law firm Mound Cotton Wollan & Greengrass. Kamara led the negotiations to buy them out of that space, too.

“What I most enjoy is thinking outside the box,” said Kamara. “Thinking of unorthodox ideas, of having to overcome a challenge.”—M. Gross

Zachary Kadden, 29

Vice President of Development, Madison Realty Capital

The executives at Madison Realty Capital snapped up Zachary Kadden as he was wrapping up his last year of law school.

Kadden, who had his doubts about a traditional legal career, had shown promise as an intern working for the firm, first in its legal department and, later on, in its development team. After graduating from the Benjamin N. Cardozo School of Law in New York, Kadden spent the summer cramming for — and passing — the bar exam, before starting full time with Madison in September 2015.

Four years later, the gamble has paid off. Kadden serves as vice president of development at the value-add investment powerhouse, working on deals ranging from Sunset Yards and 555 Waverly Avenue in Brooklyn to a major rezoning project underway in Queens.

“Brian [Shatz] and Josh [Zegen] gave me this tremendous opportunity,” Kadden said. “They like talented, smart, hungry individuals who are team players. And as they grow, they want to see everyone around them grow.”

In his role, Kadden focuses on Madison’s rezoning and land use projects, ground-up developments, which include mixed-use and mixed-income components, and adaptive reuse commercial development projects. The job involves everything from working on project design to setting up outreach meetings.

He’s currently spearheading the Queens project, at 69-02 Queens Boulevard in Woodside, which involved a zoning change for residential uses and underwent a ULURP process that added a K-5 public school. The firm began acquiring the parcels in 2015, is currently in the process of obtaining permits, and hopes to break ground next year.

“It could be an eight- to 10-year project, but it really changes the community,” he said. “So, I’m really excited to see that come through and be a part of that from start to finish.”

Kadden tied the knot last month and he and his wife, Jenny, are heading to Australia and New Zealand in December for their honeymoon.—S.G.

Jenna Heidenberg, 28

Senior Associate, SCG Retail

Jenna Heidenberg is an animal lover, avid podcast listener, and star broker at SCG Retail.

Heidenberg’s family is in real estate. It was always a topic of discussion at the breakfast and dinner table. In college, she wanted to find her own path and was drawn to all things visual: architecture, art history, and communications, but eventually she found her way back to real estate. “I was denying myself something I felt passionate about,” she said.

After spending some time in private equity, Heidenberg decided she wanted a change. “There was a lot of time spent sitting in my office with a jar of peanut butter and spreadsheets,” she said. “I wanted to work with more tangible assets. I also really wanted to interface with people more.”

At SCG, Heidenberg works with David Firestein, to represent Starbucks and Taco Bell on their atypical offerings, including Starbucks’ bakery brand Princi, and Taco Bell’s updated offering Taco Bell Cantina.

Heidenberg helped Starbucks sign an 18,000-square-foot lease for a commissary in Red Hook in 2017 and helped secure locations for several Princi locations. “They’re kind of right-sizing, and looking to capture more lunch traffic, high lunch traffic,” she said. She also represents Taco Bell at their corporate headquarters in New York.

Heidenberg’s work is split 70-30 between her larger clients, and smaller, less-established firms. “Every broker wants a rollout,” she said, but she gives all her clients the same level of service.

When she’s not working, Heidenberg is likely out walking with her dog Scarlett. “It’s one of my favorite ways to decompress and disconnect while simultaneously keeping current on the retail landscape,” she said.—C.G.

Dane Harlowe, 26

Director, Meridian Retail Leasing

Dan Harlowe has been closing deals at a quick clip this year — with 13 retail leases signed so far this year and two more nearing completion — and was even able to fill an entire strip of Broome Street between Ludlow and Orchard Streets on the Lower East Side this summer.

“That was just a cool process, essentially transforming a block,” said Harlowe, who nabbed deals with restaurant China Bull at 250 Broome Street along with a barbershop and clothing shop. “It’s kind of like creating a new image. I’m excited to see them open and eat at the eatery and get my hair cut at the barbershop.”

Harlowe has been busy all over Manhattan this year. He took on a landlord’s entire 10-building portfolio in Harlem and he brokered a 5,765-square-foot deal with Thai Sliders at 27 Cliff Street in March and Naranjito Juice Shop at 1349 Amsterdam Avenue.

The 26-year-old Virginia native got his start in real estate in 2016 working on retail deals in North Brooklyn at EXR Commercial Leasing. In 2018, Harlowe got a gig working under James Famularo at Eastern Consolidated but the brokerage shut down shortly after he started. “I went over there thinking, ‘This is going to be great, I’m working under a great broker,’ ” he said. “Then, a month in, they have a company-wide meeting saying they’re shutting down. I thought ‘Oh my god, what did I just do?’ ”

Luckily, Famularo immediately took his team aside and told them they were going to be okay. The team headed over to Meridian in June 2018.

“Meridian does a great job,” Harlowe said. “The second we get an exclusive we already have our materials ready.”

Harlowe, who lives in Murray Hill, graduated from Boston University — where he was on the wrestling team — in 2016 with a degree in finance.—N.R.

Joseph D’Apice, 27

Senior Associate, CBRE

Joseph D’Apice has been on the lookout for a good deal since he was a teen. Growing up in Westchester, his father, also a broker, would test his knowledge of the industry: “My dad would give me a lease but would change certain clauses to make it very extreme,” D’Apice said. “He would have me read it and ask, ‘What do you think doesn’t make sense? What do you think is off?’ ”

The knowledge has served him well in his position as a senior associate at CBRE focused on the technology and media sectors. In his role, where he works closely with execs Sacha Zarba and Jeffrey Fischer, D’Apice represents tenants and landlords in office deals across the country, with a client list including Grubhub, Vox Media and One Medical.

D’Apice starts his work day at 6:30 a.m. and is a big believer in canvassing buildings. “I like to walk the buildings to get a feel of the aesthetic, the vibe, the condition and, of course, to see what tenants are occupying space,” he said. “When I make a call or an email, what I’m saying is 100 percent accurate because I walked the building.”

He’s worked on deals including the disposition of roughly 70,000 square feet of space on behalf of IHS Market at 1359 Broadway. The firm found itself with a surplus of space from its acquisition of fintech firm Ipreo and was under a time crunch to sublease the floors. D’Apice tapped an existing tech tenant in the building, who he knew was looking for extra room, and the firm snapped up 25,000 square feet. Another 38,000 square feet was quickly picked up by two other users.

In a deal at 215 Park Avenue South, D’Apice sourced a 17,200-square-foot, turnkey space for The Medium Corporation via a sublease. “The market for that kind of space and that location is razor-thin,” he said. He helped the publishing platform secure the deal in the face of competing offers.

“Large tech companies are growing at an astronomical rate,” he said. “The demand for that creative, plug-and-play, turnkey space is very high.”

It’s been a busy year for D’Apice, who got married in August and lives on the Upper East Side with his wife, Alyssa. Still, he loves to hit the outdoors, including golf outings and trips back home to Westchester.—S.G.

Christine Colley, 28

Managing Director, Leasing, Cushman & Wakefield

Christine Colley didn’t know she wanted to work in real estate until she interned for Cushman & Wakefield during college.

After graduating in 2013, Colley’s first job was back at Cushman and she’s still at it.

Colley has risen from associate to managing director and is the youngest senior director at the brokerage. During her six years at the firm she’s overseen and participated in many deals, including two leases for the New York City Housing Authority that totaled 1 million square feet.

“The requirement was pretty complex and unique,” Colley said, because the agency was looking to consolidate and had a range of departments with its own needs, including warehousing, repairs, and a call center. It took two and a half years, but Colley successfully executed two deals, one in Long Island City and one in Downtown, that met NYCHA’s requirements.

Colley was also on the team that worked on Altice USA's national leasing portfolio, which includes over 5 million square feet of space. “That can include something as physically small as a retail store, leading up to major offices for their regional headquarters,” Colley said. And after Altice acquired Cablevision in 2016, there was quite a bit in the portfolio.

When she’s not working, you might be able to find Colley in Gramercy at her favorite restaurant, Maialino.—C.G.

Update: A previous version of this claimed that Colley managed Altice's portfolio, but she was part of a C&W team; Altice also disputed the amount of leasing volume the C&W team completed.Cara Chayet, 29

Vice President, New York Consulting Group, CBRE

Cara Chayet was able to close not only her largest deal of the year in July, but also of her career so far.

The 29-year-old South Florida native was part of the CBRE team that represented French advertising and public relations firm Publicis Groupe’s 977,255-square-foot renewal and expansion at 375 Hudson Street, the biggest single office lease so far this year.

Publicis already had 680,000 square feet in the building, but the lease ended in 2023 and the company was looking to consolidate offices. Chayet played a key role in preparing a financial analysis for Publicis.

“We spent a good amount of time making sure it was in a format that was easy for them to follow,” she said. “Helping them put that together was very beneficial in negotiating a really solid lease.”

Chayet, who was promoted in April to vice president of CBRE’s New York consulting group, has had her hand in lots of complex deals during her seven-year tenure. Since 2015, Chayet and her team have completed 97 transactions totaling over 10 million square feet, including S&P Global’s 900,027-square-foot renewal at 55 Water Street in 2016 and Tribune Media Company’s 101,568-square-foot renewal for TV station WPIX at 220 East 42nd Street in July.

“Not only have I had access to some of the best people in the industry, but they give me the opportunities to work on these incredible transactions and see all these different kinds of deals,” she said. “I don’t know what more I could want from a career.”

She got the real estate bug after interning at the Florida investment bank Ladenburg Thalmann during college at Vanderbilt University in Nashville, but didn’t like that “everything felt very abstract.”

After somebody suggested she look into real estate, Chayet got an internship at Newmark Knight Frank in Nashville and landed a job at CBRE right after graduation.

And while July marked a huge career milestone for the Flatiron resident, Chayet also had one in her personal life: She got engaged and is currently planning a wedding for next October.—N.R.

Michael Bertini, 28

Assistant Director, Savills

Rockin’ and rollin’ is a term that could be applied to a broker signing big leases and landing big clients — or, it can be applied to an actual musician playing before sold out crowds.

For Michael Bertini, it applies both ways.

If you hang around the Mercury Lounge or Bowery Electric, you can catch Bertini strumming the bass for his band, The Anarchists. (And, yes, they’ve played sold out crowds before.)

Less anarchically, he’s a member of one of Savills’ highest-producing teams in their Manhattan office, bringing, for example, SeatGeek (the ticketing provider) to 902 Broadway, where they took 72,800 square feet. (Wait a minute! SeatGeek is a pretty good in for a bassist to have!)

“They were in growth mode,” Bertini said. “We took them to a multitude of locations — every neighborhood in Midtown South.” But eventually he found them the perfect location in the heart of Flatiron and helped them sublease the 40,000 square feet of space they had elsewhere.

In addition, Bertini has taken on clients like the law firm Manatt, Phelps & Phillips, where he landed them 80,000 square feet at 7 Times Square, and then there’s 60,000 square feet at 1250 Broadway for tech law firm Gunderson Dettmer.

Bertini grew up in Connecticut (Keith Richards was a neighbor), attended St. John’s University and now lives in Manhattan. He got into real estate when he was working at the Williamsburg outpost of the Meatball Shop and mused to one of his customers about someday going into wealth management. “He said to me, ‘Michael — you don’t know any millionaires. [Instead,] you should go into commercial real estate.’ ” He’s now been at Savills for the past six years.

“I always knew that if I could be put in a room, and the company could give me a little money to get going, I could turn it into something — that’s what business is. Grinding your butt off, staying focused, cool, calm and collected. You can’t jump for joy — you have to stay level-headed.”

Pretty even-keeled sentiments from a rock ‘n roller!—M. Gross

Ariel Benyacov, 24

Director of Sales, Westbridge Realty Group

Opportunity came knocking for Ariel Benyacov straight out of college.

He landed his first job with M&D Door and Hardware selling doors and other supplies to commercial developments across New York City. The gig involved traveling from site to site and meeting with project managers, learning the nuts and bolts of the industry along the way.

“I started doing more research into who the developer was, how he got started, and it really inspired me to get my license,” Benyacov said.

Benyacov now serves as the director of sales for Westbridge Realty Group, where he handles deals sized up to $50 million in the development, multifamily and mixed-use sectors. Over the past 18 months, he’s closed on over $65 million in transactions in Brooklyn and the Bronx.

Earlier this year, he secured the Lightstone Group as a buyer for the Sheridan Court apartments in the Bronx. He got in touch with an acquisitions contact at Lightstone, whom he’d known since the contact’s days as an intern at the firm, to lock down the $23.8 million sale.

He credits his success at Westbridge and an earlier stint at Stuyvesant Group to “extensive research and time that [he puts] into getting to know how a transaction works, what a good deal is, what a good deal looks like,” he said.

One of his first deals was the sale of 944 Fulton Street in Clinton Hill, Brooklyn, where he recalls visiting the four-story building as often as three times a week to meet with contractors handling the renovations.

Other highlights include an $8 million sale of 1015 Atlantic Avenue, a gas station in Clinton Hill, to Bruman Realty, which plans to redevelop the site into rentals. Next month he’s slated to close on a $1.5 million sale of a four-story brownstone in Bedford-Stuyvesant.

The Brooklyn-native lives in Midwood, the same neighborhood where he was raised. “My heart will always be in Brooklyn,” he said.—S.G.

Lou Baugier, 29

Founder, Vero Technologies

Like a stereotypical millennial, Lou Baugier isn’t even 30 and he’s already on his third career. After graduating from Tulane University in 2013, he did time at J.P. Morgan on their portfolio management team, then did a year as a development associate at RXR Realty before leaving to start his own company.

Baugier is the founder and CEO of Vero Technologies, a company that helps landlords screen potential renters in minutes instead of days. The idea for Vero started over lunch with Silverback Development’s Josh Schuster, where he and Baugier discussed the gap between the promises and realities of real estate technology, particularly in regard to the hackneyed leasing process.

Before lunch was over, Shuster said a variation of “Here’s some pre-seed money, let’s see what you can build.” Baugier launched Surecave, an earlier iteration of Vero, and then segued into his current offering.

Vero links the potential tenant’s bank account to the application, which eliminates the need for the tenant to collect documents like W2s, paystubs and IDs, and shortens the time between the application and the lease signing. It’s now used by companies like Compass, Halstead and MNS Real Estate.

Baugier grew up in Greenwich, Conn., and has always been passionate about real estate, which he says is the perfect combination of art and science. “Every piece of land is unique in a way that’s difficult to quantify,” he said. “That’s the arbitrage of real estate and the uniqueness of the asset class in general.”

As a startup founder, Baugier doesn’t disconnect often, but he is running his fourth marathon in November, which gives him some time away from his phone. “I find that if I disconnect, it’s hard to get back in the groove,” Baugier said.—C.G.