Rising Rates Change the Math on Defeasances: KBRA

By Matt Grossman June 7, 2018 1:50 pm

reprints

During a decade of cheap refinancings, borrowers have clamored to escape commercial real estate debt ahead of schedule to cut down on interest costs.

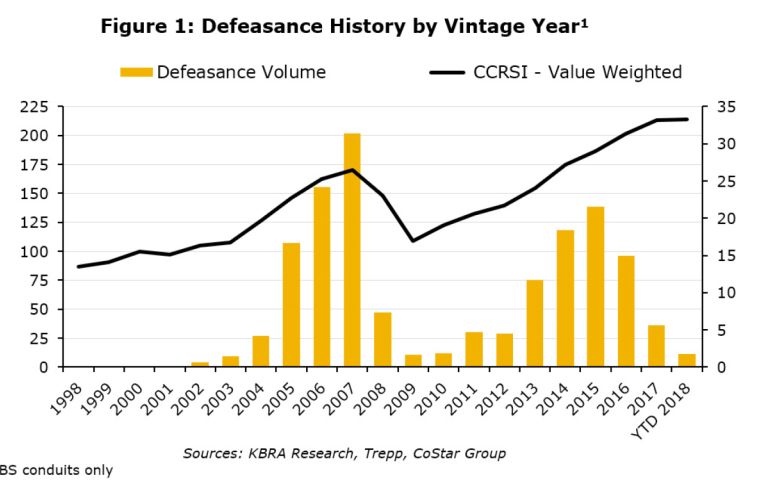

But today, rising interest rates have already begun to cut down on defeasances, according to analysts at Kroll Bond Rating Agency, marking a shift into an era when borrowing expenses are expected to grow, not shrink, year to year. Through the end of April, the most recent month for which KBRA had data available, 150 conduit loans had been defeased, a year-to-date figure that declined 28 percent from 2017.

Defeasance “will likely be tempered as prices level off and rates continue to trend upward,” Larry Kay, a senior director at the credit-rating agency, wrote in a report released yesterday. “Price growth has slowed compared with prior years…while the ten-year U.S. Treasury note broke through the psychological 3 percent level in April for the first time in four years.”

Another factor in the decline of pre-payment volume is simply the overall drop in the amount of CMBS outstanding. Just before the financial crisis, in 2007, more than 61,000 ten-year CMBS loans were underway, totaling $655 billion in principle. Today, there are only about 21,000 such loans in the market, adding up to $324 billion.

But those trends could be counteracted by higher returns offered by U.S. Treasurys, which can lower the expense of the financial maneuver. In defeasances, borrowers buy government bonds to compensate lenders for the pre-arranged flow of interest and principal payments. In a time of higher Treasury yields, borrowers need to buy fewer bonds to make lenders whole, making defeasance a cheaper choice.

And though property values have not increased as sharply this year as they have in recent memory, prices remain strong, a scenario that could also encourage defeasance as property owners angle for new chances to access the equity in their assets.

“The increase in property prices may still make defeasance attractive,” Kay wrote. “Fairly strong appreciation has accrued for five of the remaining seven [CMBS] vintages with defeasance-eligible collateral. Based on property appreciation…a number of borrowers may choose to defease.”