Stat of the Week: 6 Out of 6

Discord has grown between seller expectations and buyer demand, resulting in declining dollar volume

By Richard Persichetti January 24, 2018 1:00 pm

reprints

Property values of commercial assets across New York City have reached successive all-time highs over the past four years. However, discord has grown between seller expectations and buyer demand, resulting in declining dollar volume and property sales totals. At long last, pricing correction has begun, and as with most general market trends, Manhattan is leading the way.

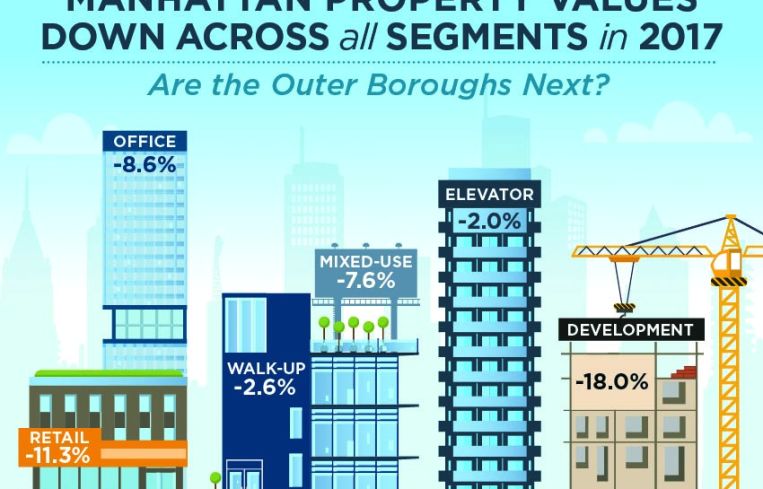

In 2017, values in all six of Manhattan’s major product segments (elevator, walk-up, mixed-use, office, retail and development) decreased for the first time in seven years. The largest value declines were for development sites, which dropped 18 percent, and retail properties, which were down 11.3 percent. Values for multifamily and office properties were positive through the first half of the year but finally yielded to eroding underlying fundamentals and ended the year in the red: Elevator product was down 2 percent, the walk-up sector 2.6 percent and office properties 8.6 percent.

This is a significant reversal since Manhattan has not recorded annual pricing drops in more than one out of six major product segments since 2012. The last time that all six fell annually was in 2010—on the heels of the Great Recession.

By comparison, in the four outer boroughs, only seven of the 28 total major product segments (which also include industrial properties) recorded a dip in pricing in 2017. Though these secondary markets were slower than Manhattan to adopt an overall pricing correction, the data suggests they will soon follow suit. Two different asset classes recorded a pricing decrease across half of the outer boroughs: Elevator properties in Brooklyn dropped 12.3 percent, and the Bronx was down 7.6 percent, along with retail properties in Queens, which dipped 6.2 percent, and Northern Manhattan, which declined 2.7 percent. Moreover, the total number of declining product segments in the outer boroughs has not reached seven out of 28 since 2012.