Stat of the Week: -64.7 Percent

Mega-investment deals totaled $8.6 billion, down 64.7 percent compared to dollar volume through the first three quarters of 2016

By Richard Persichetti December 1, 2017 3:39 pm

reprints

The New York City investment sales market has had about as prosperous a return this year as most people have from scratch-off Lotto, relatively speaking. With only $24.3 billion of investments for all property types, dollar volume is down 46.9 percent year-over-year. This trend is precipitated by an even steeper decline in Manhattan investments, which are down 54.6 percent compared with one year ago with only $14.4 billion traded. At this pace, Manhattan investment sales are on pace to finish 2017 at the lowest level since 2010, when dollar volume only reached $11.8 billion.

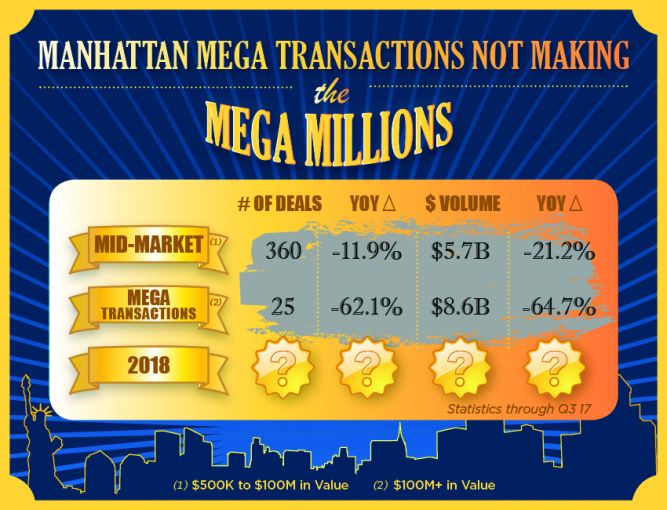

Although the number of transactions in Manhattan, which includes portfolio sales, are down significantly with only 385 completed through the third quarter, a tale of two markets is to blame for holding investment sales back this year. The number of midmarket transactions (deals ranging from $500,000 to $99,999,999) is down 11.9 percent year-over-year, but the mega-transactions ($100 million-plus) have dropped off more precipitously and impacted both transaction and dollar volume this year.

Only 25 mega-investment deals were completed through the third quarter of 2017, down 62.1 percent compared with one year ago. These 25 investments totaled $8.6 billion and were down 64.7 percent compared to dollar volume through the first three quarters of 2016. There are 13 additional mega-transactions under contract, and even if all of them were to be completed before the New Year, the year-end total would be 64.8 percent off the historical high of 108 in 2015.

The biggest impact on the market is the lack of office sector mega-transactions in Manhattan this year, which has dampened dollar volume significantly. Only 13 Manhattan office investments greater than $100 million have been completed so far this year, totaling $6.6 billion. Compared with a year ago, the number of office trades over $100 million are down 51.9 percent, and dollar volume is down 60.7 percent. On the bright side, eight of the 13 investment sales are Manhattan office investments, two of which could fetch more than $1 billion—significantly more than any scratch-off jackpots.