Well, it’s almost over.

In a couple of weeks, Times Square will be packed with people as we bid farewell to a year that was historic. So long 2016 and hello 2017.

If anything, 2016 was the year of the big surprise. The winter months began with the expiration of a housing tax break that everyone said would be renewed; it wasn’t. (Eleven months after the 421a law expired, negotiations are limping toward the finish line, but even that doesn’t remain a sure thing.) And things progressively got weirder as the calendar bumped along.

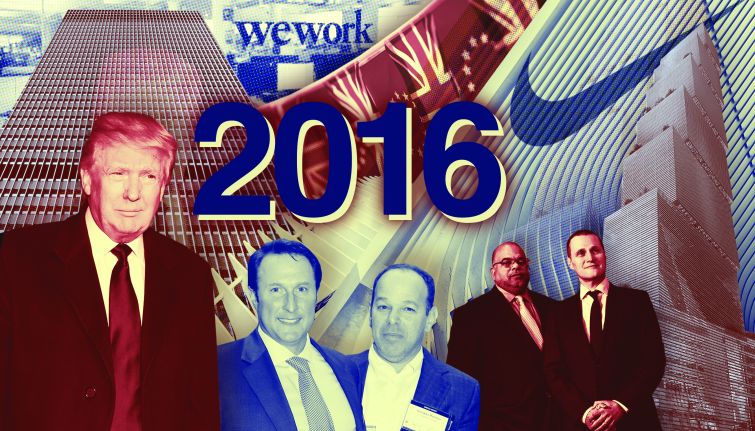

We were blindsided by the deaths of Antonin Scalia, David Bowie and Prince. We sat on the edges of our seats as Britons shocked the world by voting to leave the European Union and then, again, when the results started to show that Donald Trump would be president. In between it all, there were leasing and personnel changes that left the real estate world likewise spinning.

While it wasn’t the gangbusters year that the prior two had been, 2016 can be viewed as a leveling out point for the market, nearly a dozen real estate experts told Commercial Observer. In fact, it might have been better than most expected, coming on the heels of one that many expected to be the softening of the latest real estate cycle. That’s something they hope continues into 2017.

“I’ve felt like we’ve been in the eighth inning for a while,” said Leslie Himmel, the co-founder of Himmel + Meringoff Properties. “And I felt like we now have a few extra innings. I can’t be that specific in my forecast, although I am optimistic that 2017 is going to continue to be a terrific real estate environment.”

Now that the shocks of the year seem to have subsided, and industry players are starting to think clearer, many have expressed that they are optimistic that the Trump administration will lower taxes, invest in infrastructure and reform financial regulations. That in turn could lead to more New York City property sales and more employees coming to live and work in the city along with more office space being taken.

But, overall, there were three big issues that had an impact on commercial real estate in the Big Apple.

The Year Without 421a

One of the messiest and most shocking battles in real estate this year was over the expiration of the lucrative 421a tax abatement, which has been dead for the last 11 months.

“The suspension of the 421a program was a serious loss for all New Yorkers, especially at a time when so many communities are in need of new rental housing,” John Banks, the president of the Real Estate Board of New York, said in a statement via a spokesman. “Over the past two years, the 421a program accounted for more than half of all affordable housing projects built throughout New York City.”

The break, which is expected to cost the city $1.7 billion in foregone tax revenue this year, expired on Jan. 15, when REBNY and the Building and Construction Trades Council of Greater New York failed to reach an agreement on a prevailing wage. Gov. Andrew Cuomo last year tied the tax break’s survival to a benchmark salary for skilled construction workers.

What ensued was economic and political chaos. State legislators, who are required to vote and renew 421a, volleyed back and forth on replacement bills, which either REBNY or the unions would then dismiss. Executive members of REBNY at one point got into a shouting match over renegotiating with the unions.

The pain was visible in the statistics: The number of development sites sold through the first three quarters of 2016 totaled 560, according to data from Cushman & Wakefield (CWK). That number is 37 percent less than the 766 sold at the same time a year earlier.

Developers were seemingly willing to sit on whatever parcels of land they had, hoping for better news coming down the pike. The number of permits filed with the New York City Department of Buildings during the first half of this year was significantly down in Manhattan and Brooklyn, compared with the same period of 2014. (We left 2015 out, as many developers rushed to get projects into the ground ahead of the abatement’s expiration.)

The number of new Manhattan buildings given permits dropped 14 percent between the first half of 2014 and 2016, according to DOB data. The decrease was starker in Brooklyn, where there was a 34 percent drop in the number of new projects that got permits.

From there, the numbers promise to get worse absent a deal. There are 31,300 new housing units slated for completion by year’s end, according to an October forecast by the New York Building Congress. That’s expected to dip marginally in 2017, when 27,000 are estimated, followed by a mere 25,000 in 2018. Experts have attributed that drop at least in part to 421a’s absence.

The decrease and 421a lapse, however, might only take a small chunk out of the spending on residential construction, said Richard Anderson, the outgoing president of the Building Congress. While residential construction might not be at pre-recession highs, he said, it’s been about one-third of overall construction spending, which has hovered around a historic $40 billion the last two years. A decrease of a percentage point or two shouldn’t have rippling effects.

Developers likely won’t have to worry for long; REBNY and union officials struck an accord in November to bring 421a back. Construction workers will get an augmented wage on large-scale projects in heavy construction areas, while landlords get an extension on the years granted under the tax break.

“The truth of the matter is, the availability of 421a is hugely important for residential construction,” said Larry Silverstein, the chairman of Silverstein Properties. “I applaud it. I’d like to see if happen.”

But legislators still have to vote before 421a goes back into effect. Despite some questions from a few lawmakers, the bill reviving the tax break is expected to sail through both houses in Albany. The only matter is when: Legislators have been mulling a year-end special session, during which they’d also likely consider 421a.

“We are optimistic that the program will be revived,” Banks said. “The recently announced agreement with the Building and Construction Trades Council of Greater New York will once again catalyze new rental housing development—including a substantial share of affordable units—while also ensuring good wages for construction workers.”

It’s Beginning to Look a Lot Like Renewals

When Commercial Observer spoke to industry pontificators for this story last year, they foresaw that leasing would be down in 2016.

With less than one month to go, that’s certainly true when it comes to new leases. Between this January and November there was a total of 24.1 million square feet of fresh deals closed in Manhattan, according to C&W. This was 17 percent lower than last year, which saw 28.2 million square feet of activity (tenants would have to fill the Empire State Building one and a half times in the next two weeks to catch up).

But here’s another surprise: Leasing as a whole will likely be slightly higher than the 33.8 million square feet signed last year. That’s because renewals were nearly twice what they were last year with 8.3 million square feet signed through November—a 48 percent jump from all of last year.

Some mammoth renewals carried that activity. McGraw Hill Financial signed an early renewal for 900,000 square feet at 55 Water Street; Penguin Random House did the same thing at 1745 Broadway, keeping its 603,605 square feet; UBS re-upped its 900,000-square-foot foothold at 1285 Avenue of the Americas.

A shaky global economy at the beginning of 2016 might have played a part in the biggest botched deal of the year. Media mogul Rupert Murdoch pulled the plug at the 11th hour on a 1.5-million-square-foot deal to relocate his companies, News Corp. and 21st Century Fox, to the planned 2 World Trade Center. (He cited an uncertain world as why his companies couldn’t move.)

Those in the leasing world said decision-makers were inclined to stay put this year upon lease expiration due to the uncertainty in the world—especially as a new president is selected.

“That’s a reflection of a market this year that was a little bit in flux waiting for an election outcome,” said Bruce Mosler, the chairman of global brokerage at C&W. “We were looking at almost double the number of renewals—not quite, but almost double. I believe that’s reflective of a C-suite that’s cautious.”

Not everybody agrees that’s the case. Mary Ann Tighe, the chief executive officer of CBRE (CBRE)’s New York tri-state region, noted that renewals accounted for 17 percent of all leasing in 2015, and this year indicated a return to the average of 25 percent of volume being renewals.

“I don’t think you can blame these numbers on the Trump victory and people feeling uncertain,” she said. “In my view, there are many companies that are looking at their business model in light of all of the changes swirling around us, and asking themselves, ‘Is this what my business looks like going forward? And until I can feel with confidence that I know how my business is going to operate…I’m going to sit tight and wait for that to clarify.’ ”

Plus, plenty of companies continued the trend of looking south and westward for new office stock and vacating the traditional office district of Midtown.

Tighe said that between 2013 and 2016, 12 companies leasing 100,000 square feet or more have moved to Lower Manhattan and another dozen have headed to the Far West Side. At the same time, 22 companies left Midtown. They’re mostly going to newly constructed buildings as tenants reexamine how they occupy office space.

“The statistics are pretty darn remarkable,” she said. “We’ve felt it for some time, and we’re going to see it manifest in blocks of space that will begin appearing. These shifts are happening, and I think it’s accelerating.”

David Levinson, for one, believes that tenants are jumping at the opening to take efficient space that allows for density.

“The headline is really ‘tenants want new space,’ ” said Levinson, the chairman and CEO of L&L Holding Company. “There’s momentum toward that. It was slow in 2014 and 2015. Now it’s picking up speed.”

Two Shocking Votes and a Boost to the Economy

United Kingdom voters’ decision in June to leave the European Union sent the market into a tailspin, with the value of the Pound Sterling plummeting. But, ask around the Big Apple and stake holders will say London’s loss is New York’s gain.

Robert Knakal, C&W’s chairman of New York investment sales, said while not all of the capital invested in the U.K. might have gone to New York, the city perhaps nabbed 10 to 20 percent of money that otherwise would have been poured into London. He added that sales are likely to rise in the latter part of 2017 as prices start to level out.

“Investors are—and have been—a little more cautious about not being too aggressive with their purchases, but there are still tremendous pools of money out there looking to buy product,” he said. “The prices just have to be a little more rational, and I think that’s where we’re getting.”

Those potential investors might be coming into a different kind of environment, however. The Federal Reserve has indicated that at long last interest rates will begin to increase, having hovered around zero during the lengthy recession recovery. Governors of the Fed are slated to announce what those new rates during the end of a two-day meeting this week.

Himmel, whose firm has about 2 million square feet of commercial space mostly in Manhattan, said rates would rise—thus helping to level off the recent sales boom. Her company, too, has been ramping up for the interest rate hike: It refinanced debt on five properties this year to capitalize on the low rates.

“The one headwind is interest rates,” she said. “And it’s clear that interest rates are going to go up.”

She and many other people interviewed for this story said, of course, the biggest surprise of the year was Trump’s election. (Disclosure: CO Publisher Jared Kushner is the president-elect’s son-in-law.)

“I think from an economic basis, looking at the stock market going over 19,000 [points] and the prospective tax changes, it will hopefully be terrific for real estate,” she said.

Silverstein said he believes the market will become more bullish now that the uncertainties surrounding a most unusual election year have been answered.

“I think and hope that we’re going to see more stability,” Silverstein said, adding that he hopes a rising tide will lift all boats. “It has to have an impact as quickly as possible, because there are too many in America who are suffering and don’t have many of the advantages that so many of us do have and enjoy.”

Aside from his rhetoric on lowering taxes and infrastructure investment, those in the commercial world said they’re watching what the future Trump administration will do about the Dodd-Frank Wall Street Reform and Consumer Protection Act. The developer-turned-politician stated during the campaign he would either repeal the regulatory legislation, or reform it so it allows the financial services industry to spread its wings.

“This may generate jobs in that sector,” Mosler said. “And if we have the combination of a healthy [technology, advertising, media and information] sector and a healthy banking sector—that for the first time is adding jobs not just in compliance, but jobs in the broad brush—that could have a compounding effect on our marketplace.”