Kevin Maloney’s PMG is Building Empires in New York and South Florida

A little more than two years ago, Kevin Maloney, the founder and principal of Property Markets Group, was talking about a possible partnership with a wealthy Emerati named Khadem al-Qubaisi who had flown in to New York for a meeting.

Midway through their discussion, it came up that Mr. Maloney’s new friend needed an apartment in the city.

Mr. Maloney was better equipped than most to accommodate; he was in the middle of selling Walker Tower, one of the premier new developments in Gotham. And, as it so happened, Walker Tower had a pretty spectacular penthouse on the market.

With his prospective-business-partner (and partner’s entourage) in tow, he walked over from his office on West 17th Street to the Art Deco-era condominium conversion a block away at 212 West 18th Street between Seventh and Eighth Avenues.

Mr. al-Qubaisi spent a few minutes touring the nearly 6,000-square-foot unit that took up a whole floor and boasted dramatic floor-to-ceiling windows, new millwork and custom everything.

How much?

$55 million.

After considering it for a moment, the gentleman asked Mr. Maloney if he would accept $51 million.

And that was that. The biggest sale in Downtown Manhattan. (The final sale was recorded for $50.9 million, according to StreetEasy.)

This story might be a vestige of a New York City real estate scene that’s already in the rearview mirror. Back then, Russian or Middle Eastern billionaires seemed desperate to park their money in New York City real estate, and Walker Tower—which had originally been built in 1929 and served as an office for the New York Telephone Company before it was renamed after its architect Ralph Thomas Walker—exemplified it. The building, which PMG developed with JDS Development Company, sold at an average of $4,364 per square foot, according to StreetEasy. (The penthouse mentioned above is back on the market for $55 million—or $9,235 per square foot.)

But whether the era of the insanely luxe condo has crested, or not, Mr. Maloney is hardly taking his foot off the gas.

“This cycle, we’ll probably do about $4 billion, $5 billion in business,” Mr. Maloney, 57, told Commercial Observer from his new Chelsea office, “depending on what we actually get built. And the retail component [of PMG’s portfolio] could be as much as $1 billion.”

The portfolio of projects underway stretches from the east in Long Island City, where he has a planned 830-unit tower called Queens Park Plaza, which he’s currently wrapping up joint venture funding for, as well as a separate 391-unit rental called Queens Plaza South, a 45-story tower which should be completed in the next 90 days. It reaches south to Gowanus where PMG has been snatching up parcels of land (no word yet on what the company will do with it but probably some sort of rental). It pops up in the fanciest neighborhoods of Manhattan, like at 10 Sullivan Street, a 24-unit, four-townhouse project designed by Cary Tamarkin that should have its first closings in a week and where a typical unit averages around $3,500 per square foot. And it extends way, way farther south to Miami where PMG has become one of the biggest South Florida players and west to Illinois. (“We’ll probably do 1,000 units in Chicago next year,” Mr. Maloney said.)

But as far as building plans go, the most talked about has been Steinway Tower at 111 West 57th Street between Seventh Avenue and Avenue of the Americas, a condominium PMG is building with JDS.

The plans drawn up by SHoP Architects call for a 1,428-foot-high, 60-foot-wide tower, making it the tallest residential building in New York City—a good 150 feet higher than the Empire State Building. (Although, that designation might not last long as Extell Development Corporation’s proposed Central Park Tower a couple of blocks west is a whopping 1,550 feet.)

Writing in Vanity Fair, the architecture critic Paul Goldberger said Steinway’s design was “quite possibly the most elegant” of its competitors on Billionaire’s Row. And on a block where apartments have traded for north of $90 million, it was anyone’s guess what untold riches Steinway Tower might unlock.

But, with the market for ultra-luxury condos softening and some of Billionaire’s Row stock sitting around and waiting for loose buyers, some might say that Steinway Tower looks like less of a sure thing than it did when plans were first unveiled. (The numbers originally batted around for full-floor and duplex units was as much as $100 million, but the offering plan approved in the fall of 2015 by the Office of the Attorney General of the State of New York had the priciest unit at less than $60 million and a projected sellout of $1.45 billion.)

However, PMG is probably in a better position than some of its competitors. The project is fully capitalized; AIG Global Real Estate put up $400 million as the senior lender for the building, and Apollo Global Management put up a mezzanine loan for another $325 million. PMG and JDS split up the rest of the equity. (Mr. Maloney says that figure is somewhere between $125 million and $150 million.)

And Mr. Maloney is realistic about the turn in the market. “We’re really focusing on the construction of the building,” he said. Completion is slated for less than 30 months from now, and construction has been underway for the last year. “We think when the building really starts to rise up it’s going to be very, very noticeable… That’s when we really begin the marketing program.”

That is the approach PMG is taking with the market in general. “We’re sort of sitting out 2016,” he said. Much of what the firm is building in New York has already broken ground, having long been approved for 421a tax abatements before the program expired earlier this year. “We’re really just finishing up work.”

Whatever else, it’s a big finish.

*

“Having been a lawyer for many years, working with different clients through different economic cycles—and you’ve heard this analogy before—[development] is very much a game of musical chairs,” said Marc Shapiro, a partner with Mayer Brown, who has served as PMG’s attorney over the years and invested with Mr. Maloney on a handful of individual projects. “Everything’s good, and suddenly the music stops and there’s one less chair.

“That’s what real estate development is all about. It is in large part luck, it is an equal measure of skill—but an important element in avoiding the problem times is avoiding the natural tendency towards greed. Kevin has always had an ability to avoid the greed—that’s probably one of the most important elements of his success.”

Given how brazen some of its plans might seem, PMG has been conservative about the way it constructed its real estate empire. When Mr. Maloney brought the Walker Tower deal to Mr. Shapiro, it was a relatively modest investment.

“The acquisition costs were something like $23 [million],” Mr. Shapiro said. “I remember Kevin saying, ‘This is going to be a solid project for us. We anticipate we can market these units at $1,700 to $1,800 per foot. It’s not going to be a homerun, but it will be solid.’”

Mr. Maloney undersold it beautifully. “There was a profit to the partners of close to $400 million,” Mr. Shapiro told CO.

Likewise, while one might assume there’s a great deal of risk in such an ambitious project as Steinway, one can also assume that PMG has given itself a lot of margin for error.

“We have a lot of latitude in our price structure,” Mr. Maloney said. “If you believe you can complete a project at $3,000 a foot and you believe that the market is even $6,500 a foot, you have a lot of room to make your market where you’re not in jeopardy. So we had a lot more latitude than, say, another project that might be on the Central Park South and 57th Street corridor where the basis is much higher.”

“He doesn’t get stuck with inventory,” Mr. Shapiro said. “That’s what kills you. Particularly when it’s financed and you owe money to a bank on something. That’s when it all starts coming down.”

Mr. Shapiro added, “There’s no one who doesn’t borrow money—everybody borrows money. In my experience most people find themselves over-leveraged and don’t have sufficient equity to sustain a downturn. Kevin is very aggressive in that respect. He invests a considerable percentage of his own capital.”

For his part, Mr. Maloney doesn’t necessarily set hard rules for himself about how much capital he puts into every project. “In Florida, the equity slice can be under 10 percent—but that business model is different in every state.”

Mr. Maloney got his first taste of real estate when he was an undergraduate at SUNY Buffalo. He was working part-time as an arc welder, making $6.50 an hour and living off campus.

“Off-campus rooms were $100, $110 per month,” he said. “I realized you could buy a house for $17,000, $18,000, split it up into eight to 10 rooms [and rent those to his fellow students] and you have a really good deal.”

He used his student loans to put down payments on two duplexes and a single house. “I was able to amortize down and pay off the houses over four years.” When he left college, he had $100,000 in debt-free real estate and hired a young undergrad to manage the properties for him. (He wound up selling them off not long after for $120,000.)

After school he started in construction lending, doing a stint at Chemical Bank, before landing at Ensign Bank where he ran the real estate department.

But more than just appraisal or financing, Mr. Maloney had a flair for building. “I knew nothing,” Mr. Maloney said. “I just thought I knew a lot. Certainly, I knew the financing side very well because I was in that world, but a lot of the early projects not only incorporated construction but property management.”

Mr. Maloney’s first project was a 40-unit rental on Central Park West and West 64th Street, for which he partnered with Ziel Feldman, who is now the head of HFZ Capital Group. (Mr. Feldman is not the only blockbuster alum amongst Mr. Maloney’s former associates; Messrs. Feldman and Maloney also started buying walk-ups with Gary Barnett of Extell who cast the first stone on Billionaire’s Row with One57 and is currently working on Central Park Tower at 225 West 57th Street.)

“It was a failed conversion that FDIC [Federal Deposit Insurance Corporation] owned,” Mr. Maloney said. “I think they had a loan on it for $7 million, and we bought the buildings from the government for $1 million.”

For the first part of his development career, a lot of the projects PMG did were modest ones.

“We’ve probably done 125, 150 buildings in our career between Chicago, Miami and New York,” Mr. Maloney said. “Many of the buildings were five-story walk-ups. We started like everyone else…doing a lot of smaller projects and then putting those in our portfolio and managing those for years. When the market got right, we packed up and sold them. Then we graduated to mid-rise….then ground-up construction, then larger ground-up construction projects.”

Finally, he landed at the projects where the costs run well into the hundreds of millions of dollars. “Ten years ago, if we were doing a $100 million project that was a very, very large project,” Mr. Maloney said. “Today a $100 million project is something we’d have to think about whether we could build because it could be too small for the company.”

His modus operandi when financing these projects has been to sell “out significant percentages of those projects early on and pay down significant portions of the bank debt,” Mr. Shapiro said. “So his exposure is equity exposure. He doesn’t have to feed his equity. He’s out of his third-party obligations and can wait for the recovery of the market…He doesn’t have construction risk, and he doesn’t have interest risk.”

*

Florida is very much in PMG’s scopes, and it has a lot of the same pluses and minuses as New York. By Mr. Maloney’s reckoning PMG did $1.2 billion worth of business in the Sunshine State since 2010.

“There are about 100 buildings planned for South Florida for 2016,” Mr. Maloney said. “I would say less than 10 of them get built.”

This means that the developers who actually get financing and get projects in the ground will have an advantage.

“All those cranes you see in the skyline? Once those buildings get topped off or finished, you’re not going to see any new cranes,” Mr. Maloney said. “I’d tell this to people publicly, and they’d say, ‘Yeah, but there’s so much other work—infrastructure work, hospital work, highway work.’ I’d say, ‘The condo business in South Florida is probably one-third of the construction business. When you take one-third of the construction business away from the construction industry you’re going to see prices drop.’ ”

Related Companies is one of the developers still plugging away with a good eight to 10 condos, and another eight to 10 rentals currently under construction—as is Mr. Maloney’s old partner, Mr. Feldman, whose HFZ is currently at work on the Fasano Hotel + Residences at Shore Club, which is being delivered in 2017.

But Mr. Maloney’s prediction has already been borne out. At the beginning of the year, when PMG got construction estimates for a new rental it’s constructing, projections were 15 percent lower than they were six months earlier.

“We’re going to sit tight for another 90 days because I think we’re going to see another 10 percent dip in costs,” Mr. Maloney said. (Mr. Maloney’s conversation with CO took place in February.) “We have a long way to go from $500 down to $150—I don’t think we’re ever going to get to $150 again. But if we as builders can even see $100 a foot in savings and costs, that’s a huge margin which would stimulate some new development.”

PMG started building in Florida in the early 2000s and was badly hit by the downturn, but nevertheless made a strong play when much of the housing market was still licking its wounds.

“He knew exactly what he wanted,” said Carlos Ott, the international architect whom PMG hired to start working on its South Florida projects roughly eight years ago. “He came aggressively and bought land right on the water in Hollywood, Fla.”

“He comes to Miami on Monday,” Mr. Ott said. “On Tuesday he walks in, looks at everything, and tells you exactly what he wants.”

When PMG was trying to come up with concepts for 300 Biscayne Boulevard, a two building complex on an L-shaped finger of land on the water, Mr. Ott was in Paris with his girlfriend. “I was doing sketches and sending them back to New York to Kevin. My girlfriend said, ‘We are in Paris!’ I almost wound up [getting broken up with.]”

Mr. Ott worked around the clock, sending, by his count, thousands of sketches, doodles and diagrams to New York for three weeks.

“He doesn’t tell me, ‘Do it yellow,’ or, ‘Do it pink.’ But he wants something iconic, something symbolic,” Mr. Ott said.

The condo portion of 300 Biscayne Boulevard is perhaps his most ambitious project to date in Florida, jutting up more than 1,000 feet in the sky. “He had a vision to create the emblematic building” of the city, Mr. Ott said. (The condo section hasn’t broken ground yet.) There’s also a rental part of 300 Biscayne currently under construction.

In Aventura, a section of Miami-Dade, PMG is also at work on a 1-million-square-foot condo consisting of 190 residences called Echo Aventura; the developer also has another 57-story, 180-unit condo called Echo Brickell in the Brickell section of Miami.

“People look at the Miami housing market, and they think it’s boom or bust,” Mr. Maloney said. “But the dynamics have changed.”

For one thing, buyers are typically putting up larger deposits. “That really decreased the default rate,” Mr. Maloney said. “We just started closing in December [2015] at Echo Aventura, and we didn’t have one default because people had in that building 60 percent deposits—which was really the cost to build the building, so on that particular project we didn’t need a lender. Last cycle you had 15 to 20 percent deposits, and it just took the market to get below that 20 percent devaluation and everyone said, well, my deposit’s gone, I’m walking away.”

This time, nobody will walk away when they’ve got that much equity in the project.

*

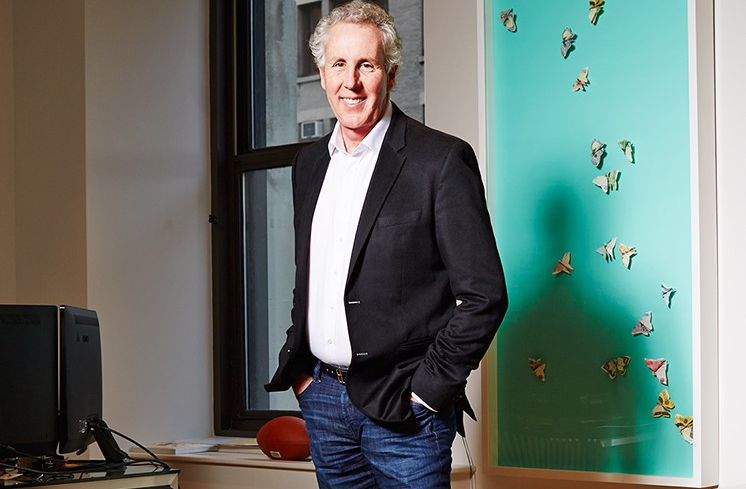

Tall and lean with curly grayish hair, Mr. Maloney doesn’t quite look like his fellow developers. When he met with CO, he ignored his profession’s standard-issue uniform (suit and tie) and instead chose a pair of jeans, and a sports jacket.

He lives in the penthouse of a building he converted on the Upper West Side with his wife Tania and their 2-year-old daughter Madeline. (“A lunatic” is how he describes the youngest Ms. Maloney.)

“He hasn’t changed much [in 28 years],” Mr. Shapiro said. “He’s an extremely honorable guy—that sets him apart from a lot of people I’ve known.” (Mr. Ott is, if anything, even more effusive. “He could be Lorenzo il Magnifico,” he said.)

When Mr. Maloney started PMG in 1991, he asked Mr. Shapiro to do legal work for him at an extremely reduced fee (or, in some cases, gratis) until the firm got its sea legs. As the company’s portfolio and success grew, Messrs. Shapiro and Maloney took on a more traditional lawyer-client relationship.

“In 1996 he came into my office one day and asked me what I thought I had given him, either in reduced fees or for free,” Mr. Shapiro said. “I said it was a silly question—who cares? He said, ‘No, I want to know.’ ”

After thinking about it, Mr. Shapiro came up with a sum—a large one.

As soon as Mr. Shapiro said the amount, Mr. Maloney took out his checkbook. “I’ve done OK,” Mr. Maloney told his dazed friend.

“No one does that,” Mr. Shapiro said. “It was a singular experience for me in my entire law practice. Every lawyer I’ve ever told that story to has said that never happened to him.”