Brookfield Lands $75M Acquisition Loan from ICBC

By Danielle Balbi December 1, 2015 4:58 pm

reprints

Industrial and Commercial Bank of China (BACHF) provided Brookfield Property Partners with a $75 million acquisition loan for its recent Brooklyn buy, according to records filed with the city today.

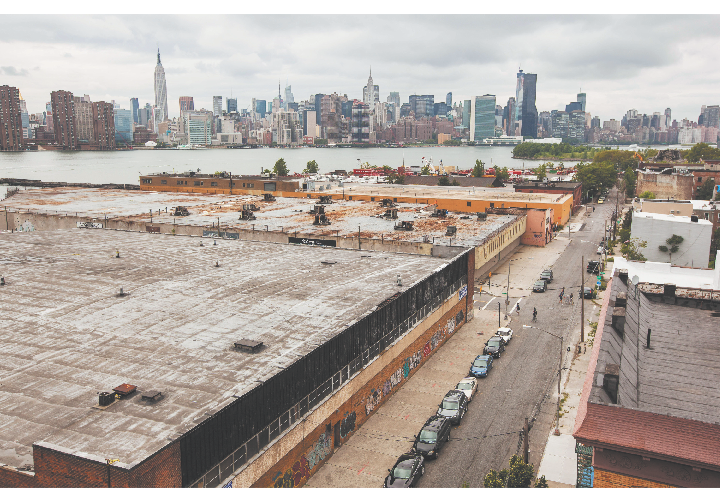

The company will be co-developing two rental buildings with Park Tower Group, as a part of Greenpoint Landing—a 22-acre development site along the East River. The project is estimated to cost $600 million, according to a news release that Brookfield released in October.

Brookfield acquired the two vacant sites on Commercial Street for $59.8 million and $46.5 million from Park Tower Group in a deal that closed on Oct. 19, property records indicate.

“We are excited about this multifamily development opportunity and for this partnership with the Park Tower Group,” Richard Clark, a senior managing partner and the global head of real estate at Brookfield, said in the release. “This is an important addition to our growing multifamily platform. It is compelling to be part of a large development in a vibrant community that will provide housing choices for many New Yorkers.”

Construction is expected to start in the first half of 2016, and is slated for completion in 2019. The first tower will stand at 30 stories with 365 units, and the second tower will reach 40 stories with 415 units.

In the last few years, there has been more and more residential development in Greenpoint.

L+M Development Partners is constructing 294 affordable apartments at Greenpoint Landing. Chetrit Group and Clipper Equity are also developing nearby, at 77 Commercial Street. The partnership acquired the site in 2012 and borrowed a $27.5 million bridge loan from New York Community Bank back in May of this year for a 720-unit, two-tower development, as COF reported.

Representatives for Brookfield and ICBC did not immediately respond to press inquires.