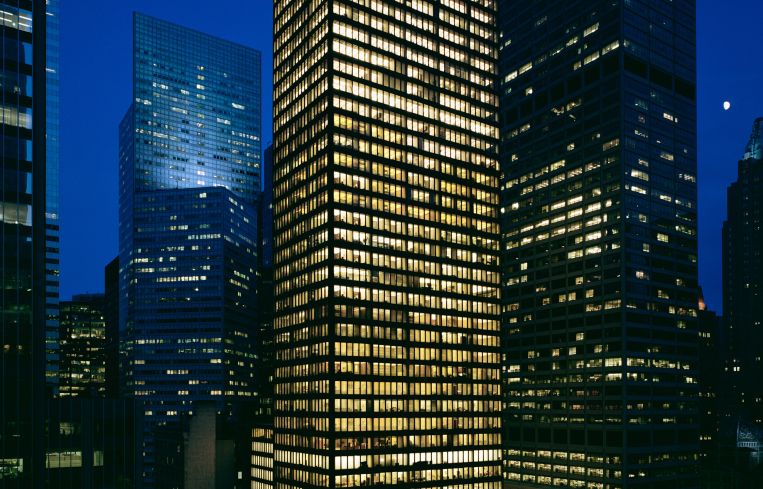

Investment Firm Takes Space at 375 Park Avenue for First NYC Office

By Rachel Butt October 5, 2015 3:29 pm

reprints

Strategic Value Partners, a global firm that focuses on distressed debt investment, is moving into a 3,684-square-foot office space at 375 Park Avenue, according to a release from landlord RFR Realty.

The Greenwich, Conn.-based firm signed a five-year lease for its space on the 17th floor of the building between East 52nd and East 53rd Streets. Strategic Value Partners was seeking a high-end building for its first New York City office.

“They want the presence… and they want to find a premier building in a premier location,” Brian Goldman of Newmark Grubb Knight Frank told Commercial Observer. He represented the firm in the deal.

Strategic Value Partners is one of the three tenants that have recently inked deals in the building with RFR.

Clayton, Dubilier & Rice Holdings, a New York-based private equity firm, has renewed and expanded its office space in the building.

The firm, which has occupied 34,254 square feet in the building for 11 years, signed a 10-year lease for an additional 4,746 square feet in the building. The office now spans the 18th and 19th floors as well as a part of the 17th floor. Clyde Reetz of CBRE represented the tenant in the deal.

“375 Park Avenue continues to attract and maintain a strong base of leading global financial firms,” AJ Camhi, the senior vice president and director of leasing at RFR, said in the press release.

Another tenant has renewed its lease in the building.

Berkley Insurance, a subsidiary of the W.R. Berkley insurance firm, expanded and took the entire 35th floor in the building. The insurance firm, where total revenues grew 45 percent in the five years through 2013, now occupies 18,214 square feet in the building. That is nearly triple the 7,817 square feet the firm initially had in the building. No one from Berkley Insurance immediately responded to requests for comment.

The asking rent in the three leases was $175 per square foot, said Mr. Camhi, who represented RFR in-house in the transactions with RFR President Gregg Popkin.

RFR has leased 110,000 square feet in the building this year, bringing it to an occupancy rate of about 96 percent, Mr. Camhi said.

Another 15,000 square feet of leases are under negotiation, the firm noted in the release. The deals include private investment firm Centerbridge Partners’ 46,571-square-foot expansion and renewal, Canadian investment management firm Fiera Capital‘s new 26,060-square-foot office and a 5,770-square-foot expansion for British investment management firm Winton Capital.