Stat of the Week: 8.7% Availability – Decade Analysis Part I

By Richard Persichetti November 14, 2014 3:02 pm

reprints

With the opening of One World Trade Center last week, what better time than now to survey the aging building inventory in Manhattan? Since two-thirds of the inventory for 100,000-plus-square-foot office properties was constructed prior to 1970, I figured it would be a good litmus test to analyze buildings built pre- and post-1970.

In a flight to value real estate cycle, like the one Manhattan has been in over the past four years, it is no surprise that buildings built prior to 1970 have a lower availability rate than the newer, more modern ones built after 1970. A shift in the demand landscape has played a major role in this cycle. TAMI-type tenants are looking for space in older buildings to save on real estate expenses, leaving additional capital to build-out their space.

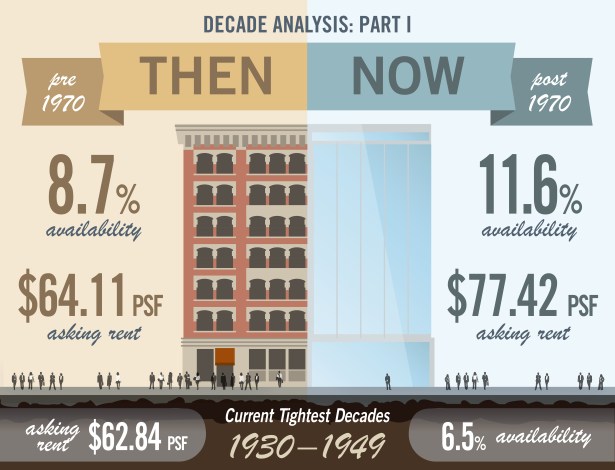

Availability in pre-1970 constructed buildings is currently 8.7 percent and is down 200 basis points from one year ago. Consequently, buildings constructed post-1970 have a substantially higher availability rate of 11.6 percent. The post-1970 buildings were able to withstand the addition of 1.27 million square feet of available space at One World Trade Center this year, and its availability has recovered more than pre-1970 buildings – down 240 basis points from 14.0 percent.

The flight to value trend is even more evident in the price comparison between these two groups of buildings; due to discounted pricing, the pre-1970 buildings are in higher demand than the post-1970 buildings. Pre-1970 buildings’ average asking rent is only $64.11 per square foot, while post-1970 buildings average 20.8 percent higher at $77.42 per square foot.

When examining buildings constructed during a specific time period, we find that the tightest market is for those built between 1930 and 1949. These buildings have a 6.5 percent availability rate and the second lowest asking rent of $62.84 per square foot. On the flip side, buildings built from 1990 to 1999 are trailing all other time periods during this cycle with a decade-high 14.0 percent availability rate.

In next week’s Stat of the Week, Decade Analysis Part II, you will be able to see the results as we take a deeper-dive on a submarket level.