Riding the Real Estate Investment Trust Roller Coaster

By Gus Delaporte May 9, 2013 9:00 am

reprints This week, Malkin Holdings cleared a major hurdle in its quest to list its portfolio, which includes the Empire State Building, as a $1 billion real estate investment trust.

This week, Malkin Holdings cleared a major hurdle in its quest to list its portfolio, which includes the Empire State Building, as a $1 billion real estate investment trust.

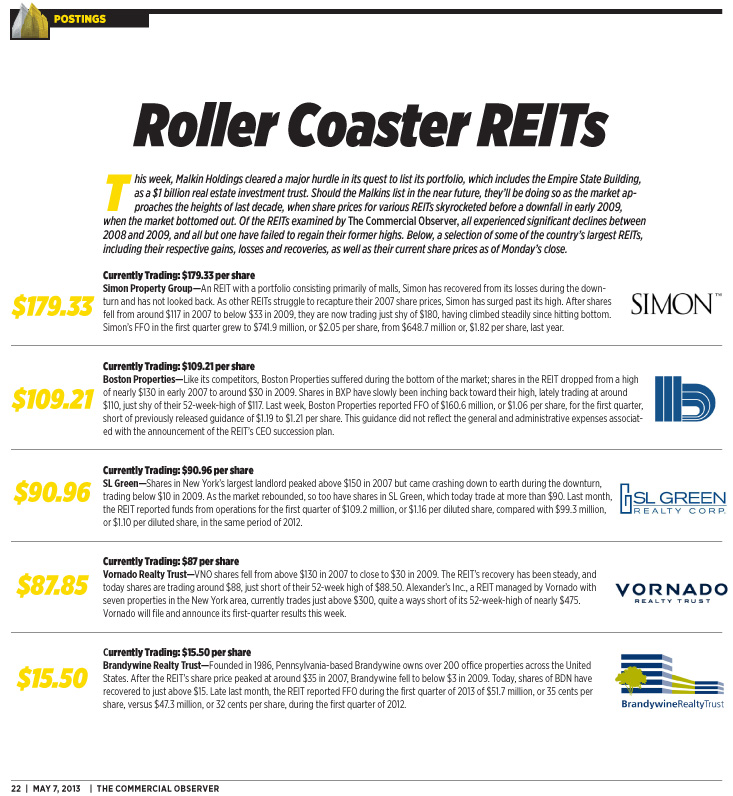

Should the Malkins list in the near future, they’ll be doing so as the market approaches the heights of last decade, when share prices for various REITs skyrocketed before a downfall in early 2009, when the market bottomed out. Of the REITs examined by The Commercial Observer, all experienced significant declines between 2008 and 2009, and all but one have failed to regain their former highs.

Below, a selection of some of the country’s largest REITs, including their respective gains, losses and recoveries, as well as their current share prices as of Monday’s close.

[scribd id=140008195 key=key-12syqkhehj1kqhxd57sz mode=scroll]