Grand Central Submarket Building Stock Growing Long in Tooth

By Robert Sammons December 26, 2012 7:00 am

reprintsAhhh—the hustle and bustle of the Grand Central submarket.

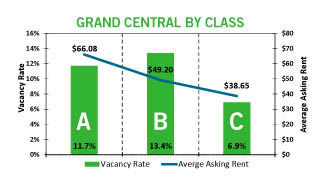

It has it all: a spectacular train station with its shops, bars, restaurants and food hall (oh, and actual trains, too), a fantastic location within walking distance of everything from Times Square to Central Park (and you can always take the subway if you’re lazy) and a thriving commercial office market consisting of almost 59 million square feet of inventory (though only 27 percent of that is considered Class A).

But all there isn’t absolutely perfect—something about those wonderful buildings getting a bit long in the tooth, maybe? After all, it’s not really the Mad Men days of yore, and the building stock (average age: 72 years) doesn’t necessarily work for all those companies looking for wide-open floorplates and glass from floor to ceiling. That’s the reason a number of government and private-sector movers and shakers have decided to, well, shake things up by looking to upzone a large swath of the area.

Not only will Grand Central be affected, but its ritzier neighbor to the north, the Plaza submarket, will get an upzone too (43 percent of the Plaza’s inventory is considered Class A).

Not only will Grand Central be affected, but its ritzier neighbor to the north, the Plaza submarket, will get an upzone too (43 percent of the Plaza’s inventory is considered Class A).

If and when all is approved, one of the first projects that would be ready right out of the starting gate would be SL Green’s 1 Vanderbilt, at around 1.55 million square feet, with a needed FAR of 30. But don’t panic—I highly doubt that, if and when the upzoning process moves ahead, there will be wrecking balls on every corner. As a matter of fact, a 1920s-era building (475 Fifth Avenue) is undergoing a major renovation and has all of its 270,000 square feet available. And as I write this, there are, in an odd twist, new media/tech firms scouring the area in search of those lovely older buildings that they’ve treasured so much in ever-tightening Midtown South.

That current 12.2 percent overall vacancy rate for Grand Central today (already down from its recession peak of 15.3 percent) may slide even lower, with or without a rezoned submarket.

Robert Sammons, Cassidy Turley