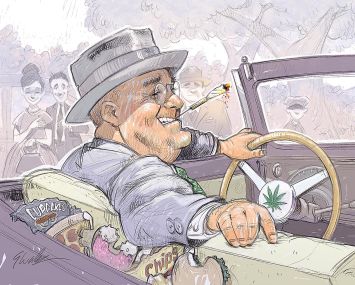

marijuana retail

As of spring 2021, recreational marijuana for adults was legal in 15 states and the District of Columbia.

It is still illegal at the federal level, which complicates conventional financing for cultivators, vendors and investors. The U.S. House of Representatives did pass legislation in December 2020 to legalize the drug at the federal level, but that bill has so far gone nowhere in the Senate and President Joe Biden is on record opposing legalization. (If the U.S. did legalize marijuana, it would be only the third country in the world to do so, after Uruguay and Canada.)

Marijuana sales at the retail level could prove a boon for commercial real estate. It’s estimated, for instance, that New York City could host some 800 vendors should New York state follow for marijuana stores its own guidelines on liquor stores.

At the start of 2021, there were 10 publicly traded marijuana companies with stock values of at least $2 billion each, according to information published through the Nasdaq (the list includes a firm that specializes in cannabidiol, a derivative of cannabis).

Medicinal marijuana sales have seeded most of their value and potential, and these companies then should end up the biggest players in American recreational marijuana retail. It’s far easier for existing companies that specialize in dispensing marijuana for prescribed medical purposes to transition to recreational sales than it is for new companies to break into the space.

These leading companies include Curaleaf Holdings, Green Thumb Industries and Trulieve Cannabis.