Peter Moglia and Joel Marcus

CEO and co-chief investment officer; founder and executive chairman at Alexandria Real Estate Equities

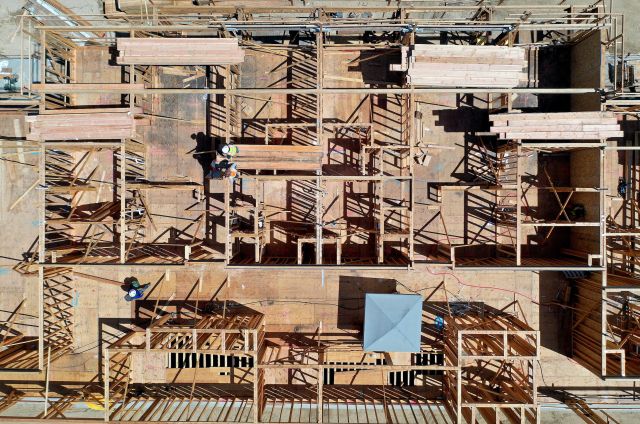

Alexandria Real Estate Equities (ARE) is the nation’s most prominent owner and developer of life sciences campuses, serving big name tenants such as Eli Lilly, Moderna, Amgen, Gilead and Vertex.

The Pasadena-based real estate investment trust is facing growing concern about the longer-term investment viability of life sciences space, particularly the use of adjoining office spaces. Self-described activist hedge fund Land & Buildings in June raised concerns about Alexandria over a 50 percent drop in attendance at its medical office properties after the pandemic. L&B specifically identified massive declines at ARE buildings throughout major life sciences markets.

Indeed, the era of rapid growth and expansion — which ARE executives refer to as the “rocketship” years — is over. ARE is not impervious to the market reset, and this year announced it’s cutting back on a portion of its construction pipeline valued at approximately $250 million. Still, Alexandria experienced higher revenues and strong leasing during the first three months 2023, and again reported higher earnings, higher net operating income, and major sales of non-core assets after the second quarter. Peter Moglia said on an earnings call that the firm recorded an increase in demand for space “ranging from 15 percent to 20 percent in our top three markets, a sign that perhaps investors are seeing the light at the end of the tunnel when it comes to economic uncertainty.”

Despite a larger slowdown throughout commercial real estate, Alexandria sold $701 million in real estate as part of its “value harvesting” or “asset recycling program” in the first half of 2023, and plans another $874 million in sales in the second half. The firm reported 93.6 percent occupancy in its North American properties, and said occupancy is expected to increase to over 95 percent in the fourth quarter. Rental rates on lease renewals and re-lease space was up 16.6 percent.

Joel Marcus founded the company as a garage startup with $19 million in Series A capital in 1994, naming it after the city of Alexandria, Egypt, the ancient world’s scientific capital. It has grown into a company serving more than 850 tenants and 75.6 million square feet in North America, with a total market capitalization of $30.6 billion.