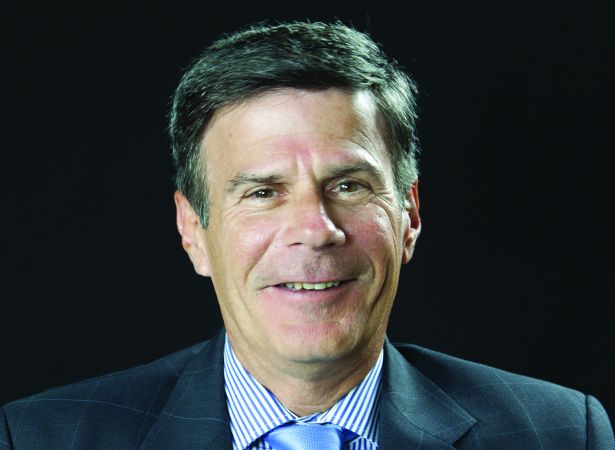

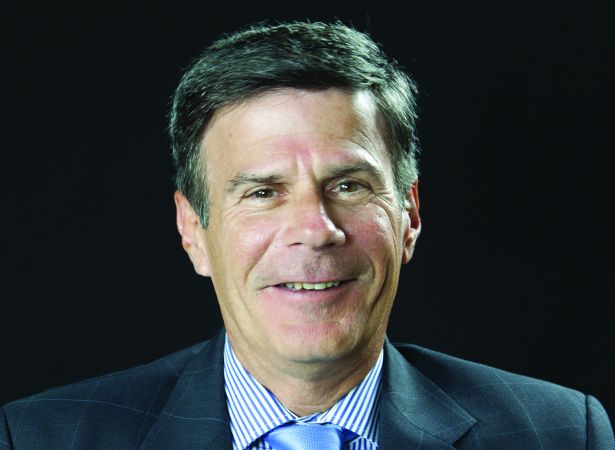

PHOTO: Courtesy John Adams

John Adams

Senior Executive Vice President and Chief Lending Officer at New York Community Bank

Last year's rank: 40

John Adams joined New York Community Bank (NYCB) in 2000. Plainly: He manages credit risk, ensuring the bank’s asset quality passes muster. To dress it up a bit: The bank’s multifamily loans rose $2.4 billion (7 percent) and specialty finance loans rose $451 million (15 percent) over the previous year. And asset quality was top-notch with non-performing assets at 7 basis points — of $59.5 billion in total assets.

Among other things on the path to loans totaling $45.7 billion for 2021, Adams was responsible for negotiating the terms of NYCB’s biggest deal of that year: $163 million for the acquisition of a package of multifamily properties in the Midwest for a long-term client.

He says 2021 offered the best kind of challenge: Keeping up with the growing needs of the customer base, especially in terms of geographic expansion. How to do it? Be responsive; seize the opportunity; and join them. “As long-term relationships ventured into other markets, we broadened our reach,” Adams said.

That meant he got to travel. “I like to kick the tires in different markets,” he said. “People can’t help but talk sometimes. They’re honest. Gives you a chance to learn what’s going on in the local market.”

The result: expansion of NYCB’s multifamily lending program into the Sun Belt. And expansion to different sectors is in play too. “We’re not a big player in the office market space, but, like everyone, we’ve taken a step back to reevaluate the higher-than-usual, higher-than-industry-norms office vacancies,” Adams said.

Don’t misinterpret. This is not an announcement of a strategy shift. NYCB’s focus remains multifamily, the executive said, but the bank can’t help but consider it.

NYCB is also considering community impact, recently announcing a five-year commitment to provide $28 billion in loans, investments and other financial support to communities and people of color, low- and moderate-income families and communities, and small businesses.

Further, Adams said, without giving anything away, “We look forward to expanding our diversity and inclusion program with upcoming acquisitions.” Stay tuned. —S.P.