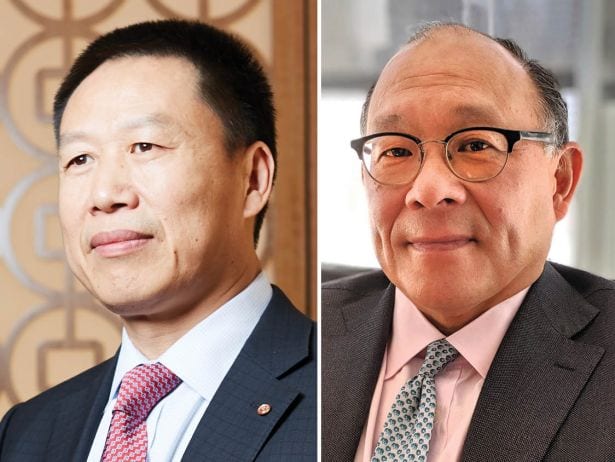

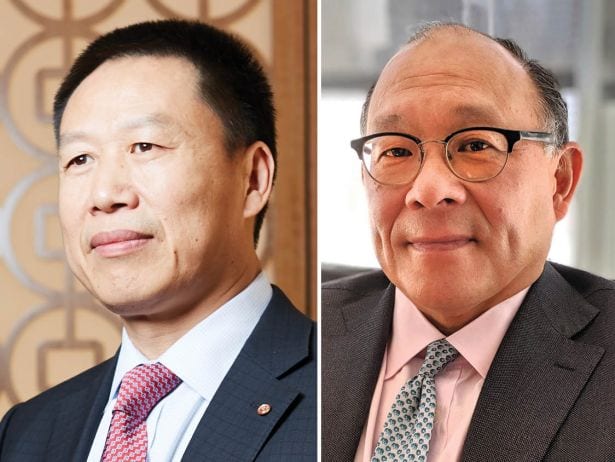

Raymond Qiao and Anthony Wong

Chief Lending Officer; Head of U.S. Commercial Real Estate Lending and Senior Vice President at Bank of China

Last year's rank: 49

Bank of China (BOC) U.S.A. originated a total of $2 billion for the 12 months that ended March 20. “During the pandemic, we continued to execute repeat business with borrowers and other lenders, and we got a lot of word-of-mouth referral business,” said Anthony Wong.

In 2021, BOC U.S.A.’s loan portfolio was primarily in urban, infill locations where the bank has branch locations. Specifically, those locations included New York City, Los Angeles and Chicago. According to the team, they only lend to top sponsors in gateway cities where their senior debt stack is moderately levered and well-structured on Class A collateral.

“Obviously, we love New York City and have terrific decades-long relationships with the best operators that call the Big Apple home and sponsors located throughout the U.S.,” BOC U.S.A.’s CRE team said in a statement.

Notable deals include providing a $1.5 billion construction loan to finance SL Green Realty Corp.’s construction of One Vanderbilt, a Class A, 1.7 million-square-foot office building adjacent to Grand Central Terminal in 2016. BOC U.S.A., with the bank group, upsized the construction loan to $1.75 billion in 2018 and contributed to the largest single-asset single-borrower commercial mortgage-backed securities in June 2021. One Vanderbilt became one of the pandemic’s major success stories, with three-figure rents per square foot.

The bank refinanced $327 million of a $655 million term loan secured by a 5.7 million-square-foot, mixed-use office building in Brooklyn. BOC U.S.A. also provided a $280 million, solely underwritten term loan to refinance the construction loan of a 76-story, 800-unit luxury multifamily property located on Grant Park in Chicago.

“Our greatest asset is our talented CRE team,” Wong said. “What we do is we think as a group, we work as a team, we roll our sleeves up, and we get our mandates close and never quit.”

Women hold executive leadership roles throughout all levels of the bank, including in corporate banking, trade finance, retail banking and the technology business.

“Throughout the pandemic, we’ve benefited from a 100 percent talent retention rate and there’s no staff turnover,” Wong noted. —E.F.