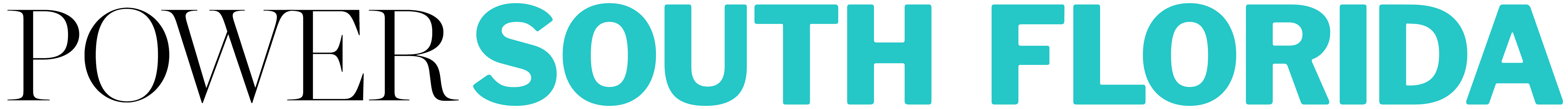

Barry Sternlicht (left) and Jeff DiModica.

Barry Sternlicht and Jeff DiModica

Chairman and CEO at Starwood Capital Group; president at Starwood Property Trust

“I can’t imagine not being here for the rest of my life,” Jeff DiModica said while looking out of his Miami office window during this Commercial Observer interview. “We’re just so lucky.”

South Florida has a lot to offer, no doubt, but we also believe you make your own luck. The week before this CO list went to press, Starwood Property Trust announced a $2 billion data center loan it made, alongside J.P. Morgan Chase, for a 100-acre campus owned by CIM Group and Novva Data Centers.

The firm is one of the leaders in the data center investment space, as the fourth-largest developer of the asset class on the equity side of its business, and with roughly $2 billion (and counting) in financing provided to other firms via its lending activities.

“After data centers — where we’ve clearly been leaning in — South Florida has been our No. 1 growth area,” DiModica said. “We probably have more exposure to South Florida than we’ve ever had, and I would expect it’s even more a year from now, because the pace of growth is still really strong.”

Indeed, Starwood expanded its South Florida exposure by 20 percent last year.

Recent headlines for the firm include the $390 million construction loan that the Barry Sternlicht-led Starwood Capital Group and Mast Capital secured for the Perigon Miami Beach ultra-luxury condominium tower. The deal rallied stiff competition from lenders, with Eldridge’s private credit business eventually taking the crown for the trophy asset.

“Our footprint in Florida continues to grow,” DiModica said. “I think part of it is being here and understanding the market. Knowing the market as well as we do, we can talk ourselves out of a lot of things that someone outside of the market might talk themselves into. We know which deals are really worth pursuing.”

On the debt side, DiModica’s team has 20 Florida loans in its portfolio with a balance of $1.6 billion — that’s 12 percent of his lending book. Including the energy and infrastructure assets in Starwood’s portfolio, roughly 20 percent of the firm’s overall investments are in Florida today.

“We sit in a unique spot,” DiModica said. “We have access to capital that our peers don’t have, both on the debt and the equity side. We trade above book value, so we can raise equity capital, and our debt trades tighter than anybody else’s, so we have access to capital to grow that our peers really don’t have.”