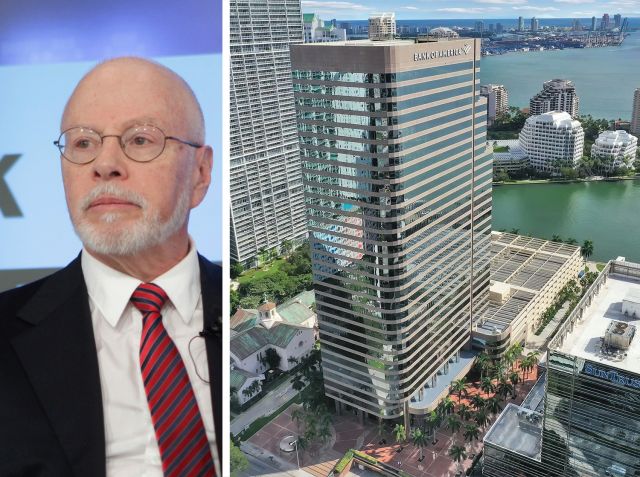

Michael Dell

Founder at BDT & MSD Partners and DFO Management

Michael Dell will forever be synonymous with computing after founding his epony-mous company, which earns about $100 billion annually. But, in the past couple of decades, Dell has also emerged as a prominent real estate investor.

The billionaire founded his family office, DFO Management, formerly known as MSD Capital, and also launched a separate investment firm, MSD Partners, which in 2022 merged with a merchant bank to become BDT & MSD Partners.

Last year, BDT & MSD Partners refinanced the historic Boca Raton Resort & Club with $1 billion after purchasing the 1,047-room asset for $875 million in 2019 and spending about another $200 million renovating the 337-acre property. The financing package, secured just as the debt market was slowing down, served as a vote of confidence for BDT & MSD Partners management. A 60-unit condo addition is in the works.

On the western coast of Florida in Naples, BDT & MSD Partners is nearing the completion of the $1 billion Four Seasons resort. Doubling down in the luxury hospitality industry, the firm made a minority investment in Auberge Resorts Collection as the chain expands in Europe.

MSD’s stakes in other hospitality properties include two Four Seasons in Hawaii, another in Vail, Colo., and a Fairmont Miramar in Santa Monica, Calif.

Earlier this year, BDT & MSD Partners scooped up out of foreclosure Boston’s former State Street Financial Center at One Lincoln Street for $400 million. The previous owners had refinanced the 1.1 million-square-foot tower, one of the city’s biggest, with a $1 billion loan in 2022.

On the residential front, BDT & MSD Partners owns more than 15,000 multifamily units nationwide. But the firm has taken hits, most notably as a lender having to foreclose on President Donald Trump’s former hotel in Washington, D.C., after CGI Merchant Group defaulted on a $285 million loan.

DFO Management, for its part, is also expanding its private credit business, which has emerged as a major player in real estate lending. Last year, the New York-based family office provided private credit firm 5C Investment Partners with its first outside investment.