Adi Chugh

Founder and CEO at Tyko Capital

We’re rolling out the red carpet for Tyko Capital as a new addition to Power Finance. This platform, which is only 18 months old, came out of the gates blazing and has earned more than its fair share of splashy headlines and industry acclaim since its debut.

Tyko Capital, a joint venture between Adi Chugh and Florida-based hedge fund Elliott Management, closed more than $5 billion in transactions this past year, leaving several competitors in the dust.

“Through our connectivity with partners, we’ve been able to create a fully customized, tailor-made financing product that’s very heavily focused on service, integrity, thoughtfulness, and is user-friendly,” Chugh said. “The opportunity set was fantastic, and we were not only able to capture market share but also lay a strong foundation for a long-term business.”

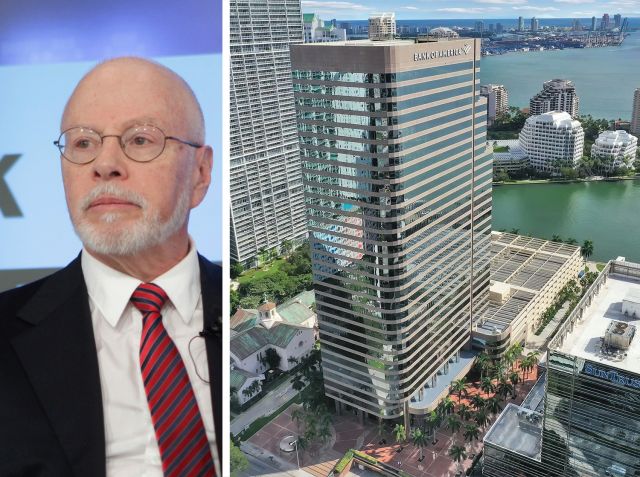

Notable deals include the $1.2 billion loan for Witkoff, Access Industries and Monroe Capital’s One High Line (Tyko was the mezzanine lender, with J.P. Morgan in the senior spot); the $565 million refinance for OKO Group and Cain International’s 830 Brickell office building in Miami; the $357 million condo conversion loan for New York’s Flatiron Building on behalf of The Brodsky Organization, GFP Real Estate and The Sorgente Group; and the $528 million condo construction loan for Related Group and Integra Investments’ St. Regis Residences in Miami.

“Our business model is very simple: top sponsors, top markets and the best assets in the best markets,” Chugh said. “The transaction volume is great, but I don’t look at my business as an annual business. I want to be here for the next 30 to 40 years.”

Tyko was formed in August 2023 to take advantage of gaps in the capital markets as banks retrench and volatility reigns. Chugh’s previous life as a debt and equity adviser places Tyko in a premium position to source deals and make savvy decisions about where to invest in up-and-down markets — and there’s been no shortage of evidence of that this past year. The firm actively plays up and down the capital stack — from senior mortgages to whole loan financings to mezzanine debt to preferred equity to limited partner and general partner equity — and across all asset classes.

To celebrate the platform’s first year, Chugh had a get-together at his apartment in New York City with his family and business partners. “It was very nice, and these moments matter,” Chugh said. ”We started Tyko with an idea. Nick [Greenberg of Elliott Investment Management] and I ran into each other outside the Aman after a few years of not meeting during COVID. Who’d have thought that happenstance, coincidental meeting would result in us sitting here a year later looking at a year that concluded in $5 billion in originations?”