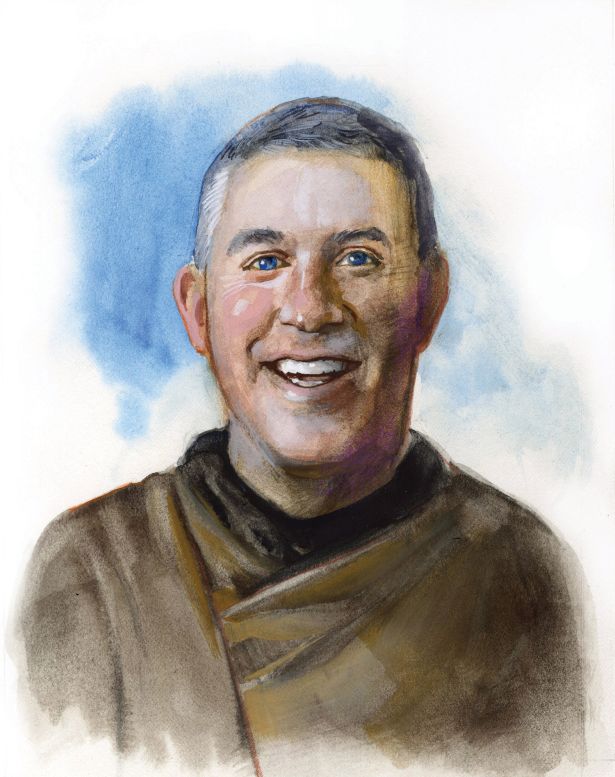

Dennis Schuh

Managing Director at Starwood Capital Group

Where in the capital stack are you most comfortable playing today, and where are you finding the best lending opportunities?

Whole loans at current unlevered yields. You will likely be able to finance them more efficiently at a later date or sell off the senior and achieve equity-like returns on debt. Also, locking in high Secure Overnight Financing Rate (SOFR) floors will likely be very attractive as we experienced when LIBOR/SOFR went to near zero for nearly two years following the pandemic.

What’s your best piece of advice for borrowers seeking financing during turbulent times?

“Maybe you don’t need the whole world to love you. Maybe you just need one person.” – Kermit the Frog. So find that one person, but make sure you call Starwood first.

Would you rather finance a well-established sponsor on a Class B office renovation in New York City, or the first-time developer of a multifamily project in the Sun Belt today? Discuss.

Neither. But I would finance a well-established sponsor on a well-located Class A office building and would certainly finance a well-established developer on a Sun Belt multifamily. We have seen a flight to quality on the best-in-class office buildings in many markets. The secular trends for Sun Belt multifamily will continue in most markets where demand will outpace new supply.

What’s your take on an impending recession? How bad might it get, and what are the silver linings (if any)?

Buckle up. It certainly feels like it is going to continue to be bumpy for an extended period of time. However, every past decline looks like an opportunity, and every future decline looks like a risk. So, go find those interesting risk-reward opportunities because “you miss 100 percent of the shots you don’t take” — Wayne Gretsky.

When will we reach the bottom of the market, and when will we see a thawing in the debt markets?

Late 2023, when base rates have peaked, the Fed starts easing (because “60 percent of the time, it works every time” — Brian Fantana) and spreads have started to tighten. Until then I think it will continue to be bumpy.

What would you do differently during the next pandemic?

We took advantage of the lending opportunity that presented itself during COVID and wish we would have done more; but, hopefully, we never have to live through another one.

What keeps you up at night, and what helps you sleep?

This time of year the NFL keeps me up at night, but I generally sleep pretty well having lived through a handful of market corrections in my career. How about them 6-2 New York Giants! [Editor’s note: This was before the Giants’ Nov. 13 matchup against the Texans.]

Lighting Round: Would you rather…

Be a contestant on “American Idol” or be a contestant on “Survivor”?

I wouldn’t get past the live auditions of “Idol” so “Survivor” it is.

Fight 100 duck-size horses or one horse-size duck?

How fast is the horse-size duck?

Work in a Michelin-starred kitchen or work in a McDonald’s?

I’m a bit of a foodie, so that rules out McDonald’s, but is Chick-fil-A Michelin-rated?

Do a 30-day all-haggis diet or extend a suburban mall loan for three years?

I love haggis, but you need to wash it down with a proper Guinness.

Traverse Jurassic Park on foot, or relive 2008?

Relive 2008, since the recovery trade from the GFC was one of those once-in-a-lifetime opportunities, plus I was never into dinosaurs as a kid.

Babysit triple infants who just ate their weight in beans or finance Adam Neumann’s latest venture?

I have four daughters, so I can change a diaper with the best of them; but I must say that I did like the “WeCrashed” movie. Jared Leto was awesome in it. Anne Hathaway was better as Catwoman.