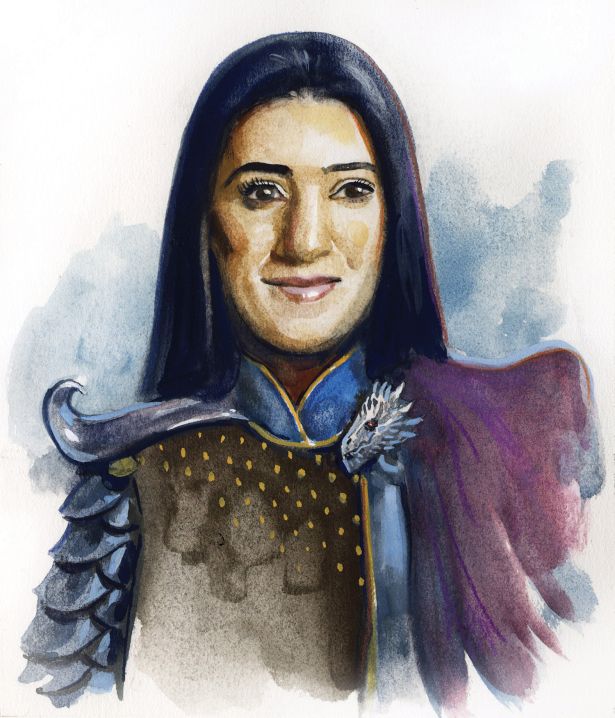

Neha Santiago

Head of Real Estate Private Credit at Cerberus

Where in the capital stack are you most comfortable playing today, and where are you finding the best lending opportunities?

We’re focused on asset classes where we expect the most resiliency in the face of choppier economic conditions. So, like others, we’re looking at multifamily and industrial assets. We’ve also continued to consider more “niche” asset classes, like industrial outdoor storage, student housing and self-storage. These have outperformed some of the more traditional asset classes during prior economic downturns, and we bring deep experience in these sectors. Because of our ability to invest across asset classes and structures, we’re also seeing interesting opportunities in the CMBS market, where spreads are widening on bond classes with strong cash flow and subordinated capital (both debt and equity).

What’s your best piece of advice for borrowers seeking financing during turbulent times?

There are still good deals in the market, but borrowers need a property-level story with strong fundamentals more than ever. Riding the market isn’t compelling enough in this environment. Now is also the time for patient capital.

Would you rather finance a well-established sponsor on a Class B office renovation in New York City, or the first-time developer of a multifamily project in the Sun Belt today? Discuss.

We’ll always believe in the quality of sponsorship and lean into those relationships. We’d expect that an established sponsor would only be pursuing a New York City office renovation if it had the right fundamentals, such as cost basis and location, at this stage in the market. Sun Belt multifamily fundamentals have overall remained strong, but we’d need a higher threshold of conviction on the opportunity when working with a first-time developer.

What’s your take on an impending recession? How bad might it get, and what are any silver linings?

It’s hard to say without a crystal ball, but we’ve been operating under the assumption that we’re in a recessionary environment since the start of this year. While we’ve always taken a disciplined approach across all market cycle phases, we’ve been prioritizing patience and capital availability for both offense and defense. In the recent bull market, we’ve seen the space become ultra-crowded and create some skewed leverage and pricing. The silver lining could be the realigning of metrics to match up with the overall risk profile. You’ll also see that companies that are positioned well to withstand the volatility, and even thrive through it, will have a powerful advantage in hiring and accessing a deeper pool of talent.

When will we reach the bottom of the market, and when will we see a thawing in the debt markets?

The lack of liquidity is driven by market technicals rather than property technicals. So, right now, it’s more difficult to nail down cap rates and, ultimately, valuations, which is impacting transaction activity. I don’t think you can generalize the bottom as it will likely differ across asset classes. There is significant capital sitting on the sidelines, so once we have stability in interest rates and cap rates, we should see activity pick back up. We’re also paying attention to how banks and levered lenders work out aging back leverage inventory marked for securitization. Depending on how this is reconciled, it could be a catalyst for thawing in the debt markets.

What would you do differently during the next pandemic?

We were in an advantageous position of not having a legacy portfolio that needed significant asset management at the beginning of the pandemic. So, at that time, we were capitalizing on opportunities and focused on new origination when many had to pull out of the market. Oftentimes, we find that dislocations in the public markets can come and go very quickly, and, at the pandemic’s onset, there were 60 to 90 days where there was real opportunity to generate some significant value in the markets.

What keeps you up at night, and what helps you sleep?

What we don’t know about this market can keep me up at night. While volatility can create some attractive opportunities, the day-to-day ups and downs can be challenging. That said, I sleep more comfortably knowing that our portfolio has been designed for both the ups and downs of the market and that our financing matches up with our greater thesis around commercial real estate.

Lighting Round: Would you rather…

Refinance a Class B office property or be locked in a room for a month with Vladimir Putin?

One month of pain seems better than three years of kicking the can down the road!

Lend on the New York office sector, or take a job as a septic tank repairwoman?

NYC office will always have a place, but it’ll just require a more judicious approach with both a quality sponsor and cost basis going forward.

Babysit triple infants who just ate their weight in beans or finance Adam Neumann’s latest venture?

Investing in Adam Neumann’s latest venture would potentially come with more downside protection (you’d at least get real collateral if on the lending side).

Be paid in crypto or Nestle Crunch bars?

Neither — Reese’s Peanut Butter Cups!

Run a marathon or swim in the Gowanus Canal?

I recently took up swimming, so I’d take the Gowanus Canal.

Work remote 100 percent of the time or work in an office 100 percent of the time?

Office. There is no replacement for in-person collaboration!

Sit in L.A. traffic for two hours or sit in a stalled NYC subway car for 30 minutes?

NYC subway. I never stopped taking it, and I’d bear a 30-minute delay.

Work in a Michelin-starred kitchen or work in a McDonald’s?

Michelin-starred kitchen. Our team has recently incorporated “Yes, Chef!” into our vocabulary after watching the Hulu series “The Bear.”