Despite Big Drop in Vacancy, Asking Rents Down

By Richard Persichetti April 24, 2018 4:02 pm

reprints

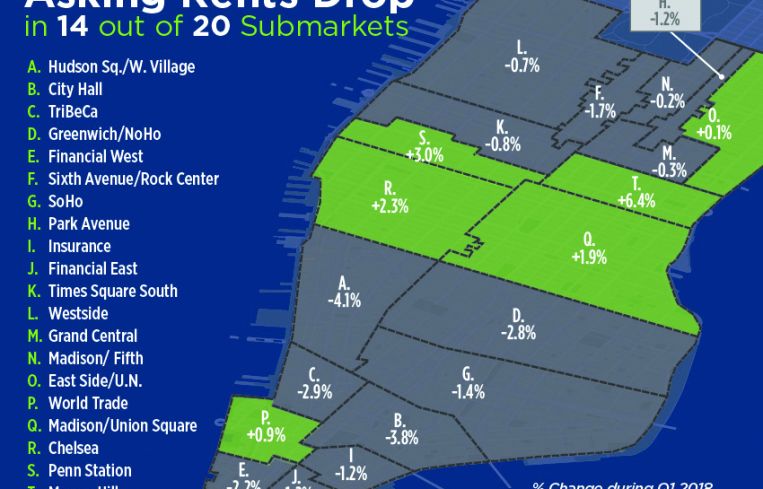

The first quarter of 2018 came to a close for the Manhattan office leasing market, and it was still more of the same. Despite a 10-basis-point drop in the overall vacancy rate to 8.8 percent in the first quarter, overall asking rents dipped $0.12 per square foot to $72.13 and new leasing activity totaled slightly less than 7.1 million square feet—a 7 percent year-over-year decline. Although overall average asking rents dropped minimally, the bigger trend was that they declined in 14 of the 20 submarkets during the first quarter.

Overall average asking rents in Midtown actually increased $0.12 per square foot to $77.06 in the first quarter, despite six of the nine submarkets posting quarterly declines. There were three submarkets that contributed to the slight overall increase: Murray Hill posted a 6.4 percent jump to $62.36 per square foot, Penn Station recorded a 3 percent increase to $61.85, and the East Side/U.N. inched up 0.1 percent to $73.43 per square foot. The remaining six submarkets had asking rent declines in the first quarter, with Sixth Avenue/Rock Center posting the largest drop—down 1.7 percent to $83.90 per square foot. Park Avenue asking rents dropped 1.2 percent to $89.42 per square foot, while the remaining four submarkets each had less than 1 percent declines.

In Midtown South, asking rents increased $0.26 per square foot to $69.13, despite asking rent declines in three of the five submarkets. Hudson Square/West Village recorded the largest drop in Manhattan, down 4.1 percent to $77.18 per square foot, followed closely by Greenwich/Noho’s 2.8 percent drop to $75.25 per square foot and Soho’s 1.4 percent decline to $72.57 per square foot. These decreases were not attributed to weakening market conditions, but were due to higher-priced space leased in the first quarter. Both Chelsea and Madison/Union Square recorded asking rental increases, 2.3 percent and 1.9 percent respectively.

Downtown was the only major market to post a drop in the overall asking rent during the first quarter, down $0.56 per square foot to $59.67. Only one submarket, World Trade, posted a rental increase of 0.9 percent to $65.03 per square foot. The remaining five submarkets recorded asking rental declines ranging from high of -3.8 percent in City Hall to a low of -1.2 percent in Financial East. Downtown was the only market that did not record an increase in new leasing year-over-year, and with activity down 59.9 percent compared with 2017, asking rents could further decline if demand remains in the red.