Prologis Reports Record Leasing and Data Center Investment in Q3

By Isabelle Durso October 15, 2025 2:35 pm

reprints

Prologis has reported yet another solid quarter as it focuses on leasing and data center investment.

The industrial giant — which currently owns or has investments in properties and development projects totaling 1.3 billion square feet — recorded core funds from operations (FFO) per diluted share of $1.49 during the third quarter, a jump from the $1.46 reported the previous quarter and a 4.2 percent increase from the $1.43 during the same period last year, according to Prologis’ third-quarter earnings report released Wednesday.

In addition, Prologis reported revenue during the third quarter of $2.2 billion, roughly the same as the previous quarter and an increase from the $2 billion recorded during the same period in 2024, the report shows.

As for net income, the firm saw a third-quarter net income of $762.9 million, up from $569.7 million in the previous quarter but down from $1 billion during the same time last year, according to the report.

But where Prologis seemed to really shine this past quarter was in leasing. The firm reported a record 62 million square feet of lease signings and an average occupancy rate of 94.8 percent during the third quarter of 2025, the report shows. Prologis’ leaders attributed the firm’s success to an uptick in new leasing and healthy renewal activity.

“We’re in a classic real estate cycle,” Dan Letter, president and CEO-to-be at Prologis, said during Wednesday afternoon’s earnings call. “Demand is strengthening, and we’re seeing these large customers make decisions — that’s the real big early sign of a recovery. And as supply remains low and occupancy and rents bottom out, that’s a good sign for what’s to come.”

Chris Caton, managing director and global head of strategy and analytics at Prologis, agreed with Letter’s remarks, saying “an inflection point in the market is here” due to “greater breadth and depth of our customer discussions and their willingness to make decisions.”

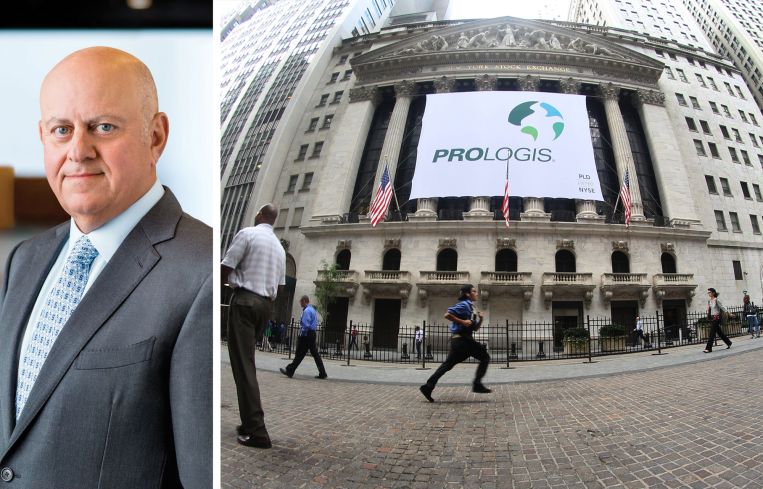

Besides leasing success, Prologis has made progress on the data center front, now boasting a 5.2-gigawatt allocation of “utility-fed capacity secured or in advanced stages,” according to Prologis CEO and co-founder Hamid Moghadam.

Now, with a $15 billion investment into the field and roughly 14,000 acres of land, Prologis is one of the largest owners of both power and land available to data centers, largely due to its success from build-to-suit leases with hyperscalers. And the plan is to keep the ball rolling, Letter said.

“We have taken the next step of starting an exploration over what the universe of opportunities are and what’s possible for us in data center, business and capitalization,” Letter said.

Wednesday afternoon also marked Moghadam’s last earnings call as CEO of Prologis, after the firm announced in February that he would be stepping down in January 2026 to be replaced by Letter.

“When we started this business in 1983, it was a tiny startup,” Moghadam said in closing remarks on Wednesday. “The world was just a very different place in terms of our industry. Today, Prologis is one of the most valuable property companies in the world, and the business has become highly professionalized and has grown in its scope and global footprint. To witness that arc and to have had the privilege of leading this company through it all has been surreal.”

Isabelle Durso can be reached at idurso@commercialobserver.com.