La Caisse Sells L.A.’s PacMutual to Leo Pustilnikov, Others for Just $49M

The deal is a massive discount from the $200 million that La Caisse, operating as Ivanhoe Cambridge at the time, paid for the office property in 2015

By Nick Trombola October 7, 2025 2:45 pm

reprints

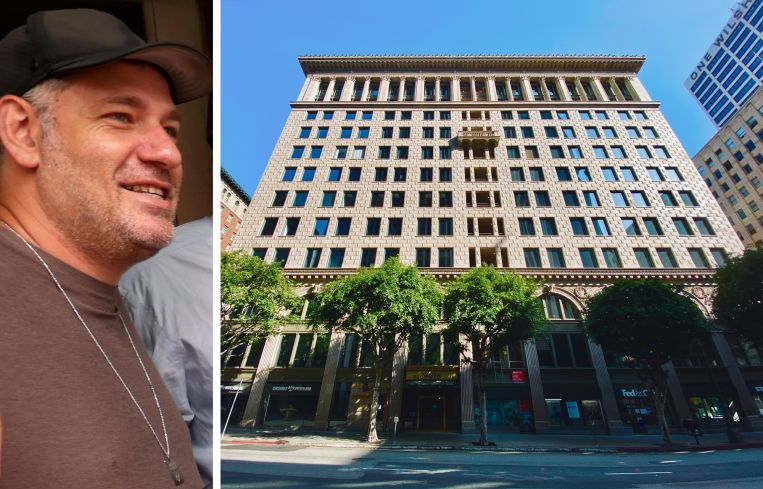

A trio of Southern California investors, including a prominent developer who became the unofficial face of an unorthodox pro-housing strategy, has acquired a three-building office campus in Downtown Los Angeles for less than a quarter of its sale price from 10 years ago.

Leo Pustilnikov, who in recent years pioneered the use of California’s builder’s remedy provision, along with Joshua Javaheri and Kaveh Bral together paid $48.5 million for La Caisse’s PacMutual property, according to records from PropertyShark. The investors also landed a $31.5 million loan from Symetra Life Insurance for the acquisition, records show.

La Caisse, which recently rebranded and formerly operated as Ivanhoé Cambridge, had acquired the complex at the corner of Sixth Street and South Grand Avenue for $200 million in 2015. Yet by 2023, Ivanhoé wanted out — the Montreal-based firm began marketing the property for $100 million, half the price it paid less than eight years earlier, as it shifted toward logistics and residential properties, Commercial Observer reported at the time. The Real Deal first reported news of its latest sale.

The 460,000-square-foot PacMutual campus consists of three interconnected offices constructed in the early 20th century: the Clock Building, Sentry Building and Carriage House. The complex was designated a historic-cultural landmark in 1982, yet by the 21st century had begun showing its age. That’s until Rising Realty Partners acquired the campus in 2012 for $60 million, spending roughly $25 million in renovations before trading it to Ivanhoe a few years later.

Pustilnikov, Javaheri and Bral’s plans for the property were not immediately clear. Javaheri did not immediately respond to a request for comment, and Pustilnikov and Bral could not be reached.

Downtown L.A.’s office market has shown some promising signs of recovery, even as its availability rate still hovers near 30 percent, but serious financial distress remains. In August, Rising Realty and DigitalBridge’s 1 Cal Plaza was placed in receivership, and potential deals for both EY Plaza and Jamison’s 811 Wilshire Boulevard have recently fallen through.

Nick Trombola can be reached at ntrombola@commercialobserver.com.