Distress on the Rise for Bank CRE Loans

CRED iQ’s analysis of the most recent banking data for the second quarter of 2025 provides a comprehensive snapshot of the U.S. banking industry’s financial health. Covering 4,421 Federal Deposit Insurance Corporation-insured commercial banks and savings institutions, including community banks, with total assets of $25 trillion, the report highlights stable but modestly declining profitability, resilient deposit growth, and generally favorable asset quality amid persistent pressures in select loan portfolios.

This summary draws from the report’s key findings, with a targeted focus on CRE metrics relevant to investors and lenders. While overall banking conditions remain sound, the report flags ongoing weaknesses in CRE segments like non-owner-occupied properties and multifamily, where delinquency rates exceed pre-pandemic averages (defined as the first quarter of 2015 to the fourth quarter of 2019).

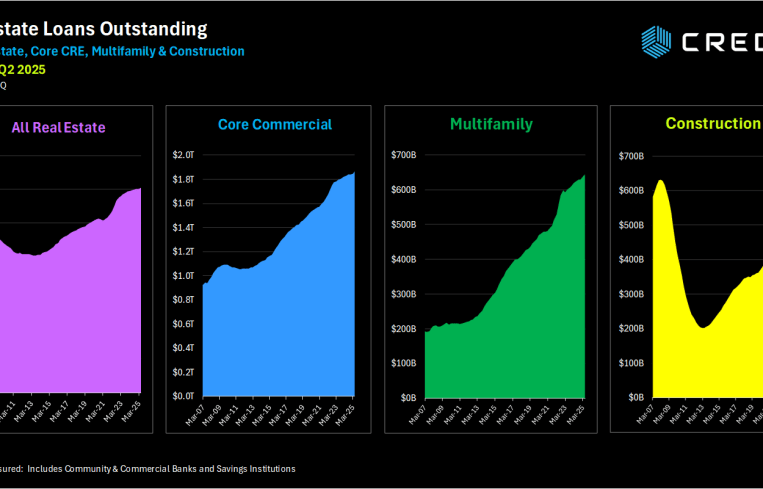

CRED iQ’s analysis provides detailed delinquency and net loss metrics for loans as of June 30, segmented by property types. For CRE investors and lenders, the data reveals moderate stress in key subsectors — construction and development (C&D), core CRE (office, retail, industrial and hotel) and multifamily — amid high borrowing costs and softening demand in segments like office. Total CRE loans outstanding reached approximately $3 trillion (sum of C&D, core CRE and multifamily), representing about 23 percent of all loans.

Core CRE (office, retail, industrial, hotel) performance

30-89 days delinquent: This delinquency bucket is at 0.27 percent for core CRE, down from 0.34 percent from prior quarter, and in line with a year ago.

90-plus days delinquent: The 90-plus days delinquency bucket is at 1.38 percent for core CRE, up slightly from 1.36 percent compared to prior quarter, and in line with a year ago. Total balance of 90-plus-day delinquent loans amounts to $25.8 billion for the core CRE asset group.

Overall delinquent: Combining these two delinquent buckets amounts to 1.65 percent overall, which is down 5 basis points from the quarter earlier. A year ago, overall delinquency for core CRE was 1.62 percent, and was 0.75 percent in December 2019.

Net losses: Net losses across the core CRE properties totaled $3.92 billion (0.21 percent) in the second quarter of 2025, which is up slightly from $3.88 billion last quarter, and is down from $6 billion (0.33 percent) in the fourth quarter of 2024, which represents the highest amount of losses since March 2012).

Multifamily performance

30-89 days delinquent: This delinquency bucket is at 0.24 percent for multifamily loans, down from 0.42 percent the prior quarter, and down from 0.39 percent compared to a year ago.

90-plus days delinquent: The 90-plus days delinquency bucket remains at 1.05 percent for multifamily loans, the same as the prior quarter, but up significantly from a year ago (0.50 percent). Total balance of 90-plus-day delinquent loans amounts to $6.8 billion for the multifamily asset group.

Overall delinquent: Combining these two delinquent buckets amounts to 1.29 percent overall, which is down 18 basis points from the quarter earlier. A year ago, overall delinquency was 0.89 percent, and 0.25 percent in December 2019.

Net losses: Net losses across the multifamily properties totaled $902 million (0.14 percent) in the second quarter of 2025, which is up slightly from $767 million last quarter, and double the amount in (0.07 percent) in 2024›s fourth quarter. The highest quarterly amount of losses for multifamily totaled $2.66 billion in the fourth quarter of 2010.

Construction and development performance

30-89 days delinquent: This delinquency bucket is at 0.42 percent for C&D loans, down from 0.48 percent from prior quarter, and up from 0.4 percent a year ago.

90-plus days delinquent: The 90-plus days delinquency bucket remains at 0.84 percent for C&D, up from 0.81 percent the prior quarter, and also up significantly from a year ago (0.59 percent). Total balance of 90-plus-day delinquent loans amounts to $3.94 billion for the C&D asset group.

Overall delinquent: Combining these two delinquent buckets amounts to 1.26 percent overall, which is up 3 basis points from the quarter earlier. A year ago, overall delinquency for C&D loans was 0.99 percent, and was 0.82 percent in December 2019.

Net losses: Net losses across the C&D assets totaled $375 million (0.08 percent) in the second quarter, which is up slightly from $335 million last quarter, and up from $198 million (0.04 percent) in the fourth quarter of 2024. The highest quarterly amount of losses for C&D totaled $24.4 billion in the fourth quarter of 2009.

CRED iQ’s bank data analysis underscores a bifurcated CRE landscape. While total loan growth supports optimism, elevated noncurrent rates in Core CRE (office-heavy) and multifamily highlight refinance risks in a high-rate environment.

Investors should monitor large banks’ provisioning trends, as acquisitions could mask underlying weaknesses. For lenders, focus on mid-tier and regional institutions where 90-plus-day delinquent rates are rising, and stress-test portfolios against potential increases in net losses.

Community banks’ strong income growth offers opportunities for partnerships, but their higher CRE concentrations warrant caution. Overall, the industry’s stability mitigates systemic risks, but selective underwriting in stressed subsectors remains critical.

Mike Haas is the founder and CEO of CRED iQ.