Pamera North America, Targo Capital Secure $31M to Buy 640 Broadway

Citi Private Capital Bank provided the debt financing for the $50 million deal

By Brian Pascus September 16, 2025 10:50 am

reprints

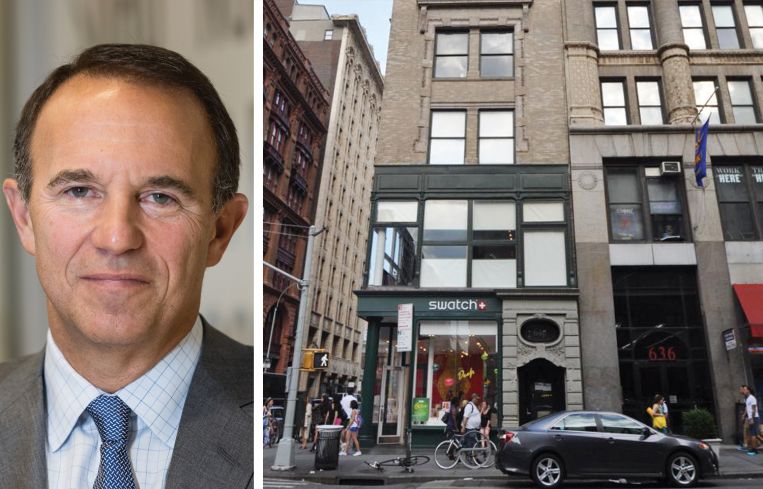

Pamera North America and Targo Capital have secured $30.5 million in acquisition financing for 640 Broadway, a mixed-use multifamily property featuring more than 53,000 square feet of rentable residential space in Lower Manhattan, Commercial Observer can first report.

The joint venture bought the building from Acadia Realty Group for $49.5 million this month.

Citi Private Bank provided the acquisition debt, while JLL’s Michael Gigliotti, Stephen VanLeer and John Flynn arranged the financing. The firm’s team of Steven Rutman, Jeffrey Julien, Rob Hinckley, and Ethan Stanton arranged the sale.

“640 Broadway presents the buyer with a tremendous opportunity to capitalize on continued demand for well-appointed homes in exciting pockets of the city, and we are thrilled to have worked with all parties on this win-win transaction,” said JLL’s Rutman.

Standing nine stories tall, 640 Broadway sits on the vibrant traffic corridor of Bleeker Street and Broadway in the NoHo neighborhood of Manhattan. The building, which opened in 1900. features 21 loft-style residential units and 4,200 square feet of ground-floor retail presently leased to UPS, Two Hands Café and Van Leeuwen Ice Cream.

JLL’s VanLeer noted in a statement that 640 Broadway sits in a neighborhood defined by “strong demand, limited supply and reliable income from a high-foot-traffic retail base.”

A product of Gilded Age New York, 640 Broadway began construction in 1896 under the direction of architects DeLemos & Cordes, who are behind the iconic Macy’s in Herald Square. It features a limestone exterior, barrel-vaulted ceilings and enormous arched windows that are characteristic of that era.

Acadia Realty Group invested more than $18 million into the property prior to the sale, according to JLL.

Cord Ernst, managing partner at Pamera North America, said, “Pamera believes that this investment matches exactly the deal profile of our investors: unique asset characteristics and trophy real estate in an irreplaceable location.”

Brian Pascus can be reached at bpascus@commercialobserver.com.