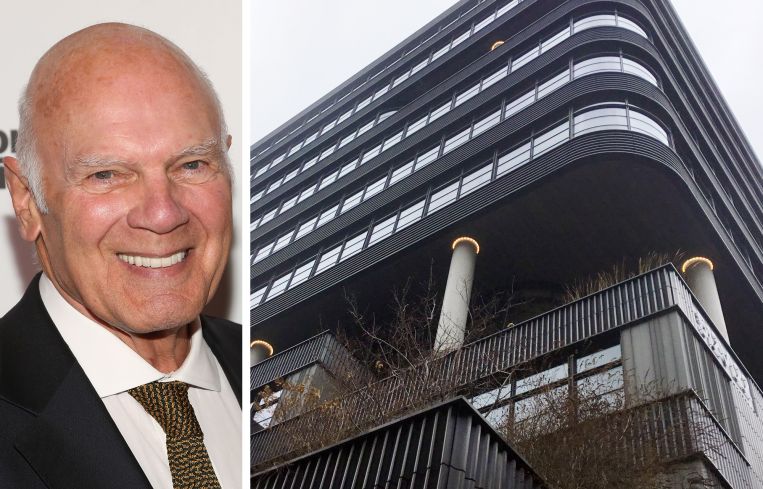

JP Morgan Supplies $130M Loan in Raghsa RE Buy of Vornado’s 512 West 22nd Street

Steven Roth’s firm renovated the former industrial property in 2016 amid a 55 percent joint ownership

By Brian Pascus August 14, 2025 4:46 pm

reprints

On the heels of positive second quarter earnings, Steven Roth’s Vornado Realty Trust has officially sold one of its prime New York City office assets.

Raghsa Real Estate, an affiliate of MKF Realty, has closed on its $205 million purchase of 512 West 22nd Street, a 172,000-square-foot, Class A office building in New York City, in which Vornado held a 55 percent ownership stake, sources told Commercial Observer.

J.P. Morgan Chase and Citigroup provided a $130 million commercial mortgage-backed securities (CMBS) loan to finance the acquisition.

CO was first to report the news of the impending sale in May.

Will Silverman, Gary Phillips, Jeff Organisciak and Alana Bassen of Eastdil Secured arranged the sale, while Eastdil’s Grant Frankel, Rob Turner and Drew Ahlers arranged the debt.

“This acquisition reflects our strategy of investing in best-in-class assets that combine architectural distinction, sustainability and location in the world’s most competitive markets,” said Edgardo Khafif, CEO of Raghsa, in a statement.

Vornado had owned the 11-story converted property in a joint venture with The Albanese Organization and The Olayan Group. CO previously reported that the firms will use the proceeds from the $205 million sale to jointly repay a $123.6 million mortgage on the property.

Vornado’s 55 percent ownership is expected to generate $112.5 million in net proceeds for the real estate investment trust and approximately an $11 million financial statement gain, according to the firm’s most recent supplemental.

The sale comes just days after the firm held its second quarter earnings call and reported a cash flow equivalent to $256 million for the first six months of 2025, up from $253 million this same period last year.

Vornado noted on the call that it secured a 70-year, $935 million prepaid lease with New York University for 770 Broadway, a 1.2 million-square-foot mixed-use office building, and that it used a portion of the payment to repay a $700 million loan the property carried.

Moreover, Vornado reported its New York office portfolio stands at nearly 87 percent occupancy, as the firm leased 3.34 million square feet during 2024, with 2.65 million square feet of that being New York office leases. However, its retail properties are leased below 70 percent.

Now, Roth’s firm is moving away from 512 West 22nd, a building Roth and Albanese invested in heavily to update for the 21st century.

The two firms had initiated a gut renovation of the property — which was initially built in 1920 as an industrial building — in 2016, using a $55.3 million construction loan from PNC Bank.

The changes paid off. CO reported in 2021 that WarnerMedia signed on as the first tenant in the building, taking 20,000 square feet in September 2019, with much of the other floors leased to small financial services tenants. Hedge fund manager Alexander Klabin signed a five-year deal in 2021 for 6,800 square feet on a portion of the building’s fifth floor.

“512 West 22nd Street is the type of property that delivers enduring value in any market cycle,” said Isaac Khafif, managing director of Raghsa. “Its quality, design and location align seamlessly with our global portfolio of sustainable, premium assets.”

Vornado and Eastdil did not respond to requests for comment.

Brian Pascus can be reached at bpascus@commercialobserver.com.