CMBS Distress Rate Adds 32 Basis Points in July

CRED iQ’s distress rate, a composite metric capturing loans 30-plus days delinquent (or worse) and those in special servicing, came in at 11.1 percent in the latest reporting period.

The CRED iQ research team analyzed the payment status of approximately $59 billion in distressed CMBS loans. The core objective of our research was to achieve a clear view of the current state of payment status reasons and associated near-term trending.

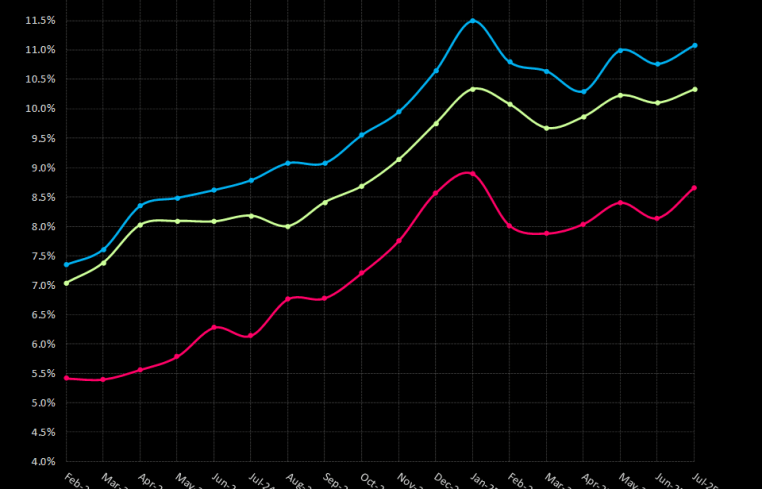

The commercial mortgage-backed securities (CMBS) distress rate added 32 basis points (bps) to 11.1 percent in July, according to CRED iQ’s latest analysis. This increase follows the previous month’s 20-bps decrease and the 70-bps increase the month before that.

Our delinquency rate increased by 52 basis points to 8.7 percent and our special service rate added 23 bps to reach 10.3 percent.

As part of our research, our team explored each payment status reason from a historical perspective. We wanted to understand the trending/evolution of each category dating back to February 2024. Our team built a heat map which reveals trends for each category to potentially augment current forecasting models.

Our research showed that $9.1 billion (15.5 percent) in loans were current in July, down $327.4 million from the June print of $9.4 billion (16.2 percent).

The July report also showed that $3.8 billion (6.4 percent) of loans are late but not yet delinquent, down from $4.8 billion (8.2 percent) from June. The data revealed $10.3 billion (17.5 percent) of loans are 30-plus days delinquent, down from $11.7 billion (20.1 percent) in June.

The July print also showed $35.8 billion (60.6 percent) in CMBS loans have passed their maturity date (up from $32.4 billion the previous month). Of these loans, 21.7 percent are performing (up from 18.5 percent), while 38.9 percent are non-performing (up from 37 percent).

Loan highlight

Two Chatham Center & Garage is a mixed-use property consisting of a 290,501-square-foot office property and a 2,284-space parking garage in the greater downtown submarket of Pittsburgh. The asset is backed by a $50.1 million, fully amortizing loan that failed to pay off at its July maturity date and has a performing matured payment status.

The loan was added to the servicers watchlist in October 2020 due to low debt service coverage (DSCR) ratio and occupancy. The asset was 35 percent occupied with a 1.13 DSCR as of March 2025.

Mike Haas is founder and CEO of CRED iQ.