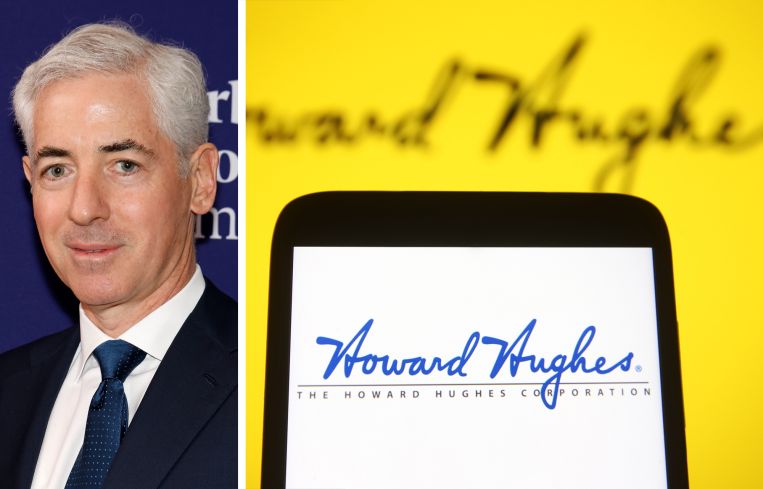

Bill Ackman Outlines Howard Hughes Holdings’ Push Into Insurance

By Mark Hallum August 7, 2025 11:18 am

reprints

Howard Hughes Holdings (HHH) reported increasing cashflow and investment funds that executives believe will reshape the company.

Bill Ackman’s Pershing Square Holdings, HHH’s parent company, is investing $900 million to transform the firm from a pure play real estate company to a diversified firm with residential and retail assets under management, executives said in a second quarter earnings call on Thursday.

Ackman said on the call that HHH will increase revenue by acquiring an insurance firm in order to provide capital for other acquisitions, a page from the playbook of Warren Buffett’s Berkshire Hathaway, but no names were dropped with the billionaire hedge fund operator saying he expected an announcement in fall.

HHH’s total net operating income (NOI) hit $69 million in the second quarter of 2025, an increase of 5 percent year-over-year, and full-year NOI guidance grew by $5 million to $267 million.

HHH saw profits grow in sales of its master-planned communities (MPC), to $1.35 million in average price per acre, a 29 percent year-over-year increase.

Sites at its Summerlin MPC in Las Vegas sold for an average of $1.6 million, and lots in Houston’s Bridgeland sold for an average of $648,000, according to HHH.

The quality of these assets and what is being built on top of them override headwinds in the market such as high interest rates and inflation, according to Ackman.

“We see those home sales as a leading indicator for what the home builders will need in land purchases on a go-forward basis,” David O’Reilly, CEO of Howard Hughes, said during the call. “To date, our home sales have been incredibly resilient, and I think that is due to the quality of assets that we have. Our MPCs have the best schools, amenities and quality of life. They’re attractive for residents and home builders. The home builders are building homes that they sell at a premium relative to those areas around them, and as a result, all the land remains incredibly attractive.”

One of the benefits of acquiring an existing insurance firm rather than starting from scratch is seeing revenue immediately rather than having to obtain licensing and deal with the regulations involved with entering the market, Ackman said.

“The typical insurance operation is pretty aggressive in making as much money as possible from insurance and using leverage to get an adequate return on assets,” Ackman said. “We think this approach is lower risk, and the way I think you should look at the insurance operation over time is [the way you would] if we had a billion dollars of equity invested in insurance, let’s say, and compounded that equity at 20 percent or more. Over time, it will become very, very material.”

Ackman also believes that HHH has enough exposure to the MPC business, and is unlikely to invest in replicating its Nevada and Texas success in new markets in favor of diversifying its returns.

Mark Hallum can be reached at mhallum@commercialobserver.com.