Bridge Logistics Buys Inland Empire Industrial Complex for $84M

The fully leased facilities were completed in 2023

By Nick Trombola July 21, 2025 4:10 pm

reprints

The industrial market in Southern California’s Inland Empire is on uneven footing, but investors are still closing sizable deals as the region’s fundamentals remain robust.

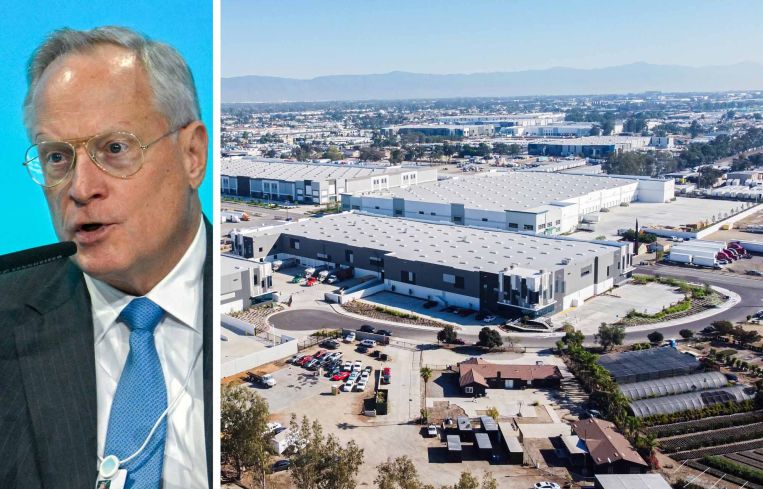

Bridge Logistics Properties (BLP), for example, purchased a three-building complex in Fontana, Calif., for $83.5 million, or about $251 per square foot. An affiliate of Dallas-based development and investment firm Hillwood — itself a subsidiary of Perot — sold the properties, according to property records.

The roughly 332,793-square-foot complex completed in 2023 contains three distribution facilities: 100,039-square-foot 14074 Rancho Court; 57,654-square-foot 14019 Rose Avenue; and the 175,100-square-foot 14928 Washington Drive, collectively dubbed Banana & Rose Commerce Center. The properties are fully leased, according to BLP.

“During this period of pronounced price dislocation, our investment thesis focuses on acquiring best-in-class, well-located assets with strong in-place cash flow,” Paul Jones, BLP managing director, said in a statement. “Local municipal headwinds, AB 98, and general land scarcity are causing significant barriers to new development. Once economic conditions stabilize and tenant demand normalizes, we believe we will see value appreciation for existing assets.”

The firm did not disclose the name of the tenants, but logistics solutions company Plastic Express appears to utilize at least part of the complex, according to a Google Street View review.

General economic uncertainty and chaotic trade policy has complicated the Inland Empire’s trajectory, according to a recent market report from CBRE. Vacancy and availability rates ticked up in the second quarter, while absorption turned negative and rent prices declined for the eighth quarter in a row. Yet strong leasing activity, healthy job numbers and a bump in build-to-suit projects in the region indicate that the Inland Empire is still a solid bet.

Still, investment sales activity paints a complicated picture. The amount of sales across the Inland Empire last quarter more than doubled compared to the first quarter of this year, per CBRE, yet the volume of sold space — 456,000 square feet — fell by 43 percent quarter-over-quarter and 58.7 percent annually. BLP’s new Fontana portfolio alone amounts to nearly 75 percent of the total amount of space that traded hands last quarter.

Nick Trombola can be reached at ntrombola@commercialobserver.com.