Presented By: Keyway

Matias Recchia on How Keyway Trains Its Lease Review AI

You can train your dragon, you can train your robot, but Keyway has trained its artificial intelligence to review real estate leases faster and more accurately than traditional methods.

The Manhattan-based generative AI company for commercial real estate is now using large language models (LLM) trained on thousands of leases to complete tasks like lease reviews in seconds, compared to weeks with traditional methods, said Matias Recchia, co-founder and CEO of Keyway.

In June, Philip Russo spoke with Recchia and asked him how Keyway’s LLM-built AI reduces costs and increases accuracy in document review.

“Keyway is starting to substitute a lot of what consulting firms are doing on lease abstraction or due diligence management and due diligence documentation,” said Recchia. “In workflow automation we’re seeing that rather than going against other software companies we’re actually starting to take over work that was done manually by consulting firms and third-party providers.”

Keyway’s system integrates with existing software, allowing users to manage documents more efficiently, Recchia said.

Using its highly trained AI, Keyway is serving landlords and asset managers’ document review needs. Keyway’s system is 100 percent AI, built on its proprietary LLMs, said Recchia. “On top of the LLMs, we built guardrails and trained our system with thousands of publicly available leases and lease abstracts.”

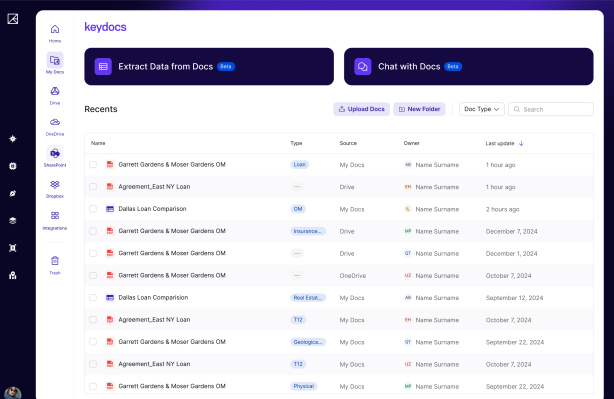

In addition to providing services to landlords and asset managers, the proptech startup founded in 2020 has recently begun working with brokers and lenders, as well. The company’s faster and more accurate document review capabilities — which analyze and abstract property due diligence, including the intricacies of leases, previous loans, covenants, and similarly important and often complex real estate document details — has driven the client growth. The result is a huge expansion in client use of Keyway products such as KeyDocs, an asset-agnostic software co-pilot that analyzes thousands of documents using powerful real estate-specific generative AI.

“Basically, what we’re seeing is we are much more actively selling our product and spending a lot of time on KeyDocs,” said Recchia. “We initially created the product to allow users to broadly use our system to automate any sort of document ingestion, document management, document analysis, etc. But we’re seeing specific use cases where they’re stopping the use of third parties and starting to use us.

“For example, one large asset manager that we’re working with was paying a global professional services company $500 per lease to review leases and create lease abstracts. This firm was taking two weeks to do this. Our system gets it done in 30 seconds exactly in the formatting they want with better accuracy than they’re getting from the consulting firms. And this is without the need to coordinate across multiple areas of the company.”

Keyway’s AI software saves clients’ money in other ways, too.

“We had a client evaluating a $50 million multifamily acquisition,” he said. “Using our system to audit 95 leases and validate the rent rolls, it flagged three missing contracts that were being charged to net operating income. It also uncovered a misapplied rent escalation. And this was done in three hours. We estimate that saved them around $120,000 on external costs. It also means that they can move faster and potentially win the deal against the competition because they’re asking the right questions at the right time.”

While saving time is always of great interest to business, Keyway’s AI has a value-add that was initially unforeseen.

“What’s very real, and surprises me as well, is that our AI is also driven by better accuracy, because at the end of the day a lot of these manual reviews were done by people that are reading documents and completing a form,” Recchia said. “It’s very repetitive and quite automatic. And the truth is, no one checks it after it’s done. It’s outsourced to low-cost countries, and no one is reviewing it afterwards because no one is reading a 500-page document.

“With AI, what we do is what’s called zero temperature — our system never makes up any data. It’s trained that way so that it only completes the data that it factually knows is correct. So it’s 100 percent correct for anything that it can get from these abstracts or loans. If the AI is unsure of the information it is reviewing, it will highlight the sections that the system thinks are relevant and let the user make a decision.”

Keyway’s generative AI can integrate into any real estate software platform and can aid in recruiting, training and retaining the client’s junior analysts or associates, said Recchia.

“Something that we’ve seen in the industry is that folks are not necessarily ready to give up on their analysts or associates,” he said. “At the end of the day, your junior people are the people that you’re using to create culture and to do work, and many times doing that work manually is the way in which you learn and how you become good at the craft, whether it’s legal, consulting, or something else. Finding ways to reduce those expenses and relying less on external products is something we’re seeing a ton of appetite for.”

As for how real estate lawyers are interacting with Keyway’s AI, Recchia admits they are not thrilled with the prospect of losing billable hours to the technology.

However, he adds, “By no means do we claim that we substitute for legal expertise, but our AI does substitute for legal documentation oversight and compliance, and basic document analysis. We do not provide any legal advice.”

Notably, the AI information extracted from lease documents is done in a faster, more accurate and specifically targeted manner, making for greater efficiencies when the client interacts with its attorneys on a deal.

“The technology allows you to ask questions, such as, ‘Have I ever signed a clause like this one before?’ Or it can create a table of all the covenants for your loans and look at the financials, prioritizing the items and sharing the data with your lawyers in a more organized manner.”

Providing a system that is faster, more accurate, less expensive and more efficient for the client, his workers and outside parties is what’s building increasing demand for Keyway’s generative AI document review system.