Kevin Murphy.

Kevin Murphy

CEO at Publix

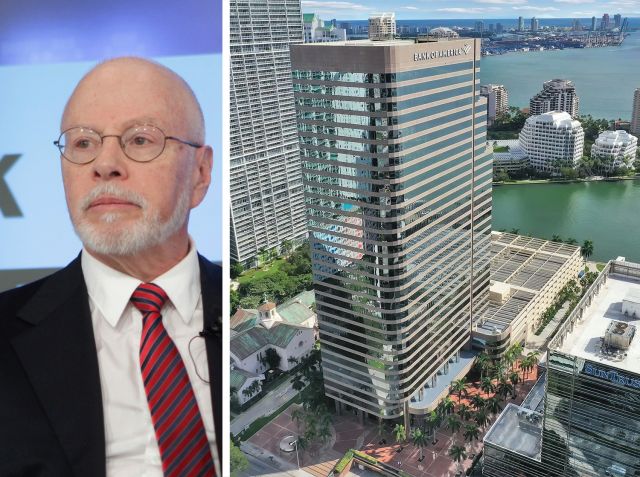

When interest rates rose, investment markets cooled as traditional real estate players sat on the sidelines. Retailers, on the other hand, seized on the opportunity and went on shopping sprees of their own, buying up some of the marquee real estate they occupy.

In New York, fashion companies Prada and Kering (owner of Gucci) bought property on Fifth Avenue, each spending about $1 billion. In South Florida, grocer Whole Foods and buzzy activewear brand Alo Yoga joined the action, too. But none was more active than Publix, the grocery store chain that has built a cult following in the South thanks to its fried chicken and “Pub Sub” sandwiches, as well as its ubiquitous presence.

Since May, the Lakeland-based company, with Kevin Murphy at the helm, dropped nearly $250 million on six retail centers that it anchors. The deals included the $59 million purchase of a 157,914-square-foot strip mall in Coral Springs, a $40 million acquisition of a 117,427-square-foot shopping center in North Miami, and an $83 million buy of two shopping centers in Davie.

These purchases will allow Publix to hedge against future rent hikes, retain a firm footing in the region, and control and curate the properties that power its grocery business.

It’s been quite a business of late, too. The grocer was flush with cash. During the third quarter of 2024, revenue rose nearly 5 percent to $14.6 billion from the same time last year, and was up by 3.4 percent from the prior quarter. Profits came in at $1.1 billion, up by nearly 32 percent compared to 2023’s third quarter.

Could more acquisitions be in store for the rest of 2025? We’ll have to wait and see, because Publix isn’t revealing what’s on its shopping list.