Nation’s Top Lab REIT Blasts Calif. Leaders, Biden Administration Over Wildfires

Alexandria Real Estate Chairman Joel Marcus puts his faith in a Rick Caruso political comeback and the Trump administration

By Greg Cornfield January 28, 2025 8:45 pm

reprints

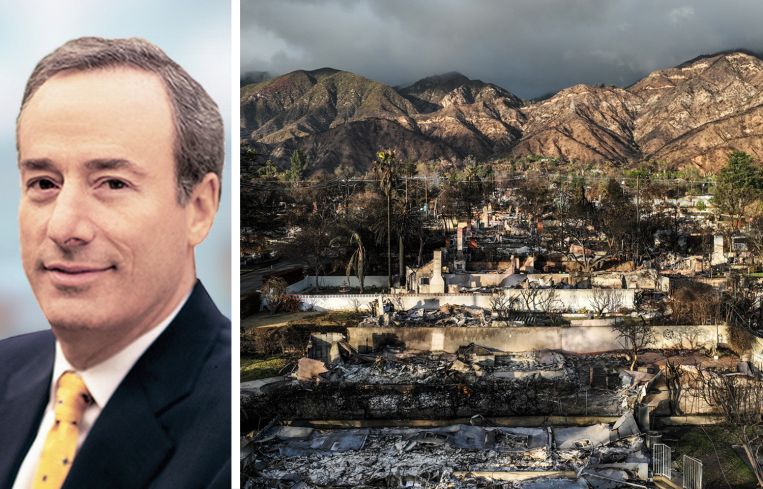

Alexandria Real Estate Equities is the nation’s largest life sciences landlord with some of the world’s largest biotech and pharmaceutical companies as tenants. But its headquarters is in Pasadena, Calif., which was one of the areas most affected by the historically destructive wildfires that devastated Los Angeles County this month.

As of Tuesday afternoon Pacific time, the Palisades and Eaton fires together had killed at least 29 people, destroyed at least 16,255 structures, and damaged another 2,090 structures.

Tuesday, on the company’s first earnings call since the tragedies, Joel Marcus, founder and executive chairman of ARE, said the firm was hit hard by the event that dislocated a large number of employees. He expressed frustration over “inadequate preparation by the local utilities, the city, the county and the state,” as there were several days of violent wind warnings that were “largely ignored by those empowered to protect us.”

Marcus echoed some of the complaints voiced by other influential commercial real estate players, including perhaps most notably Rick Caruso. The billionaire developer lost the most recent mayoral election, and was the first big name to pin the damage from the fires on local officials and to condemn the lack of preparedness while the wildfires raged.

“I hope the electorate here in California rethink how they elect local, county and state officials, and think about the election here of the current mayor [Karen Bass], compared to the one that lost with Rick Caruso,” Marcus said. “I think he’s going to come back.

“You have a choice of a political person all their lives, versus someone who’s a business person who operates real estate, who understands, who headed the police commission,” Marcus continued, referring to Caruso’s earlier presidency of the Los Angeles Board of Police Commissioners. “I think people are going to search for more common sense, practical leadership, and I think that that is kind of where California is headed.”

Marcus said he previously lived in the Palisades for years, during which time he was evacuated twice, so he “finally just gave up” and moved to a different neighborhood. Officials on Tuesday said the Palisades Fire alone burned more than 23,400 acres and destroyed or damaged more more than 7,800 structures.

“In fact, my house overlooked the reservoir that was dry. And during the days I lived there, it was never dry.”

But that doesn’t mean Marcus expects his firm to leave the state. ARE is also one of the largest commercial real estate landlords in California, which is home to the nation’s second- and third-largest life sciences markets, the San Francisco Bay Area and San Diego County, respectively.

“This is an industry that’s a knowledge-based industry, an intellectual industry,” he said. “You have to be where that tenant base, or where that knowledge base is.

“I think insurance is a big issue. The state has made it much harder for insurance companies to operate here and make a profit here and do right by their policyholders. And I hope that that changes, whether by the ballot or maybe by people just getting a lot smarter and acting more prudently.”

Marcus and Marc Binda, ARE’s chief financial officer, said the bulk of the portfolio is in good shape and not exposed to wildfire dangers, and it’s well insured. (ARE reported $65 million in net loss attributed to stockholders in the fourth quarter of 2024, but $309.6 million in net income on the year, much higher than the $92.4 million in net income from 2023.)

“The company has taken climate resilience across the portfolio very seriously,” Binda said. “It’s been something that we’ve adopted as part of the design into our buildings as well as operationally doing what we can to harden our facilities and put ourselves and our tenants in the best position to deal with a potential fire.”

Additionally, a new president has moved into the White House since ARE held its last earnings call, and Marcus said the new Trump administration makes him optimistic for the firm’s portfolio moving forward.

“The three reasons for a go-forward 2025 optimistic view are, one, the anti-industry ideologues of the last administration are gone,” Marcus said. “The new administration is focused on cracking down on the middleman […] and then likely there’ll be positive reform of the [Inflation Reduction Act] provisions and a repeal of the unconstitutional 95 percent excise tax.”

“As the new administration wins the day versus the [Federal Reserve], interest rates are likely to come down, and the life sciences industry will experience a solid return to hopefully a normalized bull market,” he continued. “I would say, compared to the last administration, it’s like night, the dark of night and the light of day.”

Marcus expects Trump to replace Jerome Powell as chairman of the Federal Reserve, and he praised the selections of Federal Trade Commission Chairman Andrew Ferguson and other leaders to take over agencies that manage federal regulations affecting the life sciences industry.

“Our industry is primarily governed by the FDA,” Marcus said. “I think both the nominee and the interim [commissioner] are both highly skilled people. We don’t see any abatement of the pace of approvals both on biologics and non-biologics.” (Trump has nominated surgeon Marty Markary as FDA commissioner, and Sara Brenner, another physician, is acting commissioner.)

He said Xavier Becerra, former President Joe Biden’s health and human services secretary (and former attorney general of California), “didn’t even know what health care was.”

“Whether [Robert F. Kennedy Jr.] gets it or not — and I know there’s a lot of controversy about that — that probably won’t have nearly as much impact as the FDA. Also, the National Institutes of Health, we feel the nominee will be a solid nominee. The NIH kind of lost its way, it lost its credibility during COVID. … But it is a fantastic agency overall that funds some of the most important core research. … I’m pretty optimistic.”

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.