How the Big Special Servicers Are Tackling Troubled CRE Loans

This week, the CRED iQ research team addressed one of the most common topics requested by our readers, which is understanding workout strategies from the special servicers’ perspectives.

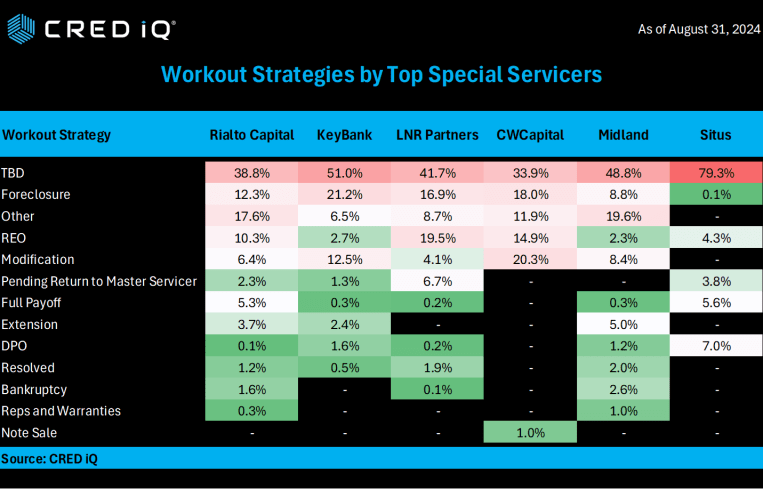

Building upon last week’s report, the objective of this study was to understand how the largest special servicers have addressed troubled loans this year as of Aug. 31. Our team examined 1,800 loans comprising loan values of $45 billion focused on the top six special servicers in Rialto Capital, KeyBank, LNR, CW Capital, Midland and Situs.

The results are quite diverse. Just over 21 percent of KeyBank’s loans were worked out via foreclosures, the highest percentage of all the top six special servicers. Foreclosure was the most deployed strategy (apart from TBD) at 14.9 percent of loans in all six special servicers.

Real estate owned (REO) strategies saw a high of 19.5 percent at LNR Partners. REO was the second-highest strategy deployed at 10 percent (apart from “TBD” and “Other”).

Modifications saw a wide range, from 6.4 percent at Rialto Capital to 20.3 percent of loans at CW Capital. Across all special servicers, modifications was the third most common strategy deployed with 9 percent of all loans falling into that category.

Loan extensions were achieved at three of the six special servicers, and allocations were modest with Midland’s 5 percent at the top of the range. Full payoffs were achieved at five of the six firms, with Situs showing 5.6 percent of its loans reaching that mark — the category high.

Situs’ results are noteworthy with 79.3 percent of their loans in the “TBD” category — substantially higher than the other organizations. Clearly, we have a very limited view of the Situs portfolio’s ultimate outcomes as of publication. For that matter, all the special servicers in our study showed high percentages of “TBD” strategies (the lowest, CW Capital, at 33.9 percent).

Mike Haas is the founder and CEO of CRED iQ.