Unpaid Utility Bills Sends Industrial CMBS Loan to Special Servicing

By Andrew Coen September 23, 2024 5:51 pm

reprints

A $96.8 million commercial mortgage-backed securities (CMBS) loan backing a Rochester, N.Y., industrial park has entered special servicing as the borrower contends with an imminent “non-monetary default” from unpaid utility bills, according to a report from Morningstar.

Cantor Commercial Real Estate, which originated the UBSCM 2017-C7 and UBSCM 2018-C8 deals securing the Tryad Industrial & Business Center in Rochester, was notified of utilities being in danger of getting shut off at the 3.4 million-square-foot property because of $2.4 million in unpaid bills, the Morningstar report shows. The property was 61 percent occupied as of June, and net cash flow was 30 percent below underwritten levels, according to Morningstar.

David Putro, senior vice president and head of commercial real estate analytics at Morningstar, said the special servicer did not indicate how long bills have been outstanding for the property, which includes a mix of industrial, flex office, and research and design. Putro noted that despite below-even cash flows for “several years,” the loan had always remained current. Revenue was $22.1 million in 2023 compared with $20.7 million at underwriting, but expenses rose in the same period to $13.9 million from $9.1 million, according to Putro.

“I don’t think this necessarily points to weakness in the industrial sector overall,” said Putro, who noted that the largest tenant at the time of the loan was a call center. “I can’t recall a loan where the borrower funded debt service shortfalls for several years then saw the loan moved to special servicing because of unpaid utilities.”

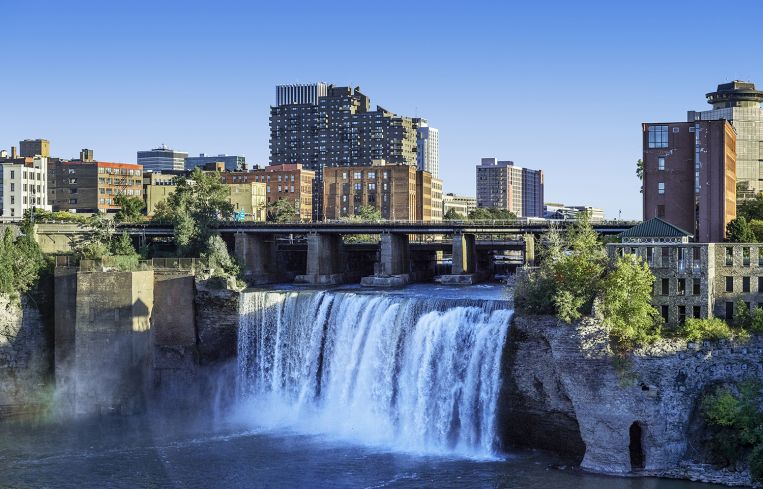

Brooklyn-based Tryad Group acquired the property, which was a former facility for Eastman Kodak in 2007 for $55 million from Cohen Asset Management, the Rochester Business Journal reported at the time.

Officials at Tryad Group, whose principals are Leslie Westreich and Morty Yashar, did not immediately return a request for comment.

Andrew Coen can be reached at acoen@commercialobserver.com