Why the Manhattan Office Leasing Market Has Been So Busy This Summer

The season’s supposed to represent the slowest time of year for dealmaking

By Mark Hallum September 2, 2024 6:00 am

reprints

Brokers looking forward to the usual slow summer with lighter workloads have been skipping the Hamptons for the closing table instead.

The Manhattan office leasing market in the second quarter was 19 percent more active than the five-year quarterly average in terms of deals, according to a report from CBRE.

Part of that was due to the slightly longer time it has taken to negotiate and sign a lease recently. But the underlying driver has been a general recovery in the market, where pent-up demand, pickier tenants and more complicated negotiations have made the flow of deals — which would usually close in the colder months — bleed into summer, according to CBRE and other brokerages.

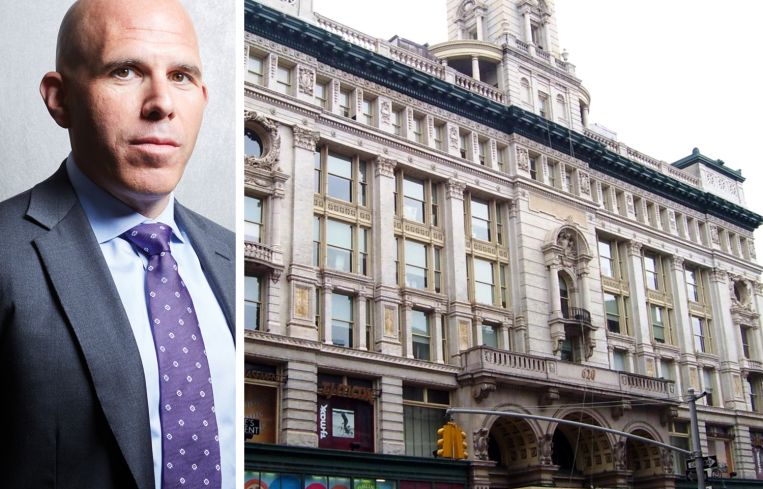

“The cynic in me would say that these deals should have closed in the spring, but what we’re finding is that transactions are taking quite a while, they are more complicated in many other ways, and there are a lot more constituencies that have to be brought into the process,” CBRE Vice Chair John Maher told Commercial Observer.

“You have a lot more people that are involved, including sustainability, [human resources], and logistics. The design process is longer because the way people are using space remains at issue in many firms who are coming back to the office,” Maher added. “All of these ingredients just elongate the process, but I will say that it is nice to see the statistics starting to bear out.”

Six-figure deals became somewhat more commonplace this summer. That includes consulting firm Bain & Company signing a 235,200-square-foot deal at Milstein Properties’ 22 Vanderbilt, Trade Desk backfilling the 126,000-square-foot void the former left behind at 1114 Avenue of the Americas, and data analytics firm Palantir Technologies taking 140,345 square feet at RXR’s 620 Avenue of the Americas. All announced in the same week, by the way.

Huge subleases also weren’t hard to come by in the dog days of summer.

Electronic payment company Stripe signed a 147,000-square-foot sublease with American International Group at 28 Liberty Street in June as well as law firm Covington & Burling inking a 20-year deal to sublease 235,479 square feet from Warner Bros. Discovery at 30 Hudson Yards.

JLL’s Joseph Messina, who had a hand in Blackstone’s expansion to 1.06 million square feet at Rudin’s 345 Park Avenue in early July, said the large deal sizes seen in recent months are a sign that submarkets are maxing out on inventory across the board.

In other words, tenants are looking to take what they can get while they can still get it.

“You look at Blackstone, the Bloomberg [deal], American Eagle, Wilkie Farr & Gallagher, right?,” Messina said. “These large transactions — 300,000 feet-plus — are the reason that maybe now is the time to take advantage of a very tenant-favorable market condition.”

And the summer heat is helping the rest of the year look sunnier for leasing stats. Year-do-date, the Manhattan leasing market saw 13 million square feet taken off the market, 35 percent ahead of the same period last year, according to CBRE data. But that figure is 21 percent behind the five-year year-to-date average seen from 2015 to 2019, according to CBRE data.

The second quarter saw the highest post-pandemic volume in terms of square footage with 6.1 percent million square feet leased, CBRE found. For comparison, the second quarter of 2019 saw 7.9 million square feet signed for followed by 2.1 million square feet in the same period in 2020.

A large number of the deals signed so far this year were renewals, with tenants re-upping on 4.8 million square feet, 10 percent higher than the five-year average for renewals recorded by CBRE from 2015 to 2019.

But just because deals are getting signed and space is leasing doesn’t mean things are going great for either landlords or tenants.

“The cost of capturing a tenant still remains very high and each transaction is scrutinized to achieve the right return on investment,” Maher said. “Let’s not sugarcoat it: There’s an enormous amount of space that’s still available now. If you’re doing a survey for a tenant of 50,000 square feet, there could be 50 spaces that you put on a survey, but in the end only five make sense.”

Manhattan had about 100.8 million square feet available in early July, according to an Avison Young report.

The availability rate in the second quarter for Midtown was 18.2 percent, a decrease of 30 basis points from the same period last year; Midtown South’s was 23.3 percent, up 210 basis points from last year; and Downtown’s was 22.7 percent, an increase of 10 basis points from the second quarter of 2023, according to CBRE.

Even with all that available space, the competition for those few ones that work makes life difficult for the tenant.

“Part of it is the tightening [of supply] in pockets of Manhattan, specifically in Midtown’s core, and tenants [are] realizing that many others are active and so they have to act before they miss out on the game of musical chairs,” Michael Slattery, research director at CBRE, said. “As [supply] of the larger blocks next to transit and the best buildings continue to tighten, we’ve seen tenants go to the next option and the next option.”

The next option usually means picking a different market rather than a less than ideal building, highlighting continued demand for Class A office space, which is quickly starting to run out around the city.

“I think that’s where you’re starting to see some of the larger deals expand beyond just the Park Avenue corridor in good, quality buildings,” Slattery said.

And CBRE’s Maher said it was important to note that even with these massive deals being signed in recent months, not every neighborhood in Manhattan is basking in the summer sun.

“We have to be very careful of painting with a broad brush of ‘here’s what’s going on in the market,’ because there are so many dynamics that create multiple markets,” Maher said. “When somebody asks me, ‘how’s the market,’ I have to ask, ‘which market’? There can be 20 different markets.”

Mark Hallum can be reached at mhallum@commercialobserver.com.