Multifamily Proptech Startup RealSage Secures $4M Seed Round

Funding will be used to grow AI-driven financial data platform for asset management

By Philip Russo March 25, 2024 9:00 am

reprints

Keeping track of finances is an ongoing challenge for multifamily owners and operators in that booming real estate sector. RealSage, an AI-driven decision-making software platform, announced Monday that it has closed a $4 million seed round to help meet that challenge.

York IE, a Boston-based software as a service venture capital firm, led the round, with Karman Ventures, StellifiVC, Golden Section and Second Century Ventures, along with angel investors, former Facebook employees, and real estate family offices in New York and Toronto participating.

Toronto-based realsage operates in Canada and the U.S. but plans to use the seed funding to further expand into the latter market, said Arunabh Dastidar, CEO of RealSage.

“It is currently a 50-50 split,” said Dastidar of RealSage’s market coverage. “We have some of the top Canadian clients and in the U.S. as well across California, New York and Texas.”

The proptech startup’s clients are some of the largest vertically integrated REITs, he said. “They love us because we add value on both levels. Ownership groups, too, because they have this problem where they are getting data and reports and all different Excel sheets, different formats, which we standardize. The third group is operators, who are generally implemented when the ownership groups tell us.”

Driven by the need for better decision-making, operational efficiency and personalized customer experiences, AI impact in real estate is expected to reach $8.9 billion by 2026, growing at a compound annual rate of 35.9 percent from 2021 to 2026, according to a report by MarketsandMarkets.

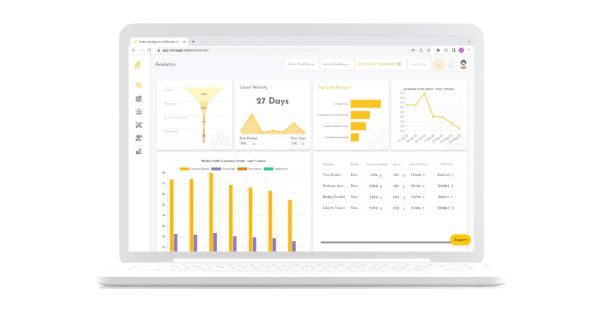

RealSage says its platform empowers asset managers to make decisions that affect their financial outcomes, while seeking to raise industry standards for operational efficiency and precision. Owners and operators can decide how and when to optimize rents, where future capital dollars should be allocated, and receive AI-based suggestions on their overall asset performance, according to the company.

“Our goal is to bring the ‘Iron Man’ movie’s JARVIS to real estate,” said Dastidar. “That is, to bring sentient, conversational decision-making into our system. We’re currently the only system which provides internal and external data benchmarking for effective optimization of assets. Basically, it uses machine learning to understand the data, but spits out human language format decision-making. You can ask questions through your data, understand how the data is working, and go from there to predictive modeling.

“All real estate is currently backward-looking,” he added, “with every decision managers make based on past data from what their operators are sending them. Our algorithms actually change that backward-looking data to forward-looking data using deterministic AI models as well as conversational models and language learning models that can make it very simple for humans to interact with their data and basically decide and make calls on their projects.”

Philip Russo can be reached at prusso@commercialobserver.com.