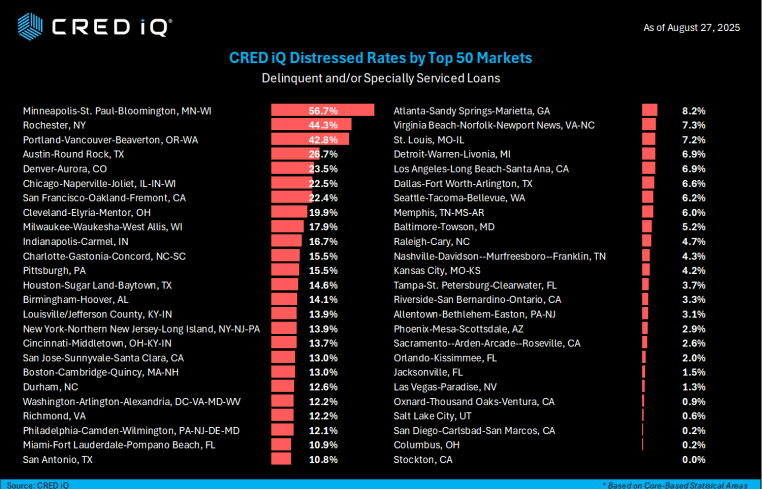

Minneapolis-St. Paul, Rochester, N.Y., Lead CRE Distress Rankings

CRED iQ research has analyzed a staggering $341.1 billion in loans spanning the top 50 U.S. markets, focusing on signs of distress. Our latest research reveals stark regional differences, as some markets show alarming levels of strain while others remain remarkably resilient.

Leading the pack in distress is Minneapolis-St. Paul (including Bloomington, Minn.), where a whopping 56.7 percent of loans are flagged. Close on its heels are Rochester, N.Y., at 44.3 percent and the area of Portland, Ore., Beaverton, Wash., and Vancouver at 42.8 percent. Rounding out the top five are Austin-Round Rock in Texas at 26.7 percent, then Denver-Aurora, Colo., at 23.5 percent, highlighting a cluster of Midwestern and Western markets feeling the heat.

On the flip side, several markets are holding strong with minimal distress. Stockton, Calif., tops the list of least distressed at 0.0 percent, followed closely by Columbus, Ohio, at 0.2 percent and San Diego-Carlsbad-San Marcos, also at 0.2 percent. Salt Lake City at 0.6 percent and Oxnard-Thousand Oaks-Ventura, Calif., at 0.9 percent stand out, too, for their low rates.

These rankings underscore the uneven recovery in commercial real estate, influenced by factors like office vacancies, economic shifts and tenant dynamics.

To put these numbers into perspective, let’s zoom in on a key example from one of the top distressed markets. The 7700 Parmer office property in Austin — a massive 911,579-square-foot asset — is backed by a $177 million loan that’s recently been transferred to the special servicer due to an imminent monetary default. This interest-only loan is set to mature in December 2025, with no extensions noted at origination.

Major tenants include Google, with 33 percent of the gross leasable area and a lease that expires in September 2027; Electronic Arts, with 19 percent of the gross leasable area and a lease that expires in August 2026; and eBay, with 10 percent of the gross leasable area and a lease that expires in May 2028. Occupancy stands at 74 percent, with a debt service coverage ratio (DSCR) of 1.96 — solid on paper, but clearly not enough to avoid trouble amid broader market pressures.

Stories like this highlight why Austin ranks high on our distress list and serve as a reminder of the vulnerabilities in office-heavy portfolios.

These rankings offer valuable insights for investors, lenders and stakeholders navigating the post-pandemic landscape. Markets like Minneapolis and Rochester may require extra due diligence, while low-distress areas like Stockton and Columbus could present more stable opportunities.

Mike Haas is founder and CEO of CRED iQ.