Who’s the Biggest Office Owner in Los Angeles?

Other top owners, across both square footage and amount of properties owned, include Worthe Real Estate, L.A. County and Blackstone

By Nick Trombola September 17, 2025 4:25 pm

reprints

When one thinks about Los Angeles County’s office market, images of vacant desks and cratering property values often come to mind. Office vacancy rates across Greater L.A. continue to hover around 25 percent, and nearly 47 percent of L.A.’s office inventory is “economically unviable,” according to a recent report by Newmark.

Yet the city has appeared to find its post-pandemic (office) floor. Investment activity, for one thing, has significantly rebounded this year despite unique hurdles such as the city’s Measure ULA tax. L.A. office sales amounted to $1.8 billion in the first half of 2025 after sales volume in the second quarter doubled year-over-year. Downtown L.A. in particular has seen a welcome resurgence of investor interest after office values bottomed out and the city pushes for enhanced public safety ahead of the 2028 Olympics.

While L.A.’s office ownership trends are ever shifting, 10 entities dominate the market in terms of total owned square footage — three of which appear on Commercial Observer’s recent 2025 Power SoCal list. CoStar shared data with CO on the biggest office portfolios, to better understand the movers and shakers behind the region’s most volatile asset class.

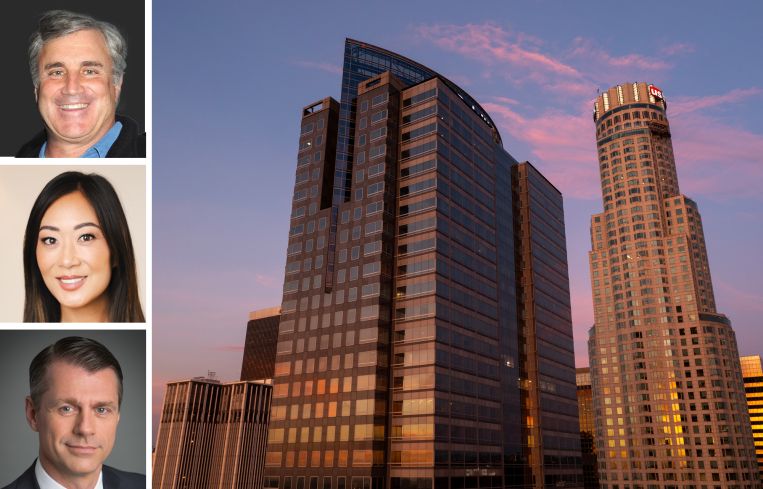

1. Douglas Emmett Management

Santa Monica-based real estate investment trust Douglas Emmett is the top dog of L.A. office, with nearly 15.8 million square feet across 73 buildings, coming in at No. 1 in both metrics, per CoStar data. The REIT particularly reigns over L.A.’s Westside, with significant holdings in Westwood, Century City and Sawtelle, as well as in adjacent cities like Santa Monica and Beverly Hills.

The Jaime Lee-led family firm has become the veritable leader of adaptive reuse projects in Southern California from its home base in Koreatown, but Jamison still comes behind only Douglas Emmett in terms of total square footage and the amount of offices under its wing. The firm owns 13.2 million square feet across 59 properties, though it actually beats out the region’s top owner in terms of land acres owned, nearly 127 acres compared to about 101 acres.

Many past headlines relating to office distress in L.A. trace back to Brookfield, which used to be the biggest owner before the pandemic. The New York-based firm in 2023 defaulted on multiple high-rise offices in Downtown L.A., with most of those properties either selling for significant discounts or transferring to lenders in lieu of foreclosure.

Still, while Brookfield controls only seven offices in L.A. County these days, the sheer amount of space those properties contain — 7.2 million square feet — is enough to place them well ahead of firms that own three or four times the number of buildings.

Worthe Real Estate Group focuses on commercial and creative office properties, with the latter being of particular importance given L.A.’s status as an entertainment hub. The firm owns 5.2 million square feet across 21 buildings, such as Second Century, an 800,000-square-foot behemoth in Burbank that is fully leased by Warner Bros. Worthe owns other entertainment and creative-related spaces in L.A. County as well, acquiring the 27-acre Burbank Studios as part of a JV last summer.

5. Los Angeles County

The L.A. County government is among the top owners of office space within its jurisdiction, with a portfolio spanning almost 5 million square feet across 39 buildings. That includes at least one major Downtown L.A. property siphoned from Brookfield’s stable — the 52-story Gas Company Tower, which the county acquired for $200 million at the end of 2024 following Brookfield’s default on the property nearly two years previously.

The following five entities that make up CoStar’s top 10 all own office portfolios between 4 and 5 million square feet. That includes Blackstone, with more than 4.9 million square feet between 27 buildings; Onni Group, with 4.6 million square feet across 24 buildings; the City of L.A., with 4.5 million square feet spread over 25 properties; Kilroy Realty with 4.3 million square feet across 47 properties; and health care network Kaiser Permanente, which owns 4.3 million square feet between 44 buildings.

Nick Trombola can be reached at ntrombola@commercialobserver.com.