Douglas Emmett Secures Over $1B for SoCal, Hawaii Resi Refi

Debt tied to the controversial Landmark Residences, formerly known as Barrington Plaza, has been fully repaid

By Nick Trombola September 9, 2025 5:35 pm

reprints

Santa Monica, Calif.-based Douglas Emmett mostly focuses on high-end office properties, but that doesn’t mean it has neglected the financials of its burgeoning multifamily portfolio.

The real estate investment trust landed, via multiple transactions throughout this year, nearly $1.07 billion in refinancing loans tied to nine of those residential properties, eight of which are in Southern California and the other in Honolulu, Hawaii. The properties together total 3,099 units, though most of their names and addresses were not immediately disclosed.

A Walker & Dunlop spokesperson declined to share further information about the properties. Representatives for the landlord and developer did not immediately respond to requests for comment.

Walker & Dunlop’s multifamily finance team, led by Allan Edelson, arranged and originated the Fannie Mae loan via the agency’s Delegated Underwriting and Servicing (DUS) program. Walker & Dunlop, Douglas Emmett and Fannie Mae have together closed over $1 billion in separate transactions over the past 10 years, per the brokerage firm.

The REIT separately announced the new financings for the eight California properties, which together totaled $941 million — meaning that the loan tied to the Hawaii property clocks in at about $127.7 million. The new loans tied to the California properties replace two tranches of debt: four loans aggregating $550 million that were set to mature in mid-2027, and five loans aggregating $380 million that were set to mature in mid-2029. The new nonrecourse, interest-only refi loans are now set to mature in 2030.

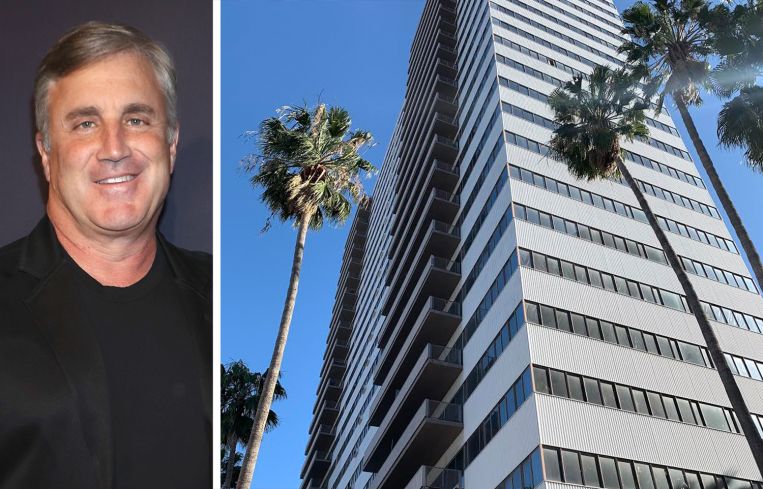

Landmark Residences at 11740 Wilshire Boulevard in Los Angeles’ Sawtelle neighborhood was the only California property named. The debt tied to the Landmark has now been repaid, per Douglas Emmett, and the REIT has added the property to its pool of “unencumbered” assets.

Douglas Emmett in 2023 attempted to temporarily close down the Landmark, dubbed Barrington Plaza at the time, after the property suffered a series of fires between 2013 and 2020. Only 577 units out of the building’s 712 were occupied at the time, and the REIT has attempted to evict its tenants in order to install a sprinkler/fire safety system that was projected to cost some $300 million. Yet after years of legal battles, a judge last summer sided with the building’s remaining tenants, who argued that the REIT improperly used a state law — the Ellis Act — in its attempt to remove them. Douglas Emmett has filed an appeal, though the status of the case was not immediately clear.

Nick Trombola can be reached at ntrombola@commercialobserver.com.