CMBS Distress Rate Reaches Record 11.78% in August

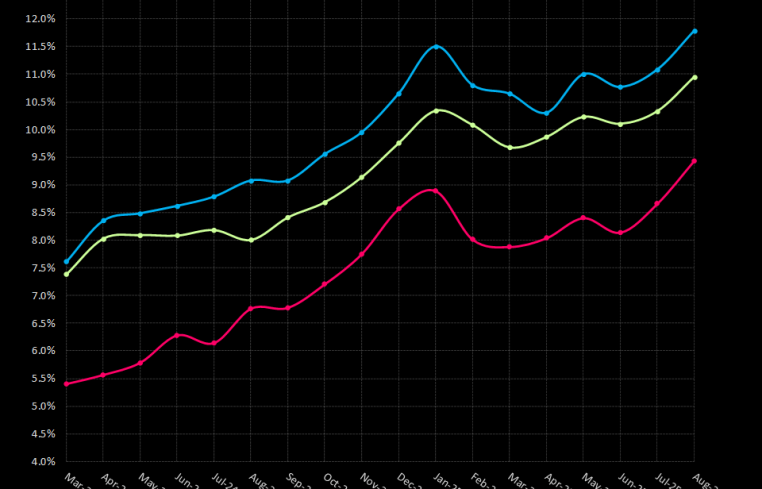

The CRED iQ research team analyzed the payment status of approximately $61.1 billion in commercial mortgage-backed securities (CMBS) loans as part of our monthly distress reporting. Our latest print for August saw the CRED iQ distress rate climb by 70 basis points (bps) to a record 11.78 percent, the second consecutive increase, and exceeding the previous record high of 11.5 percent in January

This second consecutive increase was matched by increases across the underlying metrics for the second month in a row. The delinquency rate saw a 78-bps increase to reach 9.44 percent, while the special servicing rate increased from 10.33 percent to 10.95 percent.

Our team explored each payment status reason from a historical perspective.

We wanted to understand the trending and evolution of each category dating back to March 2024.

The August report showed that $8.4 billion (13.7 percent) in CMBS loans were current in August, down $721 million from our July data of $9.1 billion (15.5 percent), notching the third consecutive decrease.

The research also revealed that $3.8 billion (6.2 percent) of loans are late but not yet delinquent, down slightly from 6.4 percent in July. The data showed $10.2 billion (16.6 percent) of loans were 30-plus days delinquent, down from $10.3 billion (17.5 percent) in July.

The latest print also showed that $38.8 billion (63.5 percent) in CMBS loans have passed their maturity dates, up from $35.8 billion in July. Of these loans, 22.8 percent are performing (up from 21.7 percent) while 40.7 percent are nonperforming (a slight increase from 38.9 percent) the previous month.

Loan highlight

Estates at Palm Bay is a 300-unit multi-

family property in Fort Walton Beach in the Florida panhandle that most recently performed with a debt service coverage ratio of 1.43 and 88 percent occupancy. The garden-style property is backed by a $61 million loan that fell 30 days delinquent in August. The interest-only loan is scheduled to mature in September 2029.

CRED iQ’s Methodology:

CRED iQ’s distress rate provides a holistic view of CMBS performance by combining delinquency (30-plus days past due) and special servicing activity, including both performing and nonperforming loans that fail to pay off at maturity. Our analysis focuses on conduit and single-borrower large loan structures, while separately tracking Freddie Mac, Fannie Mae, Ginnie Mae and CRE CLO metrics.

Mike Haas is the founder and CEO of CRED iQ.