Paramount Group’s Uneven Q2 Has a Bright Spot: Leasing

By Mark Hallum August 1, 2025 11:28 am

reprints

Paramount Group saw significant improvements in leasing in the second quarter of 2025 compared to the previous quarter, which executives said represented a “meaningful shift.” Still, the company’s overall financials were anemic.

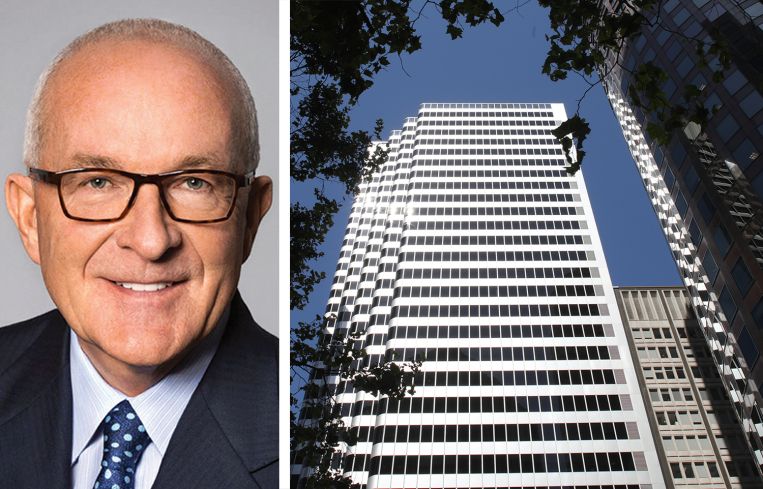

The office owner recorded 400,000 square feet of leases in the second quarter, marking the highest quarterly volume since the pandemic. Paramount CEO Albert Behler said during a Thursday earnings call that the momentum was evenly spread across its portfolio in both San Francisco and New York City.

About 190,000 square feet of that leasing was in San Francisco.

Leasing in the first quarter was 283,874 square feet, only a small improvement from the 276,717 square feet leased in the first quarter of 2024, and was offset at the time by falling asking rents, Commercial Observer reported at the time.

Average asking rents are now above $90 per square foot for assets in both cities, and 45 percent of Paramount’s leasing activity year-to-date has been on vacant space, and 27 percent on space that will be vacated in 2026.

“That’s a meaningful shift from previous quarters, where activity was more concentrated in New York,” Behler said. “This balanced performance highlights the continued strength of New York and the growing traction we are seeing in San Francisco and the broad-based appeal to our portfolio. … Our pipeline remains in good shape, and we are well positioned to carry this strength through the second half.”

Paramount’s New York portfolio is now 88.1 percent leased, a threshold not seen for the firm since 2022.

Some recent leases for Paramount in New York City included law firm Benesch Friedlander Coplan & Aronoff leasing 90,000 square feet at 1301 Avenue of the Americas and investment manager Mudrick Capital taking a 27,000-square-foot lease at 31 West 52nd Street.

The owner reported $177 million in revenue for the second quarter, down from $187.4 million in the same period last year. It also absorbed a net income loss of more than $20 million.

Mark Hallum can be reached at mhallum@commercialobserver.com.